NEW YORK/MILAN – The dollar slid against major currencies on Tuesday, consolidating Monday’s gains ahead of key inflation data and a widely anticipated US presidential debate, even though both their outcomes are unlikely to affect overall monetary policy.

The Federal Reserve is expected to cut interest rates next week for the first time in more than four years. What is still up for debate is the size of the rate cut, with the fed funds futures market pricing in a 73% chance of a 25 basis point cut at the Sept. 17-18 policy meeting and a 27% probability the Fed might do 50 bps, according to LSEG calculations..

The odds on the 50-bp cut rose as high as 50% last Friday after a mixed US labor report.

“Markets are in a bit of a holding pattern ahead of CPI (consumer price index) tomorrow, but there’s a bit of crackle in the air today from election jitters and Chinese economic sentiment,” said Helen Given, FX trader at Monex USA in Washington, referring to data from China released earlier on Tuesday.

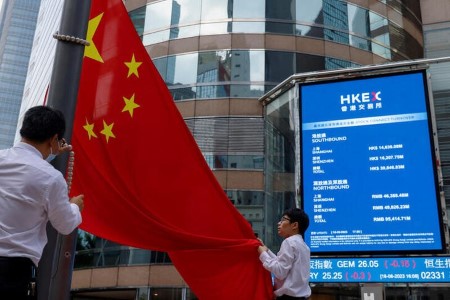

China’s imports missed forecasts and grew just 0.5%. That followed Monday’s lower-than-expected inflation data, highlighting still weak domestic demand.

China’s yuan eased slightly versus the dollar, which rose 0.1% to 7.1212, with losses capped by better-than-expected export data.

“Expectations for CPI tomorrow are a bit lower than last month’s annual reading, which would usually prompt some pre-emptive dollar weakness, but international anxieties at play and a softer Chinese import and export reading is keeping the US dollar afloat a bit,” Given added.

The headline US CPI is expected to have risen 0.2% on a month-on-month basis in August, according to a Reuters poll, unchanged from the previous month. But on a year-on-year basis it is forecast to have gained just 2.6%, down from 2.9% in July.

In midmorning trading, the dollar fell 0.4% against the yen to 142.60 yen, not far from the one-month low of 141.75 touched on Friday. The greenback fell 2.7% last week against the yen.

Analysts do not expect the Bank of Japan to raise rates or to provide decisive guidance on Friday next week.

Against the Swiss franc, the dollar slid 0.3% to 0.8472 franc.

Meanwhile, the euro slipped 0.2% to USD 1.1016 after dropping nearly 0.5% on Monday. Investors are watching Europe’s political backdrop, citing the stalemate in France and heightened uncertainty across the EU after German regional elections.

The spotlight though will also be on the messaging from the European Central Bank on Thursday after its policy meeting. Traders are pricing in 63 bps of ECB easing this year.

The euro’s slight losses pushed the dollar index, a gauge of the greenback’s value against six major currencies, 0.1% higher to 101.75. So far this year, the dollar index has moderately gained by 0.2%.

Barclays strategists noted that the greenback typically weaken ahead of Fed easing cycles and tends to overestimate rate cuts during so-called soft economic landings. Still, they said, a large part of its move had probably already happened.

Investor focus will also be on the televised US presidential debate between Republican nominee Donald Trump and his rival, Democratic Vice President Kamala Harris, later on Tuesday that could weigh heavily on the November election.

“Should a clear winner emerge from the debate, expect the forex market to start ‘front-loading’ positions it would have taken after the election result in November,” said Chris Turner, head of forex strategy at ING.

Investors see the greenback rising in the event of a Trump victory, as tariffs might prop up the currency and higher fiscal spending could boost interest rates.

The pound, meanwhile, rose after UK data showed robust employment growth. It was last down 0.1% at USD 1.3055.

(Reporting by Stefano Rebaudo in Milan and Gertrude Chavez-Dreyfuss in New York; Additional reporting by Ankur Banerjee in Singapore; Editing by Andrew Cawthorne, Mark Potter, and Jonathan Oatis)

DOWNLOAD

DOWNLOAD