Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

TODAY’S REPORT

TODAY’S REPORT

The Gist

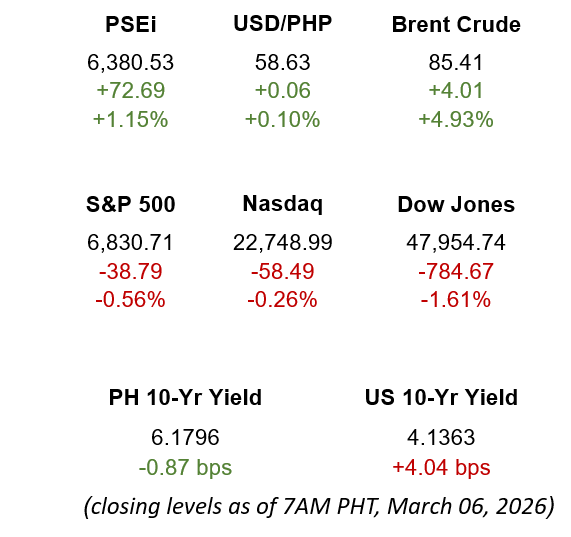

Your Morning Fix

- Headline inflation in the Philippines accelerated to 2.4% in February. The figure was driven by faster inflation for rentals, electricity, and food products.

- The Philippine government plans to procure at least a million barrels of oil to ensure domestic supply amid ongoing Middle East tensions.

- Oil prices sustained their rise on Thursday as attacks on oil tankers in the Gulf continued, as well as with the closure of the Strait of Hormuz.

- Federal Reserve Bank of Richmond President Tom Barkin said that high inflation and strong employment data may alter the course of the US Fed’s monetary stance.

- China set its economic growth target for 2026 at 4.5%-5%, its lowest in years, as it shifts its growth strategy toward being less export-reliant and more consumption-driven.

The Gist

The Gist

EXCLUSIVE STORIES FROM METROBANK

EXCLUSIVE STORIES FROM METROBANK

Investment Ideas: March 6, 2026

Here are our latest picks and calls to help you create your ideal investment portfolio

By Metrobank March 6, 2026

Ask Your Advisor: Parking money after Bahrain

As risks surrounding Bahrain’s sovereign bonds rise, rethinking exposure toward relative safety is in the cards. Learn about your options

By Earl Andrew A. Aguirre March 5, 2026

Inflation Update: Bracing for the storm

A protracted geopolitical clash in the Middle East will likely quicken inflation and lead to policy rate hikes

By Metrobank Research March 5, 2026

What to expect from the recent geopolitical ructions in the Middle East

US-Iran tensions may likely hit inflation targets, economic growth, policy rates

By Metrobank Research March 4, 2026

Ask Your Advisor: Will energy stocks sustain a rally?

Learn how the iShares Global Energy ETF (IXC) is positioned in a fast-evolving conflict-driven market

By Matthew Apostol March 4, 2026

Investment Ideas: March 4, 2026

Here are our latest picks and calls to help you create your ideal investment portfolio

By Metrobank March 4, 2026

Money Sense

A sharper strategy for bond investors in Q1

The recently released borrowing schedule offers opportunities for bond investors

Navigating the stock market rally and reality in 2026

Is it a new story for the new year? Know what is in store for the Philippine stock market.

How to build a balanced portfolio

If you have learned how to manage your budget for food well, you can do the same with your investment portfolio

Investing beyond borders: Smart moves for global homebuyers

Every smart investor plays the global market differently. Here are some things to know before diving into the world of overseas properties.

From passion to preservation: Protecting the value of collectibles

From rare toys and vintage instruments to first-edition books, collectibles are increasingly recognized for their potential to hold and even grow in value

Explainer Articles

Explainer ArticlesBonds 101: Why price and yield move in opposite directions

Ever wondered why bond prices and yields move in opposite directions? This article explains why.

Key Points

- What exactly is a bond

- Important bond terms

- Understanding bond yield

- Relationship of bond price and yield

Videos

VideosGet More Insights

Webinars

See All Webinars

2024 Mid-Year Economic Briefing: Navigating the Easing Cycle

In our most recent webinar, financial markets experts from Metrobank and our credits research partner CreditSights, discuss the possible effects on the investing environment amid an expected easing of inflationary pressures. June 21, 2024

Investing with Love: A Mother’s Guide to Putting Money to Work

In this webinar by First Metro Securities, you will learn about how a mother’s love can be related to investing. May 15, 2024

Investor Series: An Introduction to Estate Planning

In this webinar organized by the CFA Society Philippines, Wanda Beltran, Metrobank Head of the Accounts Management Division under the Trust Banking Group, shares some hard-earned lessons about poor estate planning and some tools and tips that can help people build an equitable legacy for their loved ones. September 1, 2023 Webinars

Webinars

Quarterly Economic Growth Release: Growth takes on a slower pace

Economic growth missed the mark