Tag: consumer loans

BSP’s rate cuts promise relief amid economic challenges

Filipino consumers set to benefit from policy easing as government aims for renewed growth.

The Bangko Sentral ng Pilipinas (BSP) has finally embarked on its easing cycle, bringing a ray of hope to Filipino consumers who have been grappling with high interest rates and muted consumption.

This policy shift is expected to have far-reaching effects on the Philippine economy, particularly in stimulating private consumption and investments.

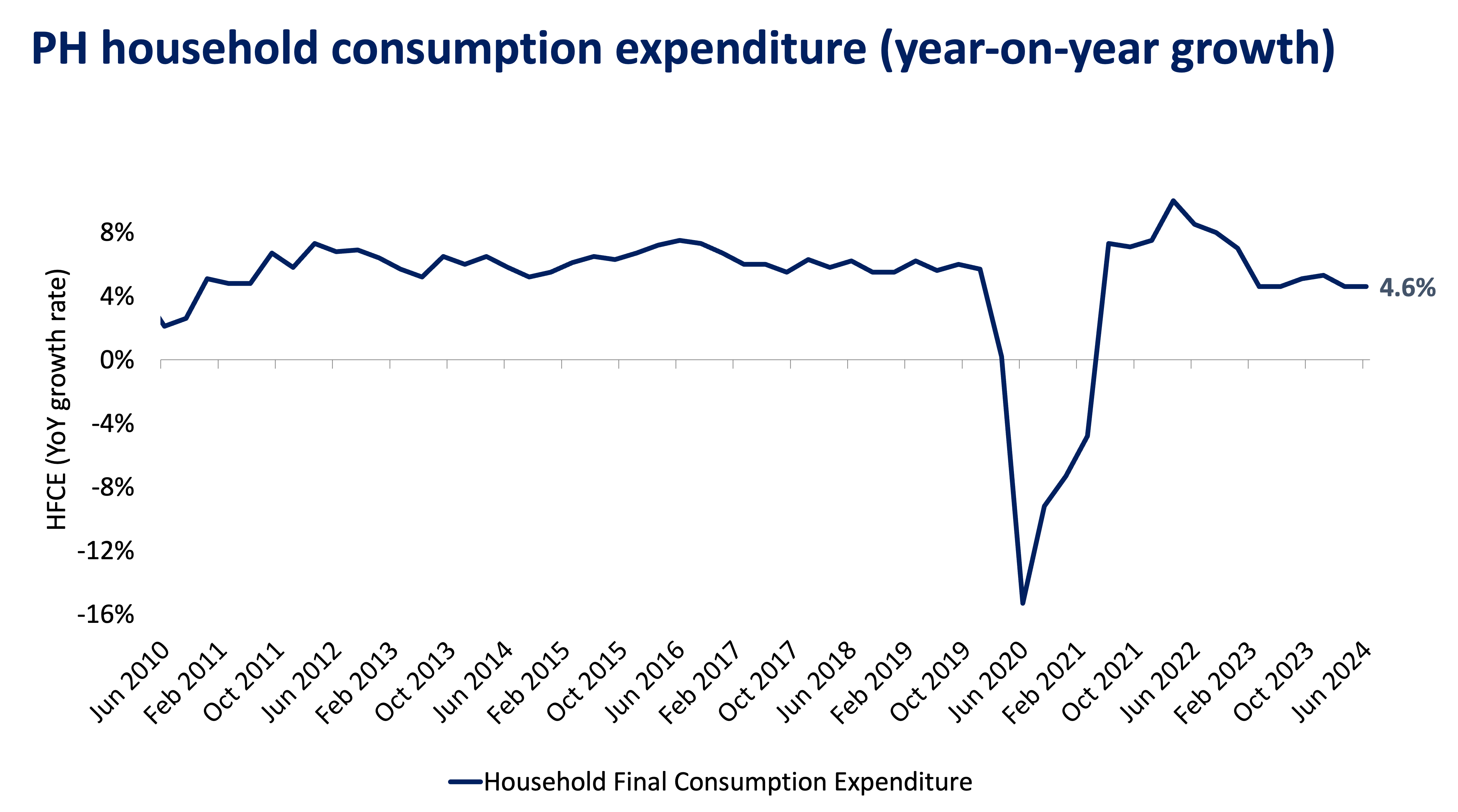

Household consumption growth peaked at 10.0% in Q1 2022 due to revenge spending, but has since declined to 4.3% in Q2 2023, indicating constrained consumer spending.

In recent times, the Philippines has witnessed a significant slowdown in household final consumption expenditure (HFCE). The second quarter of this year saw HFCE growth at a mere 4.3% year-on-year, the lowest since Q4 2010, excluding the pandemic years. This tepid growth falls below the 10-year pre-pandemic average, indicating a constrained consumer spending environment.

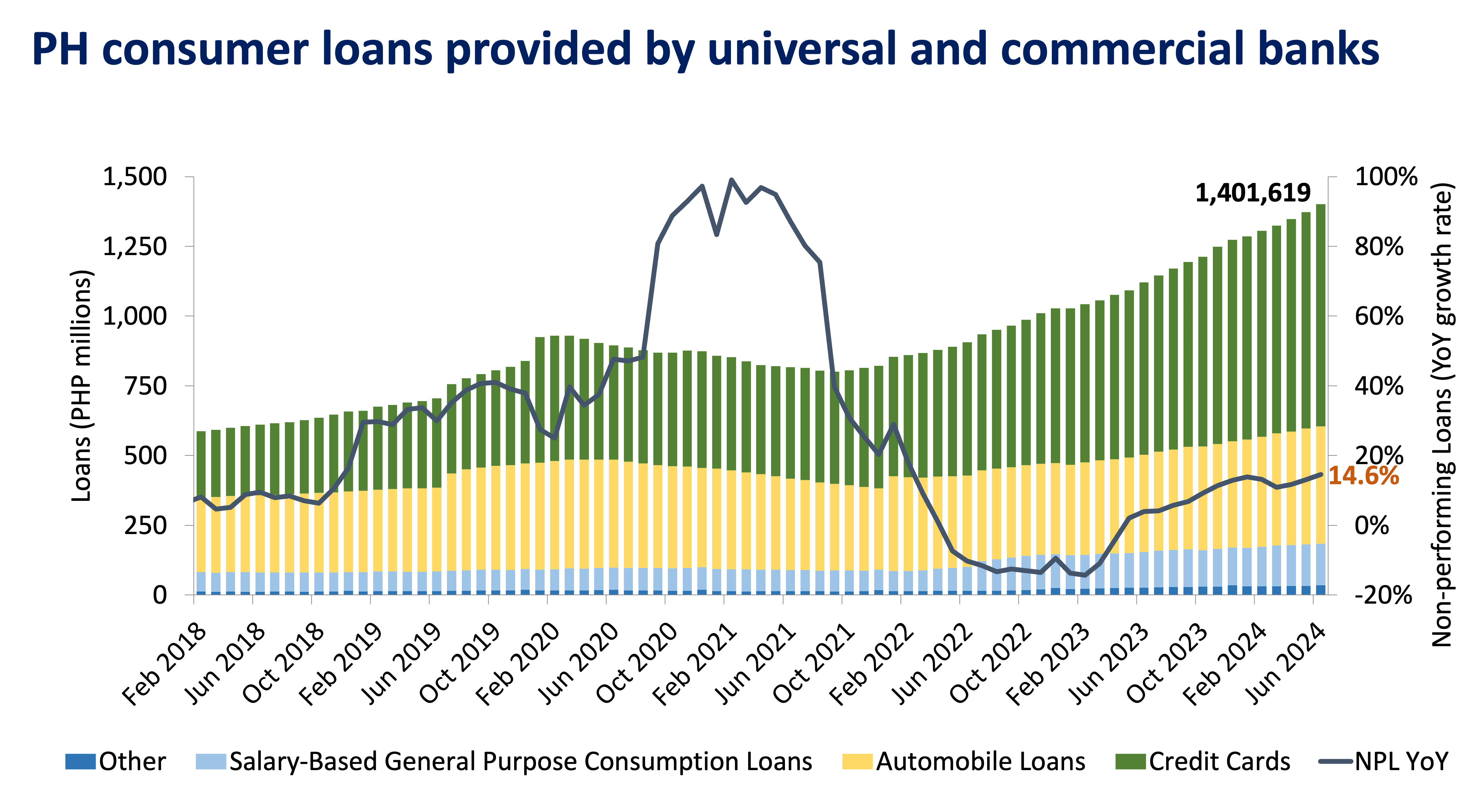

The post-lockdown period saw a surge in consumer credit, with many Filipinos turning to loans, particularly credit card and salary-based loans, to fuel their revenge spending. While this helped support economic activity initially, it has led to concerns about the financial health of households as they struggle to manage their debt in a high interest rate environment.

Consumer loans, especially credit card and salary-based loans, have more than doubled since pre-pandemic levels, reflecting increased borrowing to support spending.

However, the BSP’s decision to start easing its monetary policy brings several potential benefits for Filipino consumers:

- Lower credit card rate caps: The policy easing is expected to translate into lower rate caps for credit cards. This could provide immediate relief to consumers burdened by high-interest credit card debt.

- More favorable loan terms: As policy rates decrease, overall loan rates are likely to follow suit. This opens up opportunities for Filipinos to avail of new loans at more favorable rates or to negotiate better terms for existing loans.

- Increased purchasing power: Lower loan rates could free up cash flow for households, allowing them to either pay down existing debt more quickly or rebuild their savings.

- Stimulated consumption and investment: The combination of lower policy rates and easing inflation is anticipated to provide support for both private consumption and investments, potentially reversing the adverse effects of prolonged high interest rates.

Looking ahead, the outlook appears promising. Our forecasts as of August 8, 2024, show that policy rates could decrease to 5.75% by the end of this year and further to 5.00% next year. This aligns with expectations that the US Federal Reserve will also begin its easing cycle in September.

Moreover, inflation is projected to moderate, with full-year averages expected to reach 3.3% this year and 3.1% next year. This forecast is supported by the anticipated moderation of rice prices, backed by government policies, and a balanced assessment of other inflation risks.

As the BSP’s policy easing takes effect, Filipinos can look forward to a more favorable economic environment. Lower interest rates, combined with easing inflation, are set to provide much-needed relief to consumers, potentially spurring increased spending and investment. This shift in monetary policy could be the catalyst needed to reinvigorate the Philippine economy, offering a brighter financial future for its citizens.

MARIAN MONETTE FLORENDO is a Research and Business Analytics Officer of the Financial Markets Sector at Metrobank. She provides macroeconomic research for the bank. Her academic background is in Mathematics and Economics. She loves solving puzzles and watching mystery movies.

DOWNLOAD

DOWNLOAD

By Marian Monette Florendo

By Marian Monette Florendo