Longer-dated US Treasury yields fell on Friday after President Donald Trump said he may enact tariffs on smartphone giant Apple and imports from the entire European Union, raising concerns about slowing economic growth.

Trump threatened to impose a 25% tariff on Apple for any iPhones sold but not manufactured in the United States. More than 60 million phones are sold in the United States annually, but the country has no smartphone manufacturing.

Trump also said he would recommend a 50% tariff on the European Union to begin on June 1, which would result in stiff levies on luxury items, pharmaceuticals and other goods produced by European manufacturers.

“Today is probably a response to some of the threats from Trump to the EU and Apple and concerns over hurt growth,” said Mike Sanders, head of fixed income at Madison Investments.

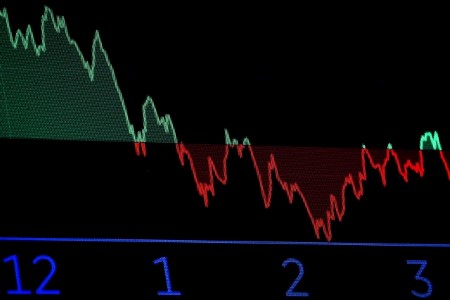

Friday’s drop in yields comes after a choppy week that saw longer-dated yields rise on concerns about the deteriorating US fiscal outlook.

“The back end of the yield curve is really responding to the fiscal situation here in the States and that the deficit is not going to be in a better situation. We’re still probably spending too much as a country and long-term investors are getting concerned,” said Sanders.

“We could spend less, which doesn’t seem likely, or we could somewhat inflate our way out of it, and that’s bad for long-term bondholders,” he said.

The House of Representatives passed a tax and spending bill on Thursday that would add trillions to the US debt load. US Senate Republicans said they will seek substantial changes to the bill.

Thirty-year bonds have taken the brunt of the selloff and posted the largest weekly increase in yields since April 7.

Moody’s Investors Service last Friday cut the United States’ sovereign rating from the top “Aaa,” citing the deteriorating fiscal outlook.

The prospect of inflation remaining sticky has also weighed on demand for US bonds as the Trump administration negotiates trade deals that are expected to retain some tariffs.

Bonds sold off sharply in the aftermath of Trump’s April 2 “Liberation Day” announcement of larger-than-expected tariffs, before recovering somewhat when most of the trade levies were paused until July 7.

The 2-year note yield, which typically moves in step with interest rate expectations, was little changed on the day at 3.998%.

The yield on benchmark US 10-year notes fell 3.6 basis points to 4.517%. It reached 4.629% on Thursday, the highest since February 12.

The yield curve between two-year and 10-year notes flattened to 52 basis points.

The 30-year bond yield fell 2.2 basis points to 5.042% after hitting 5.161% on Thursday, the highest since October 2023.

The bond market closed early on Friday and will be closed on Monday for the US Memorial Day holiday.

Whether longer-dated yields will maintain upward momentum may depend on economic data. If hard data begins to reflect a weakening economy or labor market, traders are likely to bring forward expectations on Federal Reserve interest rate cuts, which would also boost demand for US Treasury debt.

Higher inflation, by contrast, would likely keep the Fed on hold for the foreseeable future. Fed funds futures traders see the US central bank as most likely resuming interest rate cuts in September.

Businesses expect rising input costs and anticipate raising their own prices as well, St. Louis Fed President Alberto Musalem said on Friday.

Chicago Fed President Austan Goolsbee said US firms want consistency in trade policy before making big investments or other decisions.

The Treasury will sell USD 183 billion in short- and intermediate-dated debt next week, including USD 69 billion in two-year notes on Tuesday, USD 70 billion in five-year notes on Wednesday and USD 44 billion in seven-year notes on Thursday.

(Reporting By Karen Brettell; Editing by Mark Porter and Leslie Adler)

DOWNLOAD

DOWNLOAD