Tag: high dividend funds

Should you consider dividend-paying funds?

High-dividend unit-paying funds can be a tool for reaching your financial goals. Here’s how you can compare them to similar investments and see if they align with your investment strategy.

Investing in the stock market is not a one-size-fits-all activity. There are several strategies that investors can use to derive gains from investing in stocks. One option is to track the Philippine Stock Exchange Index (PSEi).

One approach is to invest in actively managed portfolios for those who have confidence in the fund manager’s selection skills in exploring market inefficiencies.

Another approach is to choose high dividend strategies, capitalizing on the dividends provided by established names in the Philippine Stock Exchange.

What is a high dividend strategy?

Dividends are payments given to shareholders taken from the corporate earnings of a company as determined by its board of directors. A high-dividend strategy selects stocks that have historically proven to give out relatively high dividends versus peers.

A high-dividend strategy fund may also apply other criteria when choosing what stocks to include, such as liquidity, free float (shares of a company that can be traded), financial performance, and average dividend yield, among others.

The fund managers may ask questions like, “How much free cash flow does the company generate?” “What are the projected dividends for the year?” “What is the historical payout ratio?” “How strong is earnings growth?”

Things to look for in a dividend-paying fund

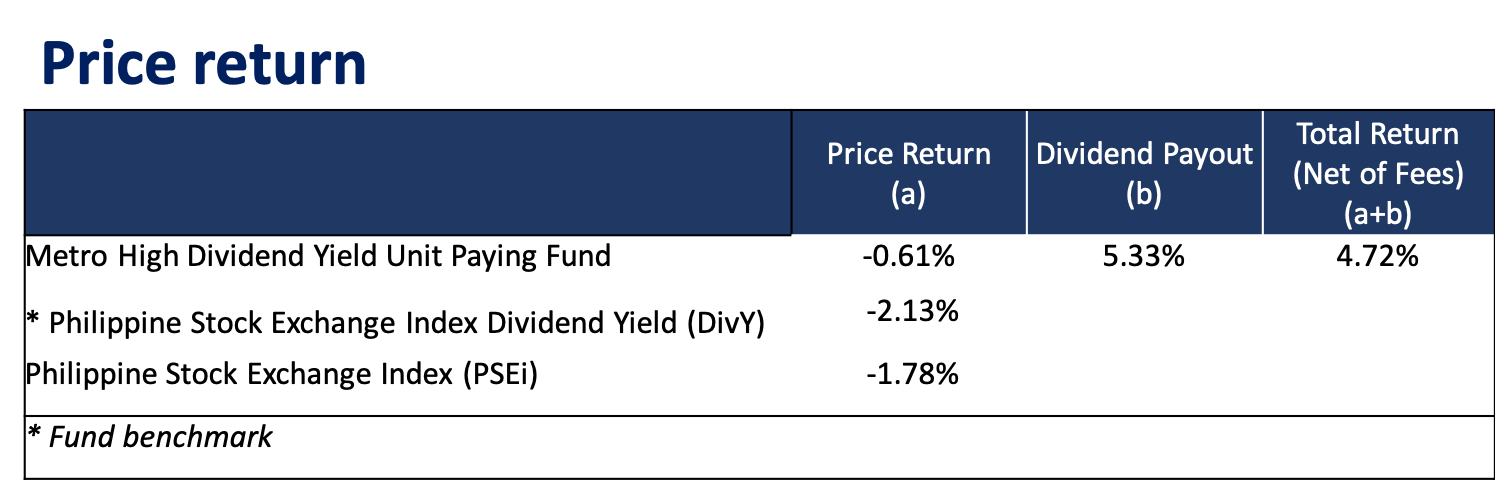

Check the fund’s performance against its chosen benchmark. A good benchmark would be the Philippine Stock Exchange Dividend Yield Index (PSE DivY).

You may check the dividend-paying fund’s total return or the overall gain of the fund over a specific period, say, a year. The dividend payout is also important. It is the portion, expressed as a percentage, of the income that is paid out to shareholders.

Look at the price return, too, which is the change in the fund’s price over time, excluding any dividends or other income.

Clearly, the fund outperformed, or did well.

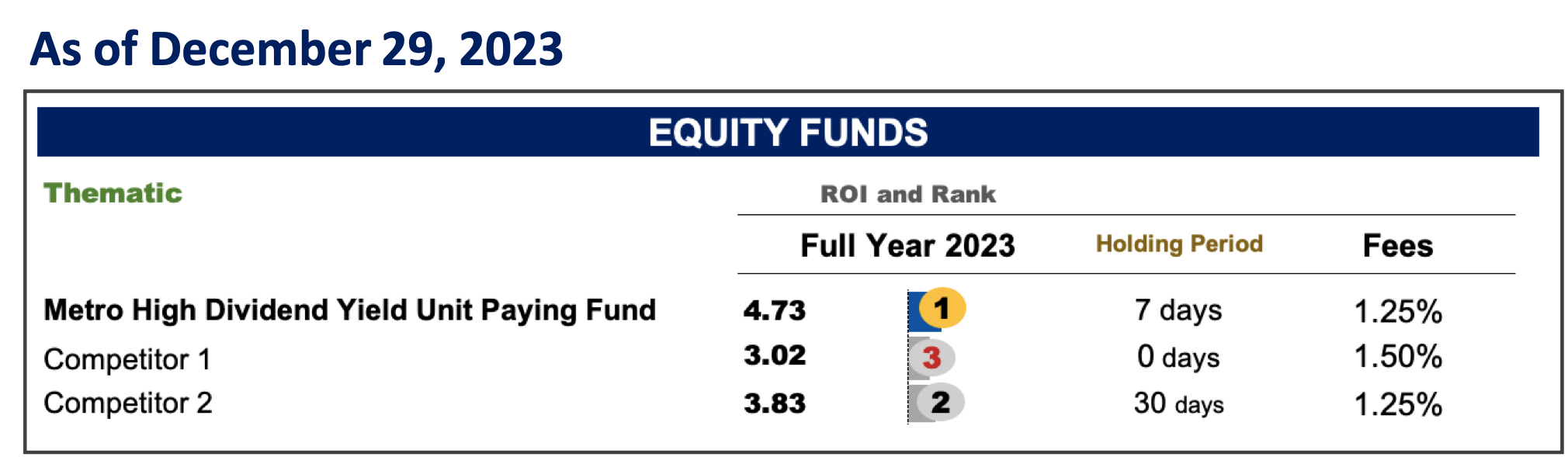

Don’t forget the fees. There are trust, management, and other fees that may affect how much you earn from your investment.

How do we compare different high dividend funds?

Locally, high-dividend strategy funds can be the traditional Unit Investment Trust Funds, or a unit-paying version. The key difference lies in how these funds handle dividends. Traditional high-dividend UITFs reinvest dividends into more dividend-paying stocks, resulting in higher unit prices and returns for investors.

On the other hand, unit-paying high-dividend UITFs automatically redeem units and credit the cash value of dividends to participants’ settlement accounts.

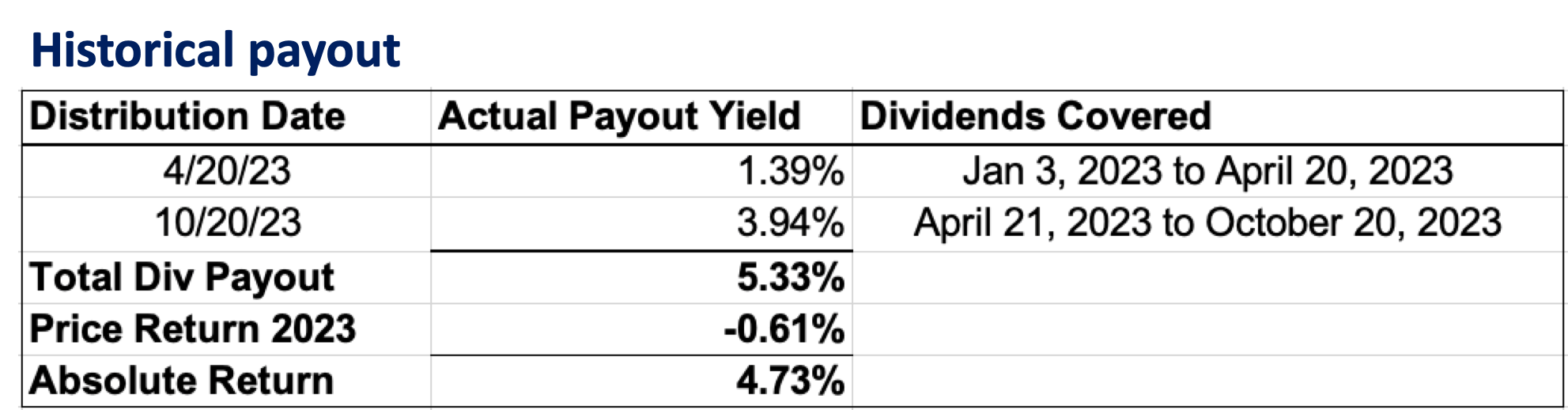

One common mistake investors make in comparing several high-dividend funds available in the market is simply comparing their prices and price return on any period.

This method completely ignores the amount paid out to investors at a regular interval. The correct method is to use total return rather than just the difference in price. Below is a quick calculation of the difference between price return and total return.

In the UITF below, the price return is lackluster at -0.61%. However, adding back payouts for the year, the true return of the UITF is 4.73%, higher than other high dividend funds in the local market.

Advantages of dividend-paying funds

Funds that regularly distribute dividends may hold larger cash reserves to meet payout obligations. The main advantage of funds that pay out dividends is their stable income generation, as investors receive regular cash payouts, providing a source of income that can be used for living expenses or reinvested elsewhere.

On the flip side, dividend payouts may limit the power of compounding, as investors lose the opportunity for dividends to be reinvested and generate additional returns over time.

It all depends on the needs of the investor. Some may need the payout for their spending needs. In general, the dividend-paying funds are for those who primarily want regular income and are more risk-averse.

Managing risk

As with any other investment, there will always be risks. Those who offer these funds are cognizant of them as well.

They employ diversification across various sectors and industries to help mitigate concentration risk. By spreading investments across different segments of the economy, they aim to reduce the impact of adverse events in any single sector on the overall performance of their portfolios.

They may also conduct thorough fundamental analysis to identify companies with strong financial health, stable earnings, and sustainable dividend payout ratios, and regularly review and rebalance portfolio holdings, while monitoring dividend trends, earnings reports, and company announcements for any signs of financial distress or dividend cuts.

How do you invest in dividend-paying funds?

It’s relatively easy to invest in these funds. Banks that offer Unit Investment Trust Funds (UITFs) may have them.

Depending on the fund, you may be required to invest a certain minimum amount. For example, Metrobank offers the Metro High Dividend Yield Unit Paying Fund which requires a minimum of PHP 10,000 initial investment and PHP 1,000 additional investment.

We advise seeking assistance from your investment counselor before you invest. After all, each investor has different needs.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here so you can begin your wealth journey with us.

JENARD MATTHEW PEREZ is a Portfolio Manager at Metrobank’s Trust Banking Group, where he manages the bank’s local Equity Unit Investment Trust Funds (UITF). With about 6 years of experience in the banking industry, Jenard has worked on both the buy side and sell side, gaining valuable insights into investment management. He holds a degree in BS Management of Financial Institutions from De La Salle University Manila and is a Level 1 passer of the Chartered Market Technician (CMT) certification. In his leisure time, Jenard enjoys spending quality time with his family and friends. He finds solace in taking long runs, which help clear his mind and provide a sense of calmness amid the volatility of the financial markets.

JON EDISON MUNSAYAC leads the Product Management Department of Metrobank’s Trust Banking Group where he oversees the Bank’s UITF product suite. He has a little over 11 years’ worth of experience in trust banking, primarily in markets research, strategy, investment solutions, and product management. He is a storyteller at heart and an avid believer in keeping things simple when possible.

DOWNLOAD

DOWNLOAD

By Jenard Matthew Perez and Jon Edison Munsayac

By Jenard Matthew Perez and Jon Edison Munsayac