Tag: recession

Technical Analysis: Rates are coming down before potentially moving higher

Disinflation, or the slowdown of inflation, is ongoing, but the recession debate continues.

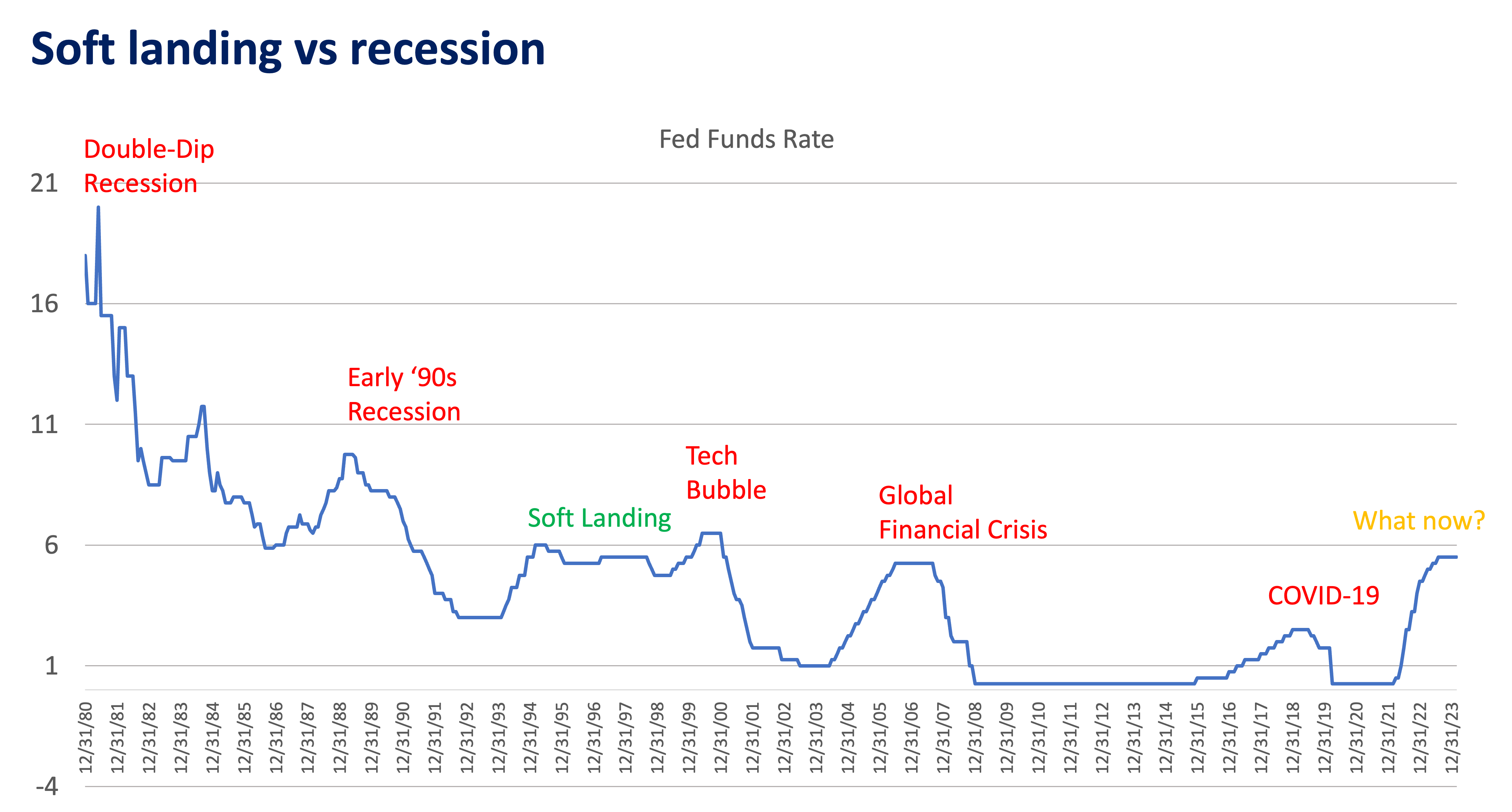

Since 1980, we have observed a secular decline in yields and policy rates and easing monetary conditions enabling capital to work leading to a golden age of financial markets. In more recent years, the system has grown dependent on fiscal or monetary stimulus triggering macroeconomic volatility whenever economic conditions tighten. This analysis examines current yield trends and their implications for investors.

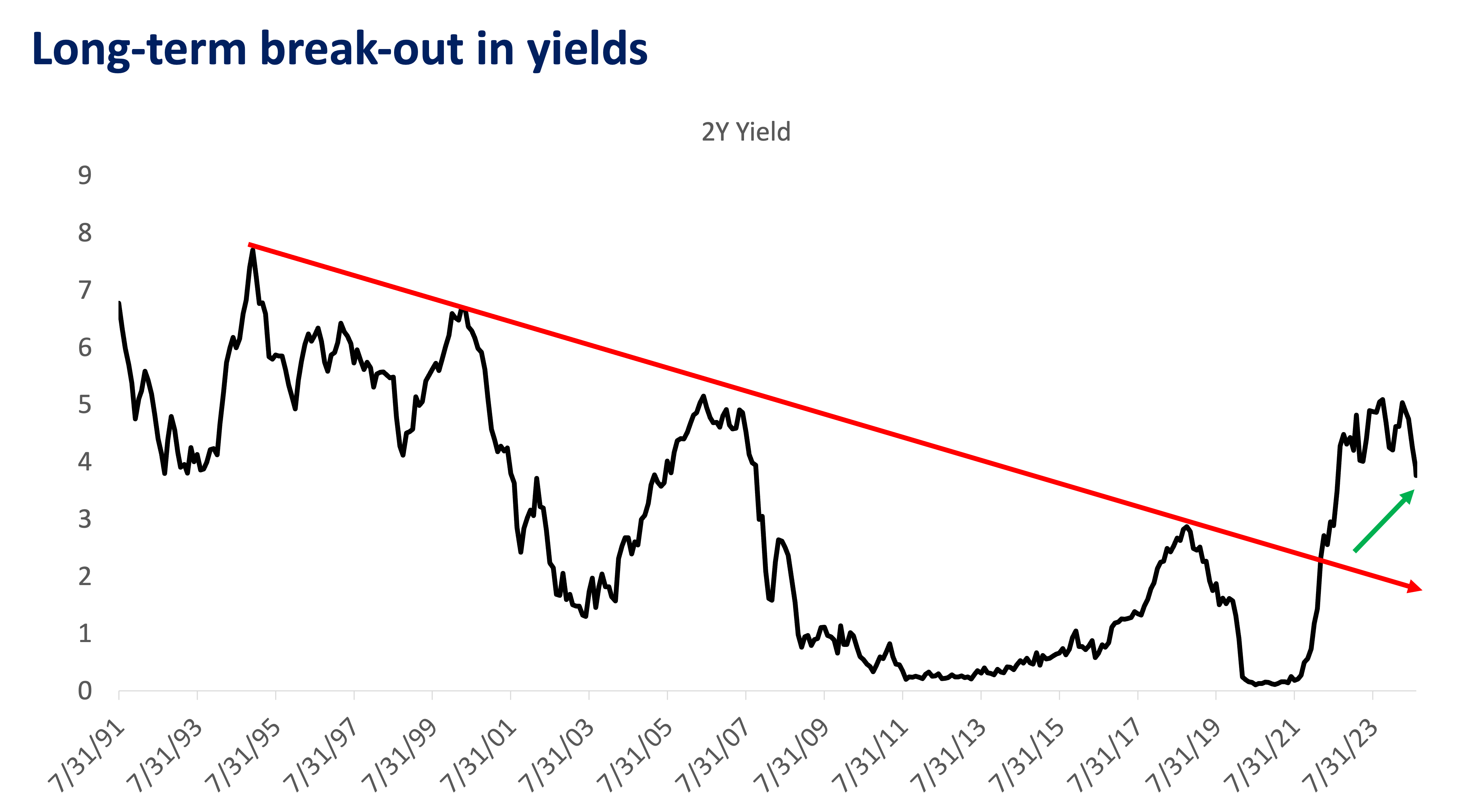

US Treasury yields across various tenors show a long-term breakout pattern since 2021, signaling a potential shift to a higher interest rate environment.

In 2021, strong break-outs can be observed following the US Fed’s aggressive fight against inflation across all tenors of the yield curve. Yields rose above the sequence of lower peaks and troughs, hinting of a long-term structural shift to a higher interest rate environment.

Growing geopolitical tensions and declining capex into conventional energy (fossil fuel) will likely be the supporting drivers of the long-term breakout in yields.

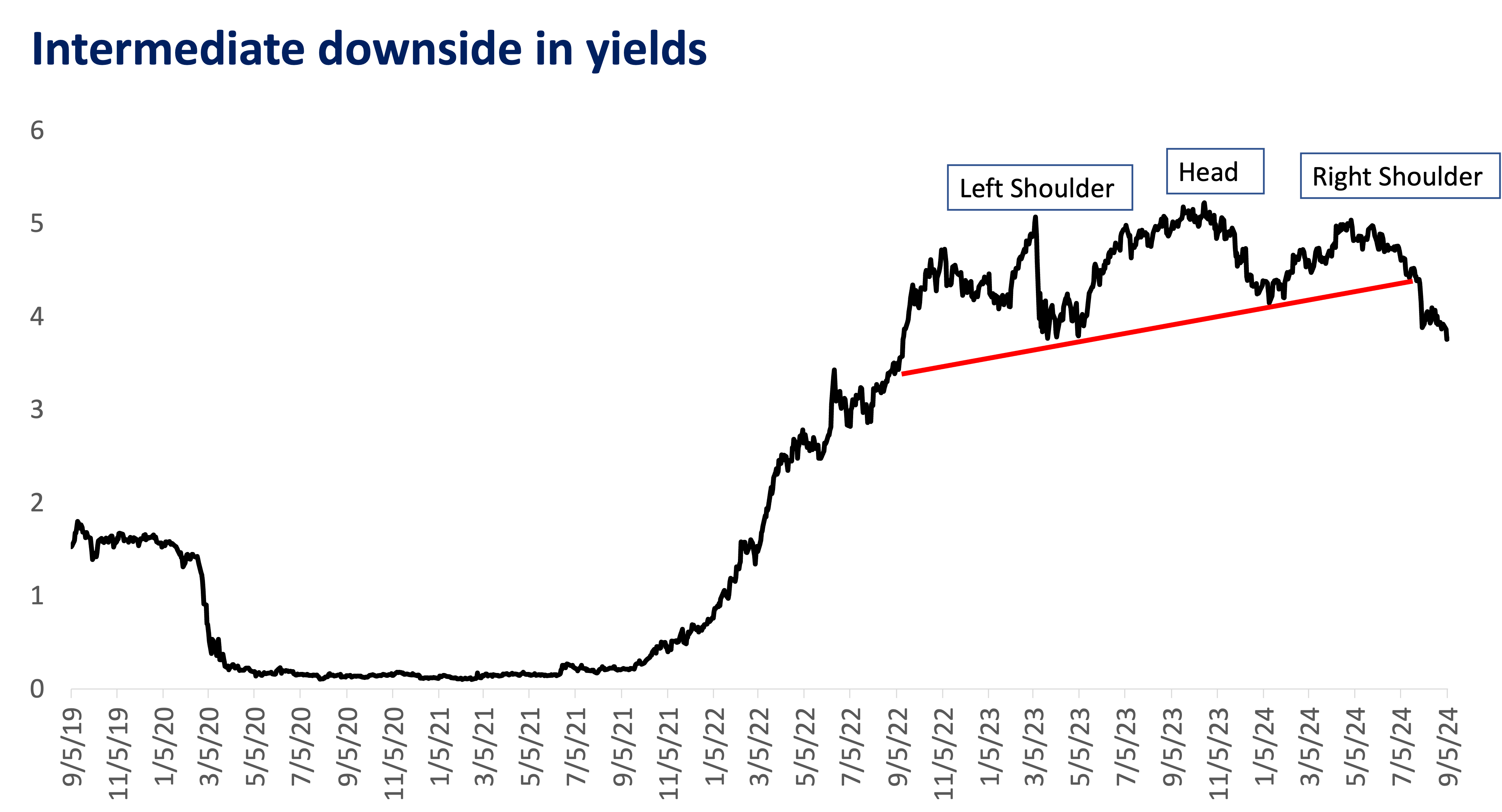

The 2-year US Treasury yield exhibits a Head and Shoulders pattern, suggesting a potential intermediate-term downside in yields for 2024-2025.

While “higher for longer… for longer” may be the new structural theme in years to come. The very sharp rise of rates since 2021 has been significant and needs to normalize before continuing higher.

Therefore, downside can be expected in 2024 to 2025. Looking at the chart of the 2-year yield, a topping pattern called a Head and Shoulders (H&S) has been confirmed following the break below the critical neckline. US Fed Chair Jerome Powell has confirmed what many expected, saying, “The time has come for policy to adjust.”

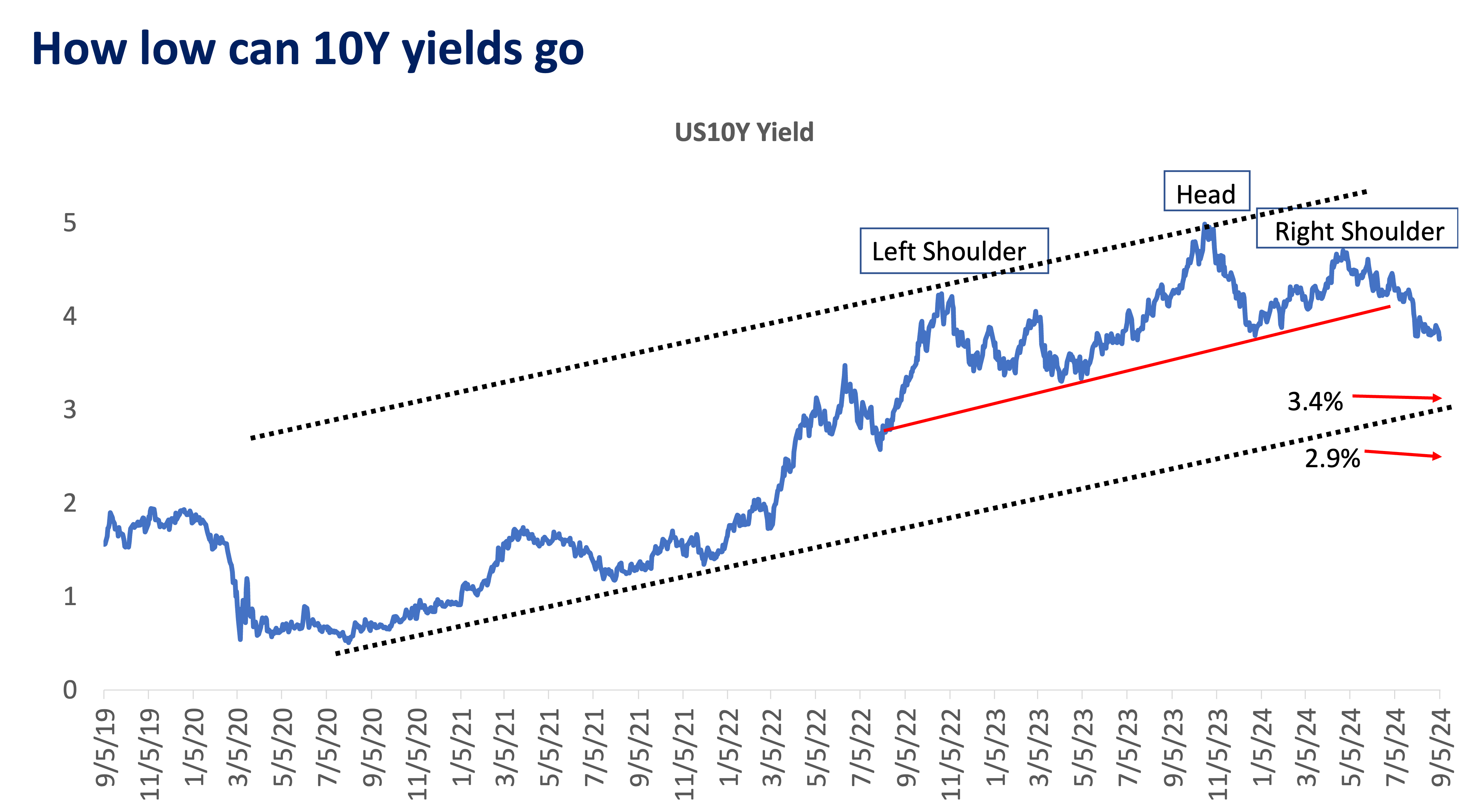

Parallel trend lines on the 10-year US Treasury yield chart indicate a possible decline to 3.4% by end-2024 in a no-recession scenario.

We naturally seek patterns, and parallel lines drawn from lows of August 2020 to the highs of October 2023 indicate yields may fall to as low at 3.4% by year-end 2024. The drop to 3.4% will likely be the max drawdown in a no-recession scenario, as it keeps the uptrend intact. A recession scenario will use the drawdown target of 2.9% of the H&S.

Historical data shows that four out of the last five Federal Reserve cutting cycles have led to recessions, highlighting the uncertainty between a soft landing and recession scenario.

While US GDP for 2Q-2024 was revised upwards to 3.0%, as disinflation continues, a soft landing cannot be concluded given the emergence of deflationary pressures signaled by the cooling labor market. Although past cycles do not dictate current ones, history does rhyme. Four of the last five cutting cycles by the Federal Reserve have led to a recession.

How to invest based on developing risks?

The current disinflationary economic regime typically creates a risk-on market environment, which generally favors both equities and fixed income investments. However, the growing concerns about economic growth suggest a more cautious approach, potentially tilting the balance towards fixed income securities.

In light of these economic conditions and associated risks, investors might consider diversifying their portfolios with a focus on high-quality bond funds. Such funds can offer a balance of potential returns and relative stability in uncertain times. When exploring investment options, it’s worth examining various unit investment trust funds (UITFs) offered by reputable financial institutions.

Some investors find value in funds that focus on domestic bonds, while others prefer those with exposure to international markets, particularly those dealing in stable currencies like the US dollar. Additionally, funds that specialize in investment-grade bonds can provide an extra layer of security for more risk-averse investors.

As always, it’s crucial to conduct thorough research and possibly consult with a financial advisor to determine the most appropriate investment strategy for your individual circumstances and risk tolerance.

Key Takeaways

- Yields are expected to come down in the short term before potentially moving higher in the long term.

- 10-year yields could fall to as low as 3.4% by year-end 2024 in a no-recession scenario, or 2.9% in a recession scenario.

- The disinflationary economic regime favors both equities and fixed income, but growing growth concerns suggest a focus on fixed income.

- Remain dynamic and responsive to changes in the economic regime, especially given the upcoming US Presidential elections and potential policy shifts.

The rest of 2024 will be noisy given the US Presidential elections, adding to the ongoing macro-economic volatility. It would be ill-advised to position ahead for the victor given the lag effect of government policy, positioning ahead may result in opportunity lost. Instead, remain dynamic and responsive to the changes in the economic regime given the coming policy easing.

Be patient with your investments, markets don’t move in a straight line so avoid chasing assets that have run-up significantly. Always have an objective and/or exit strategy to avoid making emotional decisions if prices move the wrong way.

If you wish to explore bond funds from Metrobank, you may check out the following:

- Metro Max 5 Bond Fund

- Metro $ Max 5 Bond Fund

- Metro US Investment Grade Bond Fund

KYLE TAN, MSFE, CSS is a Portfolio Manager at Metrobank’s Trust Banking Group, managing the bank’s offshore Unit Investment Trust Funds (UITF). He holds a Master’s degree in Financial Engineering from the De La Salle University, a Level 3 candidate of the Chartered Market Technician (CMT) certification course and a PSE Certified Securities Specialist (CSS). He spends his free time working out, training at the gun range, or hunting for rare Star Wars collectibles.

DOWNLOAD

DOWNLOAD

By Kyle Tan

By Kyle Tan