NEW YORK, Nov 22 (Reuters) – Global equities rose on Tuesday while US Treasury yields fell as investors awaited the release of the Federal Reserve’s meeting minutes for clues on US interest rates and as China’s COVID-19 restrictions weighed on sentiment.

The Fed will release minutes of its November policy meeting on Wednesday, offering a glimpse of how officials view economic conditions.

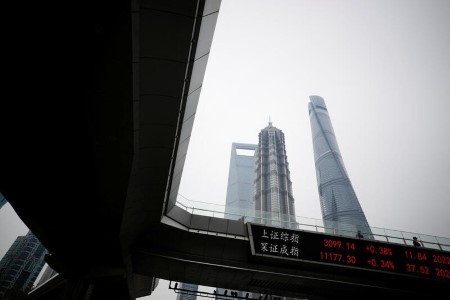

In China, authorities in Beijing shut parks and museums. In Shanghai rules were tightened for people entering the city as the country grapples with a spike in COVID cases, sparking worries about its impact on the economy.

“People are going to be poring over word-for-word those minutes to see if it will tilt towards the Fed’s official statement versus what Powell’s press conference implied, which was that they are not going to be looking at cumulative effect in considering when to stop this tightening,” said Tom Plumb, portfolio manager at Plumb Balanced Fund in Madison, Wisconsin.

The MSCI All-World index of shares rose 1.18%, while European shares gained 0.73%.

Benchmark 10-year Treasury yields were down to 3.7634% while the yield on the 30-year note fell to 3.8325%.

On Wall Street, all three main indexes closed higher led by gains in technology, energy, healthcare, financials, and consumer discretionary.

The Dow Jones Industrial Average .DJI rose 1.18% to 34,098.1, the S&P 500 gained 1.36% to 4,003.58 and the Nasdaq Composite added 1.36% to 11,174.41.

“We’re seeing technology, consumer discretionary and energy leading downside momentum while consumer staples stocks leading the upside, these are signs of investors positioning for a downturn,” said Michael Ashley Schulman, chief investment officer at Running Point Capital in Los Angeles, California.

The US dollar retreated across the board, ceding some of the ground gained in the previous session, as investors looked past worries about China’s COVID flare-ups, boosting demand for more risky currencies. The dollar index fell 0.566%, with the euro EUR= up 0.58% to USD 1.03.

Crude prices rose about 1% after Saudi Arabia said OPEC+ was sticking with output cuts and could take further steps to balance the market.

Brent crude rose 1% to settle at USD 88.36 per barrel, while US West Texas Intermediate (WTI) crude was up 1.1% at USD 80.95.

Safe-haven gold prices steadied above last session’s low as a retreat in the dollar and benchmark US Treasury yields was offset by a rise in equities. Spot gold added 0.1% to USD 1,740.19 an ounce, while US gold futures gained 0.23% to USD 1,738.30 an ounce.

(Reporting by Chibuike Oguh in New York; Editing by David Gregorio and Marguerita Choy)

DOWNLOAD

DOWNLOAD