The start of the trading week has shown that it is becoming increasingly difficult to navigate, never mind predict, markets right now, with many asset correlations being weakened by strong cross-currents of news flow and drivers.

Some markets, like the S&P 500 and Nasdaq, are taking on a momentum of their own, and others, like the US Treasury market and the dollar, are sending contradictory signals.

Rising US bond yields on Monday failed to support the dollar, the relentless tech and AI boom delivered record highs for two of Wall Street’s three main indexes yet again, while a near-2% slump in Japan’s Nikkei came out of the blue.

This is the rather fragmented backdrop to the Asian market open on Tuesday, which is further complicated by the political turmoil in France that is rocking French assets and markets across the eurozone.

Will investors in Asia take their cue on Tuesday from higher Treasury yields, the lower dollar, the US tech frenzy or the ongoing deterioration in Chinese data and sentiment?

The economic calendar across the continent is light, but the main event is a big one – the Reserve Bank of Australia’s interest rate decision, and guidance from the accompanying statement and press conference from Governor Michele Bullock.

Economists polled by Reuters are unanimous in their view that the RBA will hold its cash rate at 4.35% for a fifth straight meeting. With inflation remaining above the central bank’s 2% to 3% target since late 2021 and the jobless rate easing to 4%, an early rate reduction seems unlikely.

A near 90% majority, 38 of 43, predicted interest rates to remain unchanged next quarter, followed by a 25-basis-point cut to 4.10% in the final quarter of this year.

Australian rates markets are even more hawkish – traders are pricing in only 15 basis points of easing this year, and barely 50 bps in total by the end of 2025. Excluding the Bank of Japan, which is in the early stages of tightening policy, that’s among the most hawkish pricing for any G10 central bank.

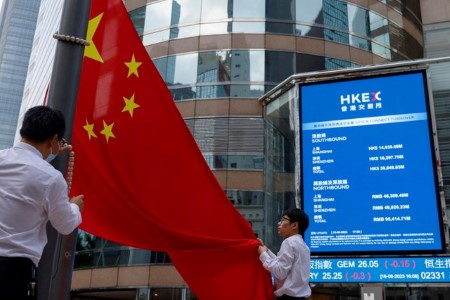

In China, meanwhile, stocks are at a two-month low and the yuan is its weakest this year after a weak batch of data on Monday – especially house prices – did little to lift the economic gloom.

Trade tensions are intensifying too. China has opened an anti-dumping investigation into imported pork and its by-products from the European Union, a tit-for-tat response to curbs on its electric vehicle exports.

Warren Buffett’s Berkshire Hathaway, meanwhile, has trimmed its stake in China’s BYD, the world’s largest seller of electric vehicles. The change in stake is tiny, but potentially symbolic of foreigners’ angst at the brewing trade wars.

Here are key developments that could provide more direction to markets on Tuesday:

– Australia interest rate decision

– Singapore non-oil trade (May)

– Fed’s Barkin, Collins, Kugler, Musalem, Logan, Goolsbee speak

(Reporting by Jamie McGeever; editing by Josie Kao)

DOWNLOAD

DOWNLOAD