Tag: commercial real estate

What does NYCB’s 2024 losses mean?

Why is NYCB’s, a regional bank in the US, stock going down? Find out the root cause and what it means for the local banking scene here.

Last month, the New York Community Bancorp (NYCB), a regional bank in the US, made headlines after a sharp sell-off.

Why is the NYCB crashing? It reported unexpectedly disappointing financials in the 4th quarter of 2023. From a USD 164-million gain in the 4th quarter of 2022, it reported losses of USD 260 million in the same period last year.

These losses were largely driven by the alignment of balance sheet liquidity with its peers following its recent acquisition of Signature Bank, another US regional bank, and the writing off of distressed loans coupled with an increase in provisions tied to its commercial real estate (CRE) exposure.

Sources: International Monetary Fund, Bangko Sentral ng Pilipinas, Moody’s Analytics, Federal Deposit Insurance Corporation, NYCB

Why is NYCB’s stock going down?

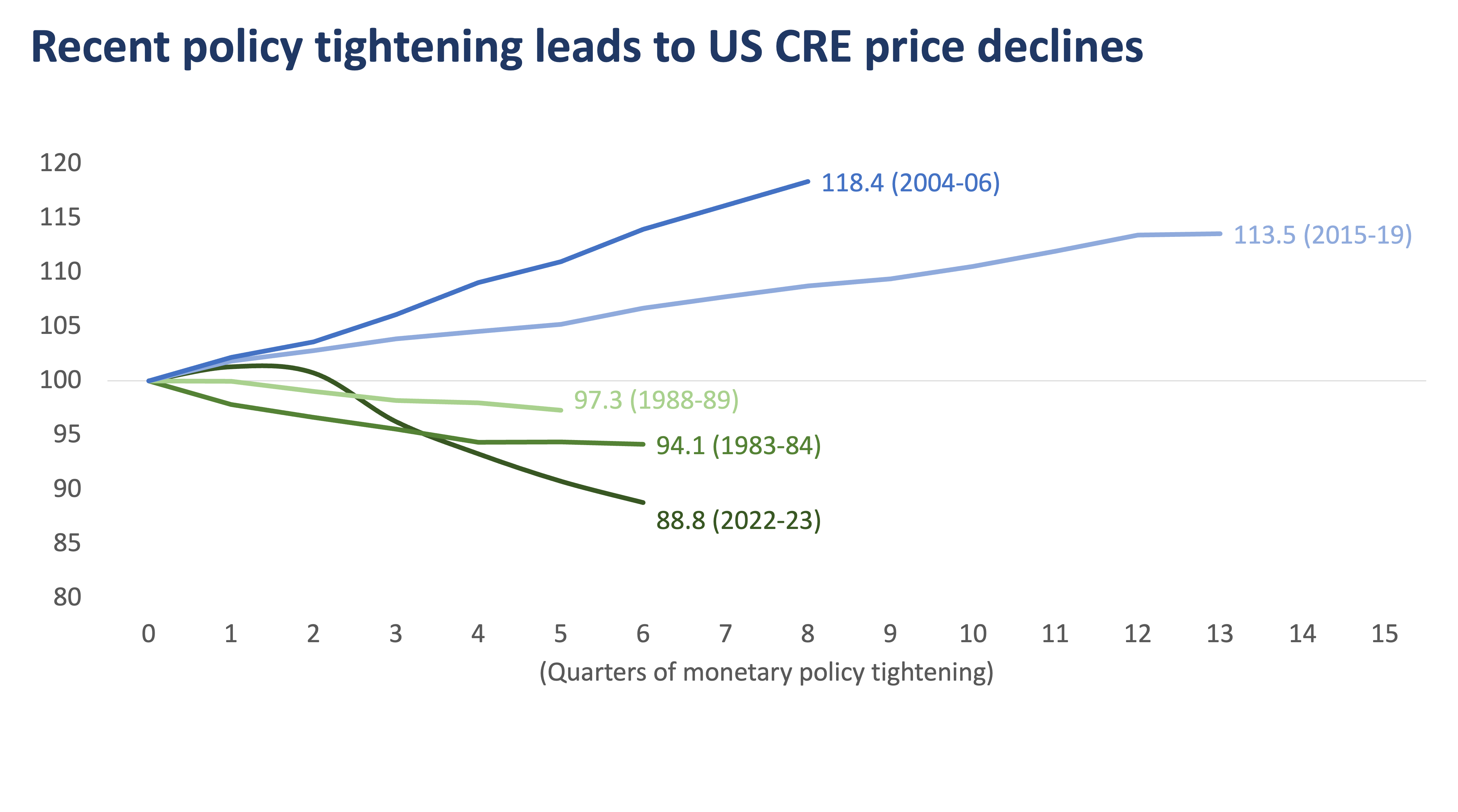

A series of bad news preceded the debacle. The firm’s chief risk officer and chief audit executive left a few months before the bank disclosed its results. And even before that, during the pandemic, commercial real estate investing took a hit as companies abandoned huge swathes of office space.

Fortunately, NYCB has recently secured USD 1 billion in fresh capital infusion from a group of investors. The success of this development remains to be seen.

So, do NYCB’s 2024 losses hint at trouble in local banks as well?

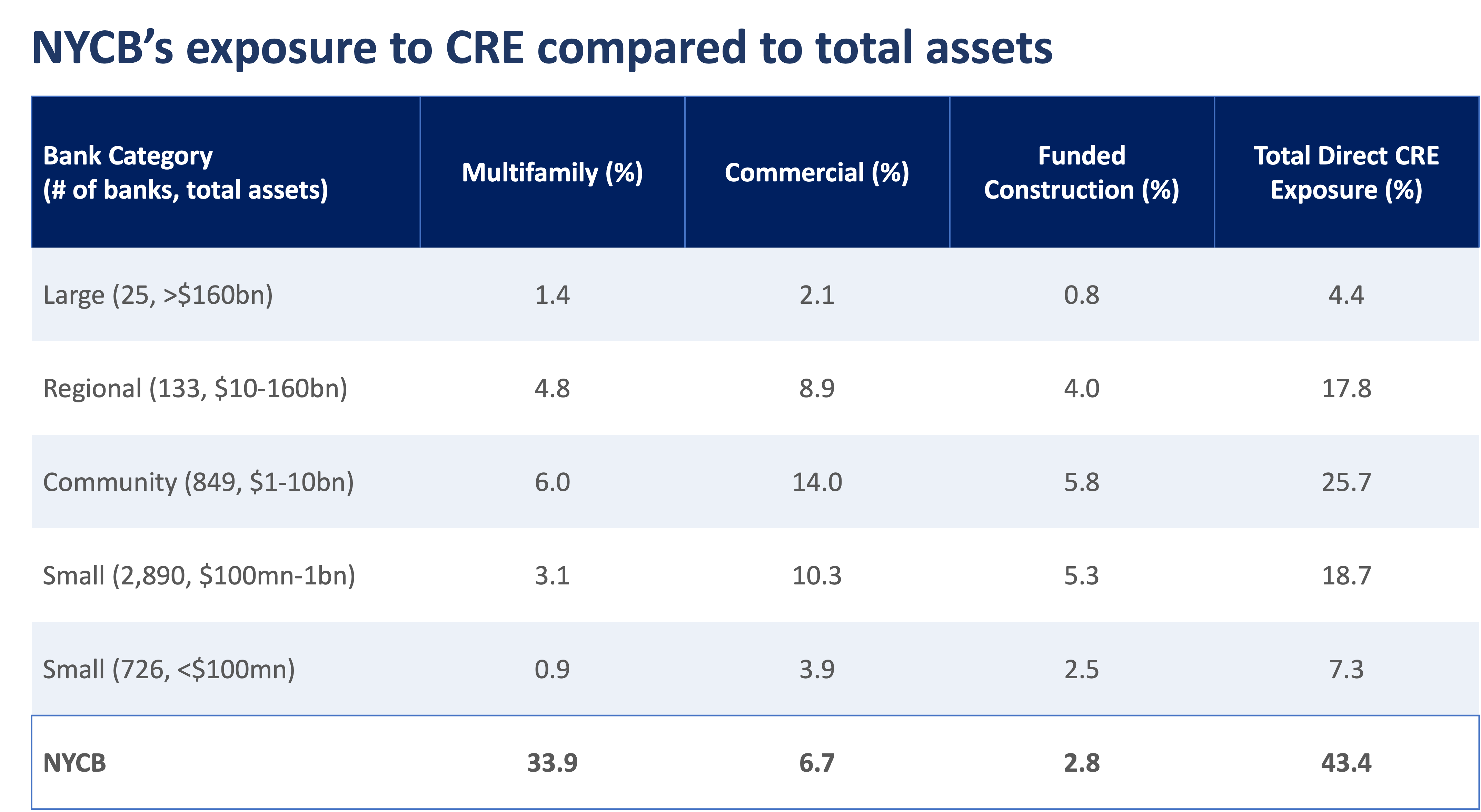

We do not think so. While many local banks have exposure to commercial real estate, the extent is not as massive as NYCB’s. NYCB had a huge 43.4% exposure to CRE as can be seen below.

Sources: International Monetary Fund, Bangko Sentral ng Pilipinas, Moody’s Analytics, Federal Deposit Insurance Corporation, NYCB

For Philippine banks, the gross non-performing loans tied to CRE is only about 2.1% as of the 1st quarter of 2023 (the latest available), an improvement from 2.6% in the 1st quarter of 2022. This is given the regulations that limit real estate exposure, currently at 25% of total loan portfolio, net of interbank loans, for universal and commercial banks.

In summary, the NYCB impact on the local banking industry is neutral at best. With the changing fortunes of the Philippine economy, that is, with the favorable forecast of a growing GDP and expectations of lower interest rates, we may yet see a recovery in real estate soon.

You may consult your relationship manager or investment specialist to know more.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here so you can begin your wealth journey with us.)

ARIZ MARCELINO is a Research Officer within the Equity Research Unit of Metrobank’s Trust Banking Group. His coverage includes select local large-cap index names and various sectors in the offshore space. Previously, he was with the Markets Research Department where he focused on macroeconomic research and sector analysis. Prior to joining the bank, he has held various research roles focusing on corporate strategy, competitor analysis, and evaluation of global equity fund of funds. He graduated from the New Era University, holding a degree in Banking and Finance, and has cleared the CFA Level 1. He is a certified UITF Sales Person (CUSP) and a Financial Modelling and Valuation Analyst (FMVA). Outside work, Ariz unwinds by watching popular sitcoms and anime series while sipping a cup of hot matcha latte.

ANNA DOMINIQUE CUDIA, MBA, CSS, is the Head of Markets Research at Metrobank’s Trust Banking Group, spearheading the generation and presentation of financial markets insights to internal and external clients. She used to be with Metrobank’s Investor Relations, where she brought in international awards and took part in various multi-billion peso and dollar capital raising activities. She has a Master of Business Administration (Finance) degree, with distinction, from the University of London, and a Bachelor of Science in Business Administration degree, cum laude, from the University of the Philippines. She also passed the CFA Level I exam and is a Licensed Fixed Income Market Salesman (FIMS), a Certified UITF Sales Person (CUSP) and a Certified Securities Specialist (CSS). She is a naturally curious person and likes to travel here and abroad.

CRISTINA GABALDON, or Gabs, is the Head of Investment Management Division of Metrobank Trust Banking Group. In her over 16 years of market experience, she has taken on roles such as Chief Investment Officer and head of equities in some of the country’s biggest banks and insurance companies before joining Metrobank. Gabs graduated from De La Salle University with a Bachelor’s degree in Accountancy and Economics. She is also a Certified Public Accountant (CPA) and a Chartered Financial Analyst (CFA). She previously served on the board of trustees of CFA Philippines and is currently on the board of trustees of the Fund Managers Association of the Philippines (FMAP) as president. She loves spending time with her husband and two kids. Gabs is also an avid painter and joins art exhibits from time to time.

DOWNLOAD

DOWNLOAD

By Ariz Marcelino, Anna Cudia, and Ma. Cristina Gabaldon

By Ariz Marcelino, Anna Cudia, and Ma. Cristina Gabaldon