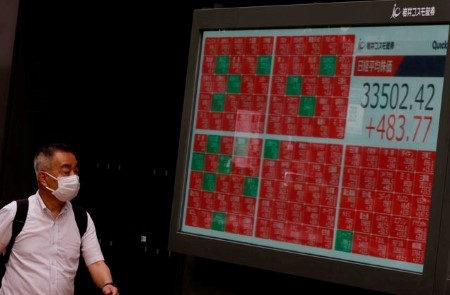

July 12 (Reuters) – The mood across Asia at the midpoint of the week is increasingly upbeat, as a growing consensus that the US central bank is near the end of its policy tightening cycle continues to weigh on the dollar, improve sentiment, and lift asset prices.

The Reserve Bank of New Zealand’s latest interest rate decision and Indian inflation figures are the main local set-piece events on Wednesday, while US inflation later in the day will go a long way to setting the tone for the rest of the month.

There also finally appears to be some good news from China. Figures on Tuesday showed surprisingly strong bank lending in June, helped by central bank efforts to support an economy that has struggled to rebound from pandemic restrictions as expected.

Chinese regulators this week extended some policies in a rescue package introduced in November to shore up liquidity in the real estate sector.

Global hedge funds added more Chinese stocks to their portfolios than they sold in recent days for the first time in seven weeks, Goldman Sachs said in a report.

Chinese stocks on Tuesday registered their best day in over a week, while the MSCI Asia ex-Japan index jumped 1.5% – its biggest rise in over a month and sixth biggest this year.

On a micro level in Asia, shares of Taiwanese chipmaker Foxconn and Indian metals-to-oil conglomerate Vedanta could be under the spotlight again after Foxconn pulled the plug on a USD 19.5 billion joint venture. Trading volume in Vedanta shares on Tuesday was the highest in seven weeks.

On a macro level, the US dollar’s weakness continues to help fuel optimism across Asian markets. The dollar’s broad value has now fallen four days in a row, the longest losing streak since March.

New Zealand’s central bank is expected to keep its cash rate – already at a 14-year high and the highest in the developed world – at 5.50% on Wednesday and leave it there for the rest of the year.

It would be the first time the RBNZ has not raised rates at a policy meeting in nearly two years, and the pause would come a month after it was confirmed that the economy is in recession. But with inflation running well above target, rates markets are leaning toward one more 25 basis point hike by year-end.

Indian consumer price inflation, meanwhile, is expected to tick up to 4.58% in June from 4.25% in May, the lowest in more than two years.

Here are key developments that could provide more direction to markets on Wednesday:

– New Zealand interest rate decision

– India inflation (June)

– US inflation (June)

(By Jamie McGeever; Editing by Deepa Babington)

DOWNLOAD

DOWNLOAD