Tag: Money market

Where to invest your money during a calm market?

Investors don’t want their money to sleep. They’re looking for where to invest their money so it grows, even in the case of a calm market. Learn the dangers of a calm market here.

Investors strive to make their money work 24/7. However, in calm markets, deciding where to invest your money in may be difficult. In these instances, deploying cash into bonds or stocks may not make sense, especially if an investor’s portfolio already has exposure to investments that are available in the market.

In times like these, when markets appear calm, it’s vital to be aware of the potential dangers of complacency. Putting cash in a parking facility then becomes a viable strategy.

In the context of investing, parking facilities are temporary holding places for cash or liquid assets before they are put into other investments.

They include money market funds, savings accounts, checking accounts, etc. They are usually short-term investments that give investors returns above the standard deposit rates.

When looking for a target parking facility, it is important to consider the following:

Timeframe and liquidity

The timeframe of the facility needs to be aligned with the amount of time the investor expects cash to remain idle. For example, if the investor needs the funds within a week, he should be able to receive them by the end of the week.

One way to do this is to subscribe to a money market Unit Investment Trust Fund (UITF) offered by banks. In Metrobank, we have the Metro Money Market Fund for pesos and the Metro$ Money Market Fund for US dollars.

Investors no longer have to look out for maturities or any minimum holding period. Those who subscribe today, for example, can already have access to their funds without any extra charges as early as the next banking day, depending on the fund. The Metro Money Market Fund, for example, offers that liquidity.

Competitive return

Apart from being very liquid, a parking facility should be able to give investors competitive returns. In comparing parking facilities, always remember to ensure that the presentation of returns is the same.

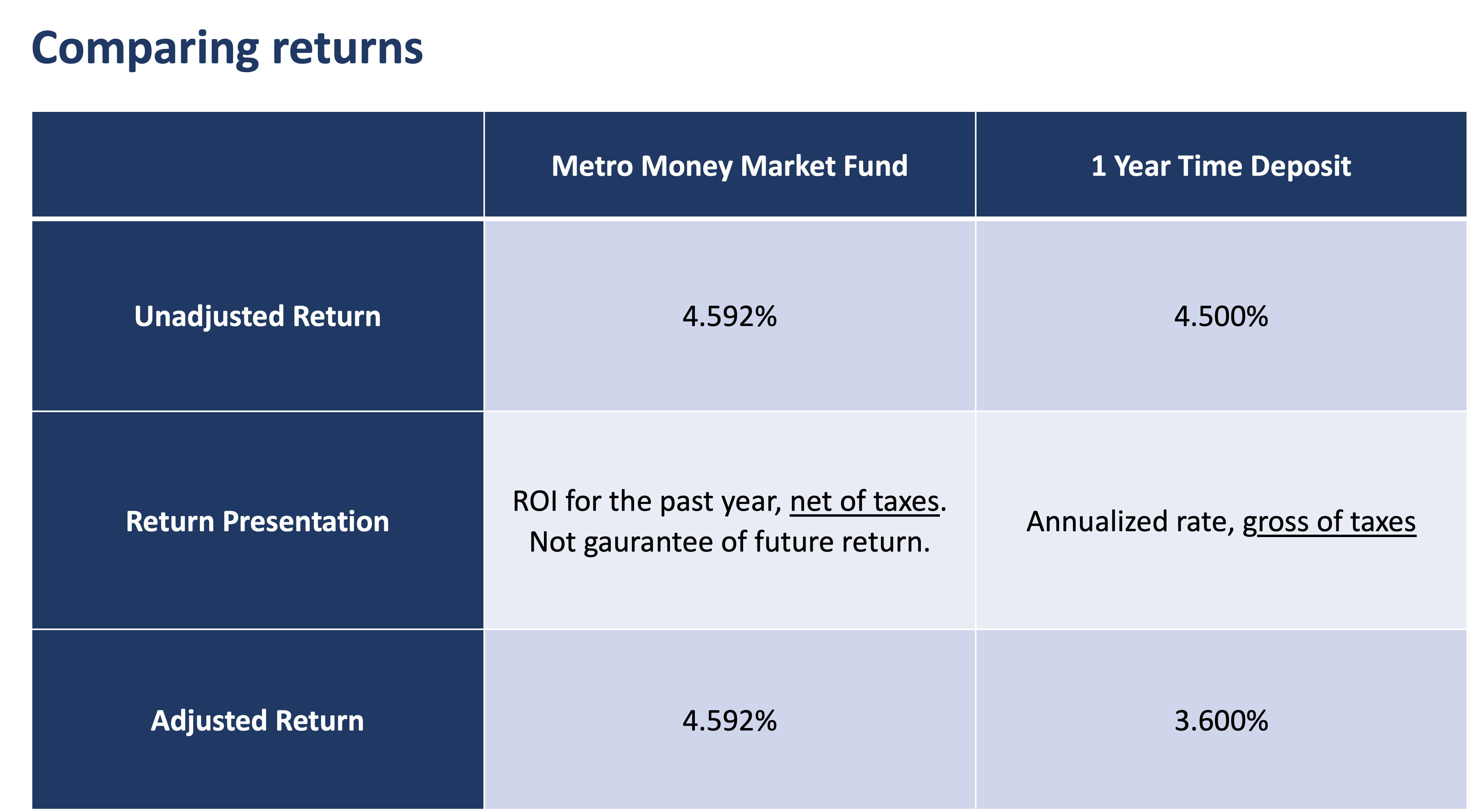

In the example below, the Metro Money Market Fund return is presented as a return that is already net of tax, while the return of the 1-year time deposit (TD) is still gross of tax.

To properly compare the two, the investor needs to convert the TD return to its net return. In this case, the comparison of the net return between the two options is clear. The Metro Money Market Fund has exposure to Bangko Sentral ng Pilipinas (BSP) bills. As of this writing, the BSP offers higher yields compared to peso time deposit rates.

Ease of transacting

Another consideration is how easy and convenient it is for an investor to execute transactions. This means being able to have access online or via a mobile app.

The convenience of quick transactions has never been more important now, as opportunities may arise quickly. Having easy access to funds can help with portfolio management and optimize returns.

How do you invest in money market funds or UITFs?

It’s easy. Most banks and some financial institutions offer these financial instruments to investors with some money to invest. The minimum amounts vary. For example, for clients with a moderate risk profile, Metrobank offers the Metro Money Market Fund and the Metro$ Money Market Fund.

Each UITF requires a minimum initial investment of PHP 10,000 and PHP 1,000 per succeeding investment for peso denominated UITFs, and USD 500 initial investment and USD 100 per succeeding investment for US dollar denominated UITFs.

It is best to seek assistance from your investment counselor before you invest to best match your needs with the right investment.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here or visit any Metrobank branch so you can begin your wealth journey with us.)

JON EDISON MUNSAYAC leads the Product Management Department of Metrobank’s Trust Banking Group where he oversees the Bank’s UITF product suite. He has a little over 11 years’ worth of experience in trust banking, primarily in markets research, strategy, investment solutions, and product management. He is a storyteller at heart and an avid believer in keeping things simple when possible.

DOWNLOAD

DOWNLOAD

By Jon Edison Munsayac

By Jon Edison Munsayac