Gold prices fell on Friday after bullion hit a more than five-week high in the previous session and as the US dollar gained, but prices were on track for a weekly rise on expectations of a Federal Reserve rate cut this week.

Spot gold was down 1.1% at USD 2,652.29 per ounce at 01:43 p.m. ET (1843 GMT), as the US dollar was steady at its highest in more than two weeks.

Bullion hit its highest since Nov. 6 on Thursday, and has risen over 0.8% so far for the week.

US gold futures settled 1.2% lower at USD 2,675.80.

“Gold had an explosive year and we’re getting into the tail end of the year which might see some unwinding going into the last few weeks, but I think that’s going to be short-lived and believe that gold is going to continue to move much higher,” said Daniel Pavilonis, senior market strategist at RJO Futures.

Underpinned by easing monetary policies, robust central bank buying, and safe-haven demand, gold has shattered multiple record peaks this year.

Traders now see a 97% chance of a 25 basis point rate cut at the Fed’s Dec. 17-18 meeting.

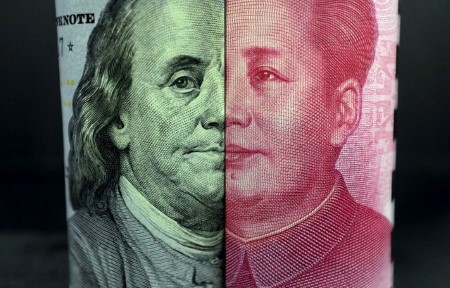

The focus will also be on Chair Jerome Powell’s commentary as market participants analyze US monetary policy for 2025, especially in the light of President-elect Donald Trump’s tariff plan which economists say would stoke further inflation.

Central banks typically keep interest rates elevated to curb inflation, which in turn increases the opportunity cost of holding non-yielding bullion.

“Generally speaking, we see a stronger US economy next year, which should leave less room for rate cuts and should thus bring less tailwinds for gold,” said Carsten Menke, an analyst at Julius Baer.

Spot silver fell 1.3% to USD 30.55 per ounce. Platinum lost 0.9% to USD 921.75 and palladium shed 1.9% to USD 951.87. All three metals were set for weekly losses.

(Reporting by Anjana Anil and Daksh Grover in Bengaluru; Editing by Alexander Smith and Krishna Chandra Eluri)

DOWNLOAD

DOWNLOAD