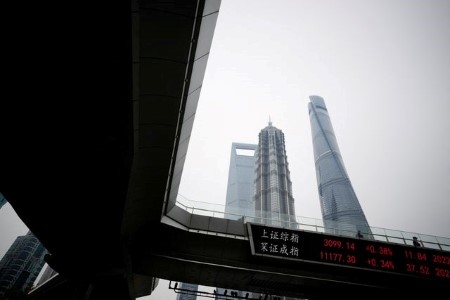

HONG KONG/SHANGHAI, Nov 25 (Reuters) – China’s central bank will offer cheap loans to financial firms for buying bonds issued by property developers, four people with direct knowledge of the matter said, the strongest policy support yet for the crisis-hit sector.

The People’s Bank of China (PBOC) hopes the loans will boost market sentiment toward the heavily indebted property sector, which has lurched from crisis to crisis over the past year, and rescue a number of private developers, said the people, who asked not to be named as they were not authorised to speak to the media.

China has stepped up support in recent weeks for the property sector, a pillar accounting for a quarter of the world’s second-biggest economy. Many developers defaulted on their debt obligations and were forced to halt construction.

The country’s biggest banks this week pledged at least USD 162 billion in credit to developers.

The PBOC loans, through its relending facility, are expected to be at much lower than the benchmark interest rate and would be implemented in the coming weeks, giving financial institutions more incentive to invest in private developers’ onshore bonds, two sources said.

Terms such as the interest rate on the loans were not immediately known.

The PBOC is also drafting a “white list” of good-quality and systemically important developers that would receive wider support from Beijing to improve their balance sheets, two of the sources said.

The central bank did not immediately respond to a request for comment on the planned measures.

At least three private developers – including Longfor Group Holdings Ltd, Midea Real Estate Holding Ltd and Seazen Holdings – received the green light this month to raise a total of 50 billion yuan (USD 7 billion) in debt.

If there were not enough demand from investors for such new bonds, the PBOC would likely step in to provide liquidity via the relending facility for the rest of the issuance, said one of the four people and another source.

Hong Kong’s Hang Seng Mainland Properties Index was up as much as 4.7% on Friday, adding 1 percentage point after Reuters reported the PBOC moves. China’s top developer by sales, Country Garden, was up 10%, CIFI Holdings was up more than 5%, and Longfor nearly 4%.

FROM CRACKDOWN TO AGGRESSIVE SUPPORT

Relending is a targeted policy tool the PBOC typically uses to make low-cost loans to banks to support the slowing economy, as the central bank faces limited room to cut interest rates on concerns about capital flight.

The PBOC in recent months has used the relending facility to support sectors including transport, logistics and tech innovation that were hard hit by the COVID-19 pandemic or are favoured by long-term state policies.

Beijing’s aggressive support for the property sector marks a reversal from a crackdown begun in 2020 on speculators and indebted developers in a broad push to reduce financial risks.

As a result of the crackdown, though, property sales and prices fell, developers defaulted on bonds and suspended construction. The construction halts have angered homeowners who have threatened to stop mortgage payments.

The PBOC also plans to provide 100 billion yuan (USD 14 billion) in M&A financing facilities to state-owned asset managers mainly for their acquisitions of real estate projects from troubled developers, two sources said.

Chinese media reported on Monday the central bank planned to provide 200 billion yuan in interest-free relending loans to commercial banks through the end of March for housing completions.

Among other recent official support, China’s interbank bond market regulator said this month it would widen a program to support about 250 billion yuan (USD 35 billion) of debt offerings by private firms.

Much of Beijing’s previous support targeted state-owned developers.

Yi Huiman, chairman of China’s securities regulator, said on Monday the country must implement plans to improve the balance sheets of “good quality” developers.

Fitch Ratings said on Thursday private Chinese developers face higher liquidity risk, in terms of debt structure with greater short-term maturity pressure, than state-owned peers as banks and other creditors are becoming reluctant to lend.

(USD 1 = 7.1609 Chinese yuan renminbi)

(Reporting by Julie Zhu in Hong Kong and Engen Tham in Shanghai; Additional reporting by Kevin Huang in Beijing; Editing by Sumeet Chatterjee, William Mallard and Raissa Kasolowsky)

DOWNLOAD

DOWNLOAD