NEW YORK – Oil prices held near a one-week high on Wednesday on worries about supply disruptions in Russia and the US, while the market awaited clarity on sanctions as Washington tries to broker a deal to end the war in Ukraine.

Brent futures rose 20 cents, or 0.3%, to settle at USD 76.04 a barrel, while US West Texas Intermediate (WTI) crude rose 40 cents, or 0.6%, to settle at USD 72.25.

That was the highest close for both crude benchmarks since February 11.

“The market is trying to make up its mind on three bullish drivers: Russia, Iran and OPEC,” said BNP Paribas commodities strategist Aldo Spanjer. “People are trying to figure out the impact of announced and actual sanctions.”

Drone attacks on Russian oil infrastructure are reducing supplies.

Russia said Caspian Pipeline Consortium (CPC) oil flows, a major route for crude exports from Kazakhstan, were reduced by 30-40% on Tuesday after a Ukrainian drone attack on a pumping station. A 30% cut would equate to the loss of 380,000 barrels per day of market supply, Reuters calculations show.

Russian President Vladimir Putin suggested the CPC attack might have been coordinated with Ukraine’s Western allies.

In the US, cold weather threatened oil supply, with the North Dakota Pipeline Authority estimating production in the state would decline by as much as 150,000 bpd.

There is also speculation that the Organization of the Petroleum Exporting Countries (OPEC) and allies like Russia and Kazakhstan may decide to delay its planned supply increase in April, said IG market analyst Tony Sycamore.

US President Donald Trump denounced Ukrainian President Volodymyr Zelenskiy as “a dictator without elections” on Wednesday and said he should move fast to secure peace.

However likely a US-brokered peace deal between Russia and Ukraine may be, analysts at Goldman Sachs said any associated easing in sanctions against Russia is unlikely to bring a significant increase in oil flows.

“We believe that Russian crude oil production is constrained by its OPEC+ 9 million bpd production target rather than current sanctions, which are affecting the destination but not the volume of oil exports,” Goldman Sachs said in a report.

In the Middle East, Israel and Hamas will begin indirect negotiations on a second stage of the Gaza ceasefire deal, which could weigh on oil prices by reducing the risk of supply disruption.

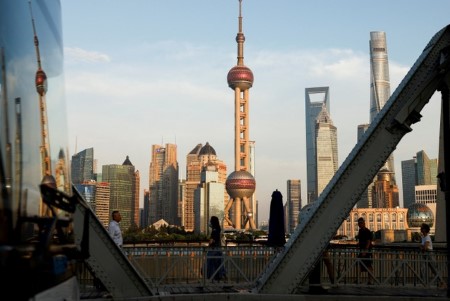

Tariffs announced by the Trump administration could also dent oil prices by raising the cost of consumer goods, weakening the global economy and reducing fuel demand. Worries about European and Chinese demand are also helping keep prices in check.

Trump’s initial policy proposals have raised concern at the Federal Reserve about higher inflation, with firms telling the US central bank they generally expect to raise prices to pass through the cost of import tariffs.

The Fed uses higher interest rates to combat rising prices and inflation. So long as the Fed and other central banks keep interest rates higher for longer, borrowing costs will remain elevated, which can slow economic growth and demand for oil.

Separately, the market is waiting for US oil inventory data from the American Petroleum Institute (API) trade group later on Wednesday and the US Energy Information Administration (EIA) on Thursday.

Those reports will come out one day later than usual due to the US Presidents’ Day holiday on Monday.

Analysts forecast energy firms added about 2.2 million barrels of crude to US stockpiles during the week ended February 14. If correct, that would be the first time energy firms added crude into storage for four weeks in a row since April 2024.

(Reporting by Scott DiSavino in New York and Anna Hirtenstein in London; additional reporting by Arathy Somasekhar in Houston and Emily Chow in Singapore; editing by David Goodman Jan Harvey, David Gregorio, and Nia Williams)

DOWNLOAD

DOWNLOAD