Tag: bond yields

Ask Your Advisor: Are 4% bond yields a good deal?

As central banks cut rates, savvy investors eye opportunities in global and Philippine bonds for steady returns.

With the US Federal Reserve (Fed) having cut policy rates by 50 basis points (bps) last September 18, 2024, global bond yields have fallen as expected. Investors are rushing to lock in long-term yields before interest rates continue their descent.

This trend has also affected the Philippine peso government securities (GS) market, even though the Bangko Sentral ng Pilipinas (BSP) cut rates by only 25 bps last August.

As global bond yields move lower, foreign investors may look to take on more risk and invest in local currency emerging market assets for higher returns. Local bond traders have started to buy in bulk in preparation for this potential influx of foreign investment.

The Fed’s policy rate reached 5.5% in July 2023, while the BSP’s policy rate hit 6.5% in October 2023. Even before these central bank rates peaked, we had been encouraging our clients to secure long-term yields, specifically 5- to 10-year US dollar bonds and 5- to 20-year peso bonds with coupon rates of at least 5% net.

Let’s examine how key global sovereign and corporate bonds, peso government securities, and peso corporate bonds have performed since then.

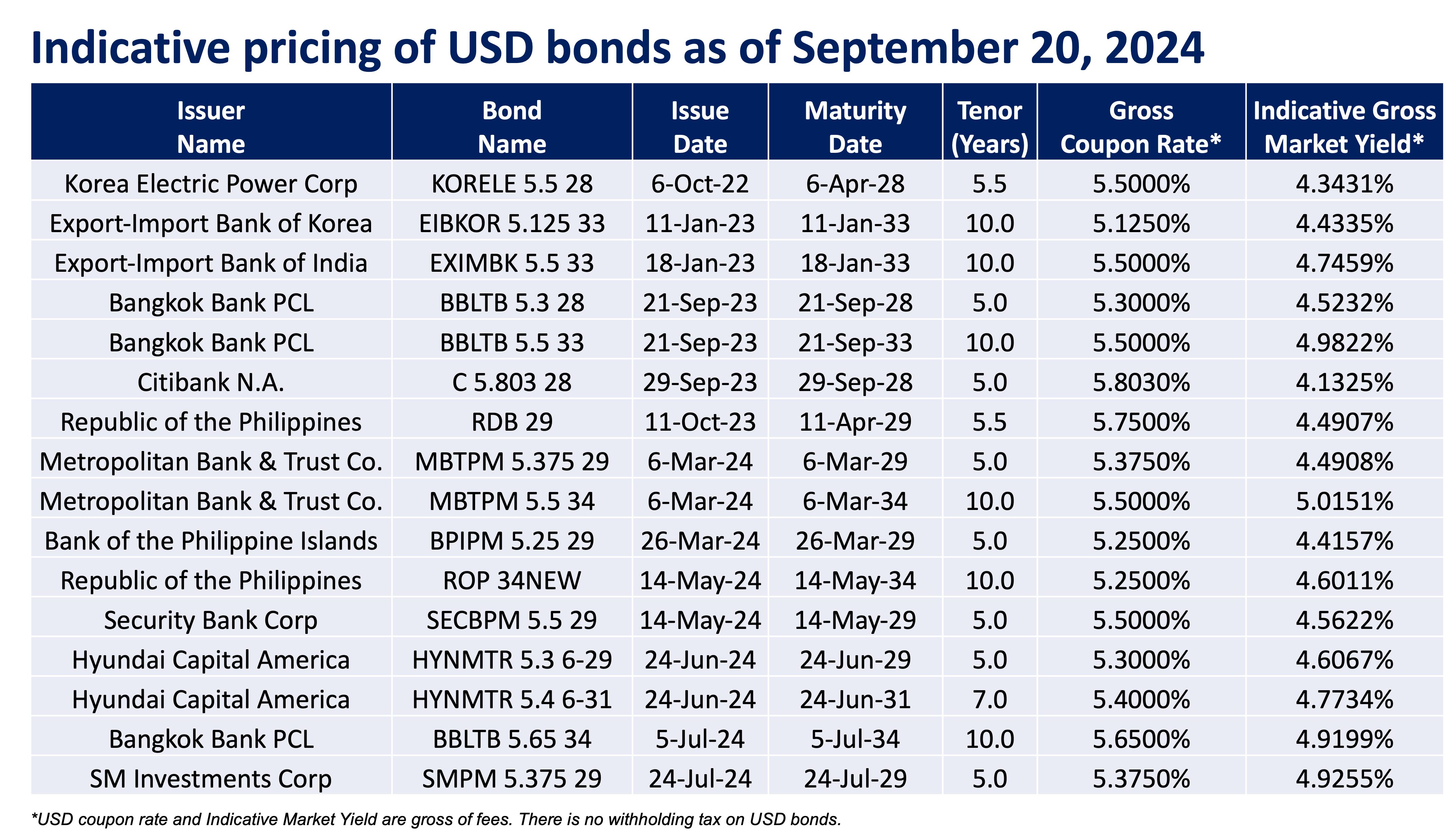

Quality global corporations issued many relatively high-coupon bonds in 2023. For example:

1. Korea Electric Power Corp (KEPCO) is the state-owned electric utility company of South Korea.

2. Bangkok Bank is the largest commercial bank in Thailand by assets and is known for lending primarily to stable large corporations.

3. Citibank, the third largest bank in the US by assets with a credit rating of A+, had its bonds priced at higher coupons due to market concerns about the impact of Silicon Valley Bank’s (SVB) closure on the US financial sector.

The Philippine Bureau of the Treasury (BTr) also issued a 5.5-year Retail Dollar Bond (RDB) that paid a whopping 5.75% per annum, rivaling the returns on comparable peso government securities. In 2024, several Philippine banks issued dollar-denominated debt. Even SM Investments Corp. was able to issue a 5-year bond with a coupon rate of 5.375% per annum just last July.

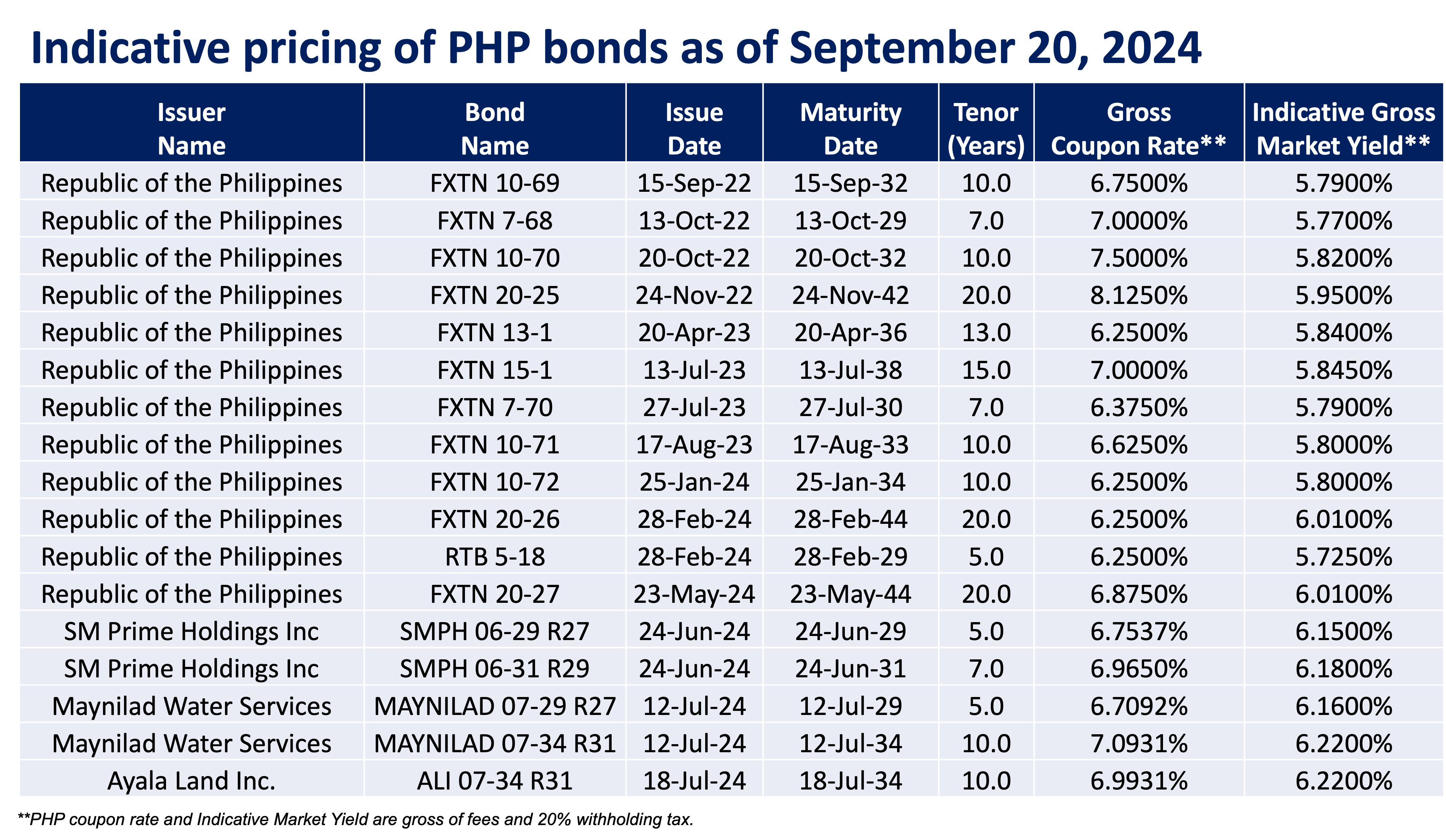

Since peso bonds have a withholding tax of 20% on the coupons, we favored bonds with gross coupon rates of at least 6.25% per annum to achieve 5% net returns. Interestingly, even in late 2022 when BSP policy rates moved from 4.25% to 5.5%, the BTr awarded higher coupon rates for 7-, 10-, and 20-year bonds, likely to attract foreign investment during the pandemic.

This trend of auctioning medium- to long-term bonds continued well into 2023 and 2024, with the jumbo Retail Treasury Bond (RTB) 5-18 paying a modest gross coupon of 6.25%. Major Philippine corporations, such as SM, Maynilad, and Ayala, also issued long-term peso-denominated debt.

As expected, the start of central bank rate cuts has caused prevailing bond yields to drop to 4% and bond prices to appreciate. Although some of these bonds already show significant gains, we recommend that clients continue to hold on and enjoy their passive income.

We also still believe that clients may continue to buy bonds at current levels, especially if we are correct in our prediction that Fed and BSP policy rates will return to as low as 3% and 4.25%, respectively, over the longer term.

To quote our Global Credits Trading Department Head Antonio Cailao, “We remain optimistic about the short to mid-term bonds. Keep duration at 5 years or below. 4% is the new 5% with the easing cycle on the way. It’s just a question of the pace now. We prefer investment grade and quality corporate bonds for carry and good fundamentals.”

In other words, 4% yield is now considered as attractive as 5% was previously, given the current market conditions and expectations for future interest rate cuts.

EARL ANDREW “EA” AGUIRRE is the Head of the Investment Counselor Department under the Financial Markets Sector of Metrobank. He has over 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By Earl Andrew A. Aguirre

By Earl Andrew A. Aguirre