Tag: inflation exchange rate

Forecast Updates: Steady progress but at a slower pace

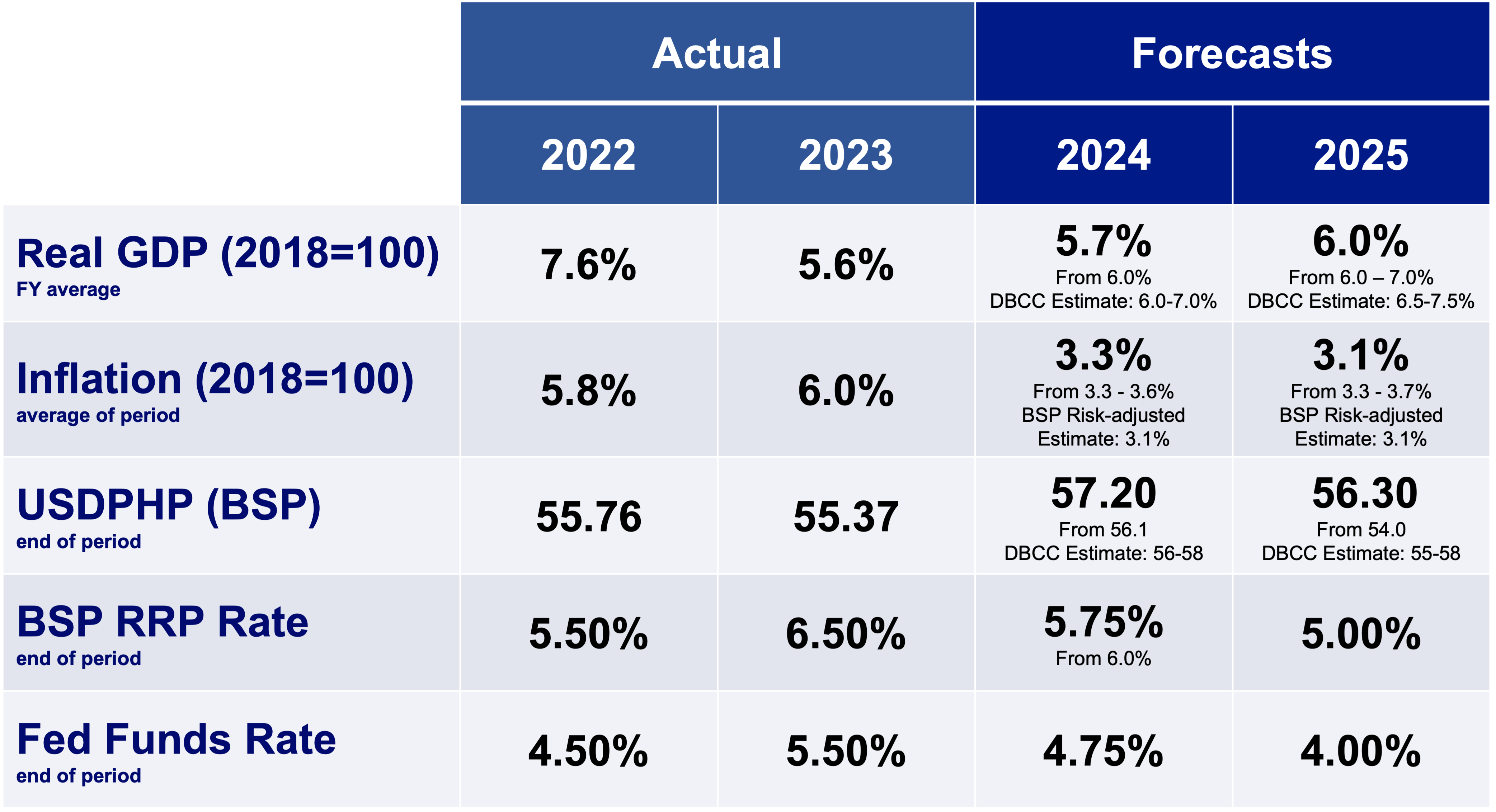

The economy is expected to grow at a steady clip, but inflation remains to be tamed and the timing of rate cuts is crucial.

We are revising our forecasts as a result of our latest analysis of market shifts, recent developments, and assessment of policy direction.

GDP: Robust growth but more work needed to reach target

We continue to believe that the country’s economic growth should remain robust, albeit at a moderated pace as investment momentum remains constrained by tight monetary policy, making it harder for businesses to invest and expand.

At the same time, many Filipinos are not spending as much as before. Some households have also incurred more debt. Despite these challenges, the economy continues to move forward, just at a more measured pace than initially hoped.

The gross domestic product (GDP) is expected to hit 5.7% in 2024 year-on-year, and additional efforts will be needed to reach the government’s target of 6-7%.

Inflation: Last year’s bane, this year to tame

The price of rice, which has been a major reason for rising costs in the Philippines, is expected to go down. This should help keep overall prices more stable. We agree with the Bangko Sentral ng Pilipinas (BSP) that inflation will stay within acceptable levels this year and next.

However, some challenges loom ahead. A strong La Nina weather event could affect crop production and prices. Also, geopolitical events could affect supply chains and push prices up as well. While the future looks promising for stable prices, our outlook may change.

BSP: Governor Eli Remolona’s urgency points to need for easing

The BSP is considering lowering interest rates in August. This move suggests that the central bank believes prices are stable and that the economy needs some help to grow faster. We believe the BSP might lower rates twice this year, with a possible third cut in December if prices remain stable and the financial markets stay calm.

However, these decisions are also dependent on what the United States Federal Reserve does with its own interest rates. The BSP will keep a close eye on how quickly the US lowers its rates, as this can affect the Philippine economy and the value of the peso.

USD/PHP: Rate cuts and import demand to stall appreciation trend

The US dollar’s strength is expected to wane when the Fed lowers interest rates. Meanwhile, the Philippine central bank (BSP) is also likely to reduce its rates, which could increase imports as the economy grows.

Looking ahead, a wider current account, where the Philippines buys more from other countries than it sells, could also establish a new baseline for the peso’s value. As a result, the peso might not strengthen significantly against the dollar, but settle at an exchange rate of about 57.20 pesos per dollar by year-end.

DOWNLOAD

DOWNLOAD

By Metrobank Research

By Metrobank Research