Tag: Japan

The end of Japan’s negative rates era: Are you ready for it?

The growing euphoria over the “land of the rising sun” is predicated on investors’ view of an ascendant economy, surging exports, and increasing foreign inflows.

The Bank of Japan (BOJ) has made a historic move as they raise rates for the first time since 2007. Investors have turned positive on Japan as the country’s economy skirts a recession, along with improving earnings growth and corporate governance reforms.

The upward revision of Japan’s fourth-quarter gross domestic product (GDP), now at an annualized rate of 0.4%, signified that the economy avoided a technical recession in 2023.

As business sentiment strengthens across manufacturing and services sectors, potential growth may be fueled by robust exports, particularly in semiconductor-related products. Given this, the anticipation of improved economic performance in the upcoming quarters could bolster support for the BOJ to further withdraw from its ultra-easy monetary policies.

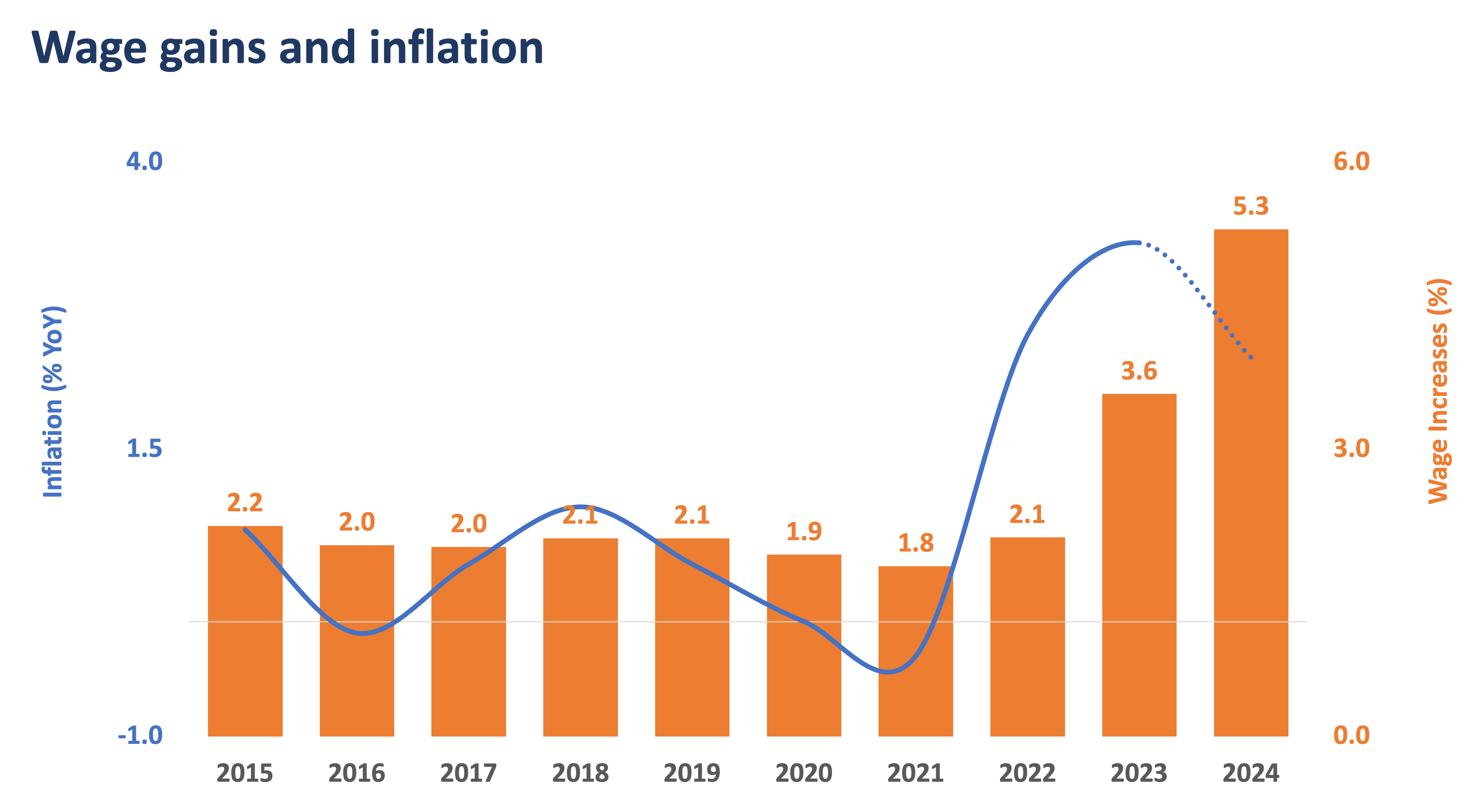

Wage hikes support price stability

Japan’s inflation reached a 41-year high in 2023 amid higher prices of food and imports. Currently, inflation remains above the BOJ’s 2% target, rising to 2.8% year-on-year in February.

The country’s annual spring wage negotiations ended with pay hikes of around 5.28%, the highest since 1991. Given this, analysts now expect average inflation in Japan to stay close to the target in 2024.

Inflation is expected to stabilize, following the higher-than-expected wage gains. (Source: Bloomberg)

The end of the last negative rate regime

The BOJ has made a historic move of officially ending its ultra-loose negative interest rates, hiking for the first time in 17 years and scrapping its yield curve control policy. The central bank has adopted a new policy rate range of 0.0% to 0.1% after sticking to -0.1% since 2016.

However, the BOJ will not likely prioritize aggressive monetary tightening as they affirmed that financial conditions would remain accommodative. While BOJ will continue buying Japanese government bonds, BOJ Governor Kazuo Ueda acknowledged that he will consider lowering their purchases “at some point in the future.” Additionally, the BOJ will also discontinue its purchases of exchange-traded funds and Japan real estate investment trusts.

Yen’s appreciation to be capped

Despite raising rates, the BOJ still kept its relatively dovish stance, which led to a weaker yen. While the currency is expected to appreciate, a significant strengthening of the currency may be limited.

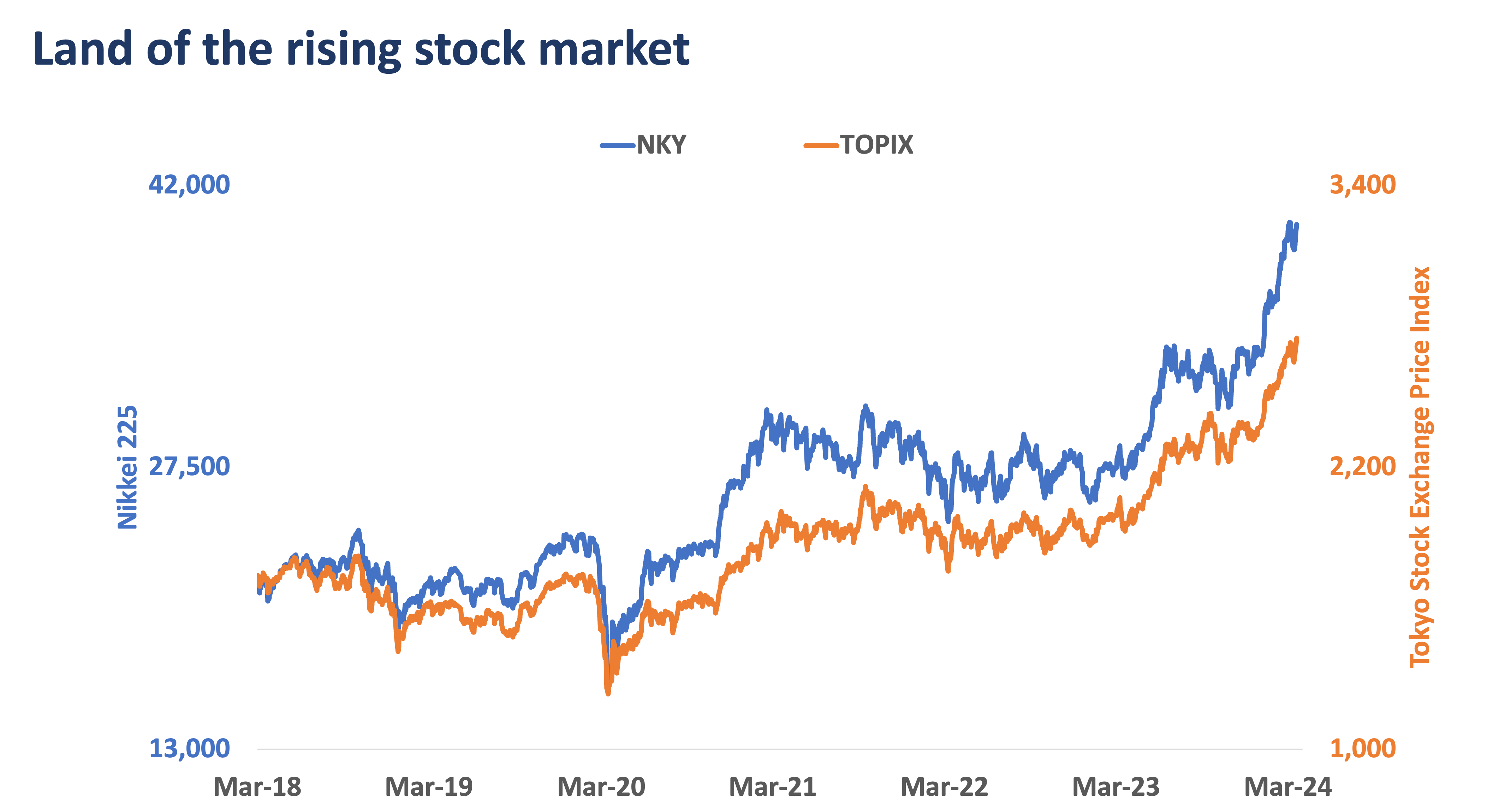

Moreover, the Nikkei 225 reached the key 40,000 level, surging over 20% year-to-date, amid improving shareholder returns, earnings growth, and corporate governance.

Equities have reached historic highs, with the Nikkei 225 surging above the 40,000 level. (Source: Bloomberg)

As overall sentiment continues to improve, investors are riding the Japan wave as it continues to move higher. We currently have an overweight call on the back of extensive corporate reforms, attractive valuations, and improving foreign inflows.

If you are looking to invest and add exposure to Japan, you may explore our Metro$ Japan Equity Feeder Fund, a US-dollar-denominated fund that invests in stocks that comprise the Japanese equities market.

Consult your relationship manager or investment specialist to know more.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here so you can begin your wealth journey with us.)

SOPHIA THERESE “PIA” BONIFACIO is a Research Officer at Metrobank’s Trust Banking Group, covering local and offshore macroeconomic research. She obtained her Bachelor’s degree in Economics with a Specialization in Financial Economics, cum laude, from the Ateneo de Manila University and is a Certified UITF Sales Person (CUSP). Pia enjoys long road trips and is a self-proclaimed milk tea connoisseur.

ANNA DOMINIQUE CUDIA, MBA, CSS, is the Head of Markets Research at Metrobank’s Trust Banking Group, spearheading the generation and presentation of financial markets insights to internal and external clients. She used to be with Metrobank’s Investor Relations, where she brought in international awards and took part in various multi-billion peso and dollar capital raising activities. She holds a Master of Business Administration (Finance) degree, with distinction, from the University of London, and industry certifications in finance. She is a naturally curious person and likes to travel here and abroad.

GINNY PECAÑA is the Head of Investment Services Division at Metrobank’s Trust Banking Group, overseeing markets and equities research, investment analysis, fund selection, portfolio analytics, and trade execution. Ginny has garnered multiple awards for fund management with her decades of banking experience. She holds a Bachelor’s degree in Business Management from the Ateneo de Manila University as well as various finance certifications. On weekends, Ginny plays Mom to two teenage boys and a 10-month-old corgi named Hobie.

DOWNLOAD

DOWNLOAD

By Sophia Bonifacio, Anna Cudia, and Ginny Pecaña

By Sophia Bonifacio, Anna Cudia, and Ginny Pecaña