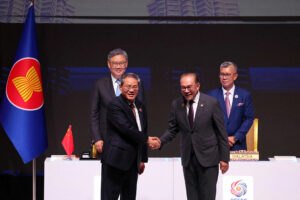

KUALA LUMPUR — The Association of Southeast Asian Nations (ASEAN) and China on Tuesday signed an upgraded free trade pact that seeks to deepen regional integration in the face of increased protectionism from the US.

Closer economic cooperation instead of confrontation could help overcome global uncertainties amid coercion and bullying, Chinese Premier Li Qiang told the ASEAN-China Summit meeting after the signing, in a swipe at the US.

ASEAN leaders including Philippine President Ferdinand R. Marcos, Jr. witnessed the signing of the third revision of the deal that was first inked in 2002 and took effect in 2010.

“The ACFTA (ASEAN-China Free Trade Area) 3.0 Upgrade Protocol seeks to expand ASEAN-China cooperation into new and emerging areas, including the digital and green economies, supply-chain resilience, competition and consumer protection, as well as support for micro, small, and medium enterprises (MSME),” according to a statement from Mr. Marcos’ office.

The free trade agreement (FTA) lowers tariffs on goods and boosts the flow of services and investment in an area that covers a combined market of more than two billion people.

Chinese trade with the 11-member bloc reached USD 771 billion last year, making ASEAN its biggest trading partner, according to ASEAN data.

Beijing is looking to deepen its engagement with the region, which has a combined gross domestic product (GDP) of USD 3.8 trillion, as it seeks to offset the impact of steep import tariffs imposed globally by US President Donald J. Trump’s administration.

China and ASEAN are also members of the Regional Comprehensive Economic Partnership, the world’s largest trade bloc, encompassing nearly one-third of the global population and around 30% of global GDP.

Mr. Trump slapped almost all of its trading partners with varying tariff levels. He imposed a 30% tariff on Chinese exports to the US in a bid to protect his country’s industries.

The US has also imposed a 19% duty on many goods from the Philippines, Cambodia, Malaysia, Thailand and Indonesia since Aug. 7.

The Philippine Department of Foreign Affairs (DFA) earlier said the new protocol aims to make the regional trade framework “more modern, more comprehensive, and better aligned with today’s global realities.”

The enhanced deal expands the scope of the original ACFTA — which focused on goods, services, and investment — to include new areas such as fair competition, consumer protection, digital transformation, green growth, and supply-chain connectivity.

It also strengthens mechanisms to support MSMEs, helping them integrate more effectively into regional value chains.

According to the DFA, the upgrade will “open new opportunities for high-impact cooperation” in critical areas that are key to the region’s long-term resilience and sustainability.

It also introduces frameworks to promote inclusive and broad-based growth across member economies.

The original ASEAN-China FTA, launched in 2010, covers trade in goods, rules of origin, customs and trade facilitation, technical regulations, sanitary measures, and investment cooperation.

The latest revision reflects both sides’ efforts to future-proof their trade ties amid shifting global economic conditions.

ASEAN Studies lecturer at De La Salle-College of St. Benilde Josue Raphael J. Cortez said the ACFTA 3.0 serves as Beijing’s strategic move to strengthen its regional influence amid intensifying US efforts to expand its own economic foothold in Southeast Asia through tariff-based policies.

While the Philippines can use the upgraded pact as limited leverage, its complex political and security ties with China temper this advantage, he added.

“With the Philippines trying to widen its trading relations both with traditional and new markets, the promise this agreement holds is a challenge for Washington to overcome by proving that the alliance we share goes beyond issues of mutual benefit in the political and security sphere. And as treaty allies, we show the same extent of commitment as well to the geoeconomic challenges of our time,” he said via Facebook Messenger. — Chloe Mari A. Hufana

DOWNLOAD

DOWNLOAD