Monthly Economic Update: Fed cuts incoming

DOWNLOAD

DOWNLOAD

Consensus Pricing – June 2025

DOWNLOAD

DOWNLOAD

Policy Rate Update: Dovish BSP Narrows IRD

DOWNLOAD

DOWNLOAD

TOP SEARCHES

30

The Gist

A daily dose of market updates and smart investment strategies to guide your portfolio decisions

Today's Report

Today's Report

Your Morning Fix

- According to a BusinessWorld survey, June inflation in the Philippines likely rose slightly to 1.5% due to higher fuel costs, though stable food prices helped keep it below the central bank’s 2–4% target range.

- Business confidence in the Philippines dipped to 28.8% in the second quarter, as firms grew cautious over potential economic fallout from US tariff policies.

- Due to minor delays in selling state-owned assets, the Department of Finance drastically cut its 2025 privatization target by 95% to PHP 5 billion from PHP 101 billion.

- Senate Republicans advanced US President Donald Trump’s tax and spending bill, despite forecasts it could add USD 3.3 trillion of debt in about a decade.

- Global stocks hit record highs, as optimism over US-China trade talks and surging tech giants like Nvidia, Alphabet, and Amazon boosted markets, while the dollar hovered near a multi-year low.

Our Portfolio Recommendation

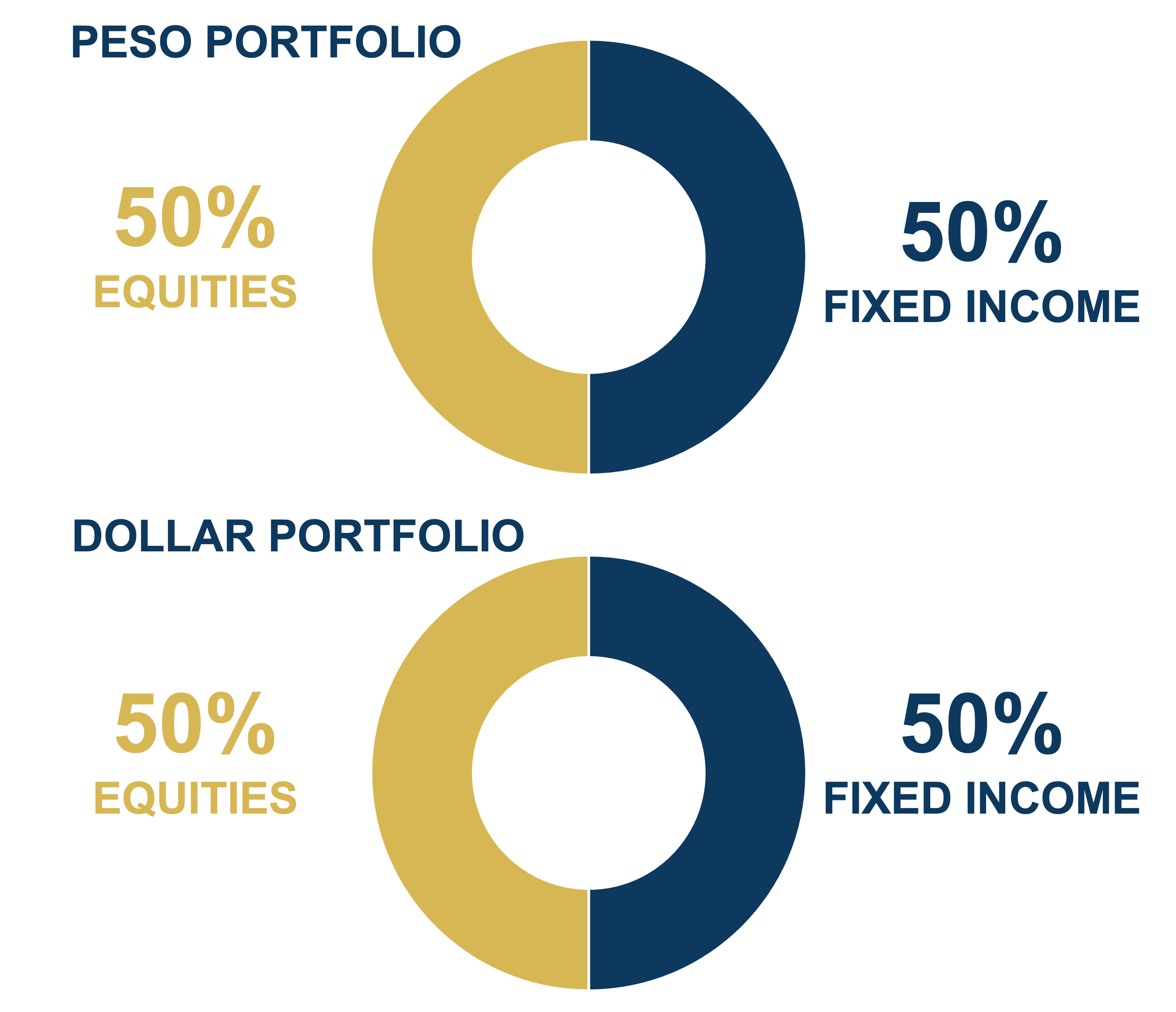

Our peso portfolio remains at a neutral stance of 50% fixed income and 50% equities as the BSP becomes increasingly accommodative. However, we remain cautious amid global uncertainties. The sustainability of the current bounce in local equities remains in contention, largely influenced by geopolitical jitters and cautious sentiment, as opposed to fundamentals. As for the dollar portfolio, we are shifting our global strategy back to 50% fixed income and 50% equities from the previous 60%/40% allocation because of easing US-China trade tensions. However, there is lingering uncertainty and we prefer to remain defensive despite the shift in risk sentiment.

| 2025 Metrobank Forecast | 2026 Metrobank Forecast | 2027-2029 Metrobank Forecast | |

|---|---|---|---|

| GDP | 5.7% | 6.1% | 6.0% |

| Inflation | 2.2% | 3.3% | 3.0% |

| BSP Target Reverse Repurchase Rate | 4.75% | 4.25% | 5.00% |

| Federal Funds Rate | 4.00% | 3.50% | 4.00% |

| USD/PHP | 56.9 | 57.7 | 55.0 |

CHART OF THE DAY

CHART OF THE DAY

Chart of the Day

Philippine trade deficit hits 3-month low deficit in May

The Philippines recorded its smallest trade deficit in three months in May, reaching USD 3.29 billion, which is a significant 30.4% drop from May of last year. This improvement was driven by an increase in exports and a decrease in imports, making it the slimmest trade deficit since February. Bloomberg, PSA

Featured Reports

More Reads

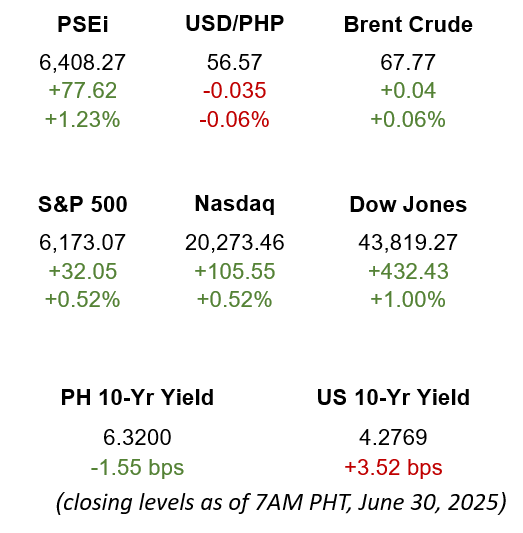

USD/PHP ends lower amid better selling

- The USD/PHP exchange rate opened 8 centavos higher at 56.57 last Friday, as the global space staged a small recovery after the past days’ dollar sell-off.

- The pair was initially bought up to the morning’s high of 56.71, but selling interest prevailed with the pair breaking the 56.60 support.

- Remittances kept the local pair pressured to the downside, leading to further lows of 56.45.

- The USD/PHP exchange rate ultimately closed at 56.57, or 3.5 centavos lower day-on-day.

- The current support levels of USD/PHP are 57.30/40 while the resistance levels are 56.70/8

Local GS players await upcoming supply

- Local yields remained within recent trading ranges last Friday, as the market awaited the release of the Bureau of the Treasury’s (BTr) 3rd quarter borrowing schedule.

- Most market participants stayed on the sidelines, awaiting more clarity on upcoming supply before adding significant risk.

- Fixed Rate Treasury Notes (FXTN) 7-70, 10-69, and 10-73 traded actively with yields settling at 5.875%, 6.120%, and 6.330%, respectively.

- Retail Treasury Bond 5-13 was the most actively traded security, accounting for around one-third of total volume, with two-way interest seen near 5.465%.

- For the 3rd quarter, the BTr cut total bond auction volume to PHP 365 billion, from PHP 410 billion in the previous quarter, and will issue across 3- to 25-year buckets.

- The BTr announced the reissuance of FXTN 7-70 for this week’s 5-year auction.

PSEi caps the week on a firmer note

- The Philippine Stock Exchange index (PSEi) ended 77.62 points higher at 6,408.27 last Friday, tracking the region’s positive tone following Wall Street’s rebound.

- Broad-based gains were led by Property (+2.79%), Holding Firms (+1.63%), and Services (+1.26%), while Mining & Oil (-1.84%) was the sole drag on the index.

- Alliance Global Group Inc. (+5.39%), Ayala Land Inc. (+4.67%), and DMCI Holdings Inc. (+4.10%) paced the index’s advance.

- Meanwhile, Manila Electric Co. (-2.01%), Bank of the Philippine Islands (-0.75%), and San Miguel Corp. (-0.45%) led the laggards.

- Foreign investors were nearly neutral with only a minor net outflow of PHP 7.6 million.

USD/PHP ends lower amid better selling

- The USD/PHP exchange rate opened 8 centavos higher at 56.57 last Friday, as the global space staged a small recovery after the past days’ dollar sell-off.

- The pair was initially bought up to the morning’s high of 56.71, but selling interest prevailed with the pair breaking the 56.60 support.

- Remittances kept the local pair pressured to the downside, leading to further lows of 56.45.

- The USD/PHP exchange rate ultimately closed at 56.57, or 3.5 centavos lower day-on-day.

- The current support levels of USD/PHP are 57.30/40 while the resistance levels are 56.70/8

Local GS players await upcoming supply

- Local yields remained within recent trading ranges last Friday, as the market awaited the release of the Bureau of the Treasury’s (BTr) 3rd quarter borrowing schedule.

- Most market participants stayed on the sidelines, awaiting more clarity on upcoming supply before adding significant risk.

- Fixed Rate Treasury Notes (FXTN) 7-70, 10-69, and 10-73 traded actively with yields settling at 5.875%, 6.120%, and 6.330%, respectively.

- Retail Treasury Bond 5-13 was the most actively traded security, accounting for around one-third of total volume, with two-way interest seen near 5.465%.

- For the 3rd quarter, the BTr cut total bond auction volume to PHP 365 billion, from PHP 410 billion in the previous quarter, and will issue across 3- to 25-year buckets.

- The BTr announced the reissuance of FXTN 7-70 for this week’s 5-year auction.

PSEi caps the week on a firmer note

- The Philippine Stock Exchange index (PSEi) ended 77.62 points higher at 6,408.27 last Friday, tracking the region’s positive tone following Wall Street’s rebound.

- Broad-based gains were led by Property (+2.79%), Holding Firms (+1.63%), and Services (+1.26%), while Mining & Oil (-1.84%) was the sole drag on the index.

- Alliance Global Group Inc. (+5.39%), Ayala Land Inc. (+4.67%), and DMCI Holdings Inc. (+4.10%) paced the index’s advance.

- Meanwhile, Manila Electric Co. (-2.01%), Bank of the Philippine Islands (-0.75%), and San Miguel Corp. (-0.45%) led the laggards.

- Foreign investors were nearly neutral with only a minor net outflow of PHP 7.6 million.

READ MORE

READ MORE