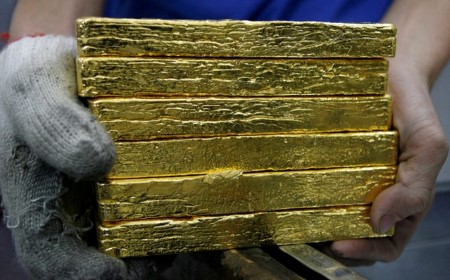

Gold prices jumped more than 2% on Thursday, breaking above the USD 2,400 per ounce level, after data showed US consumer prices unexpectedly slipped last month, boosting bets for interest rate cuts by the Federal Reserve.

Spot gold was up 1.8% at USD 2,414.75 per ounce by 2:37 p.m. ET (1837 GMT), its highest since May 22.

US gold futures settled 1.8% higher to USD 2,421.90.

“Gold surges above USD 2,400 as the friendly CPI number nearly cements a September rate cut. Gold bulls are likely to push for a new all-time high perhaps as soon as next week,” said Tai Wong, a New York-based independent metals trader.

Spot gold prices hit a record high of USD 2,449.89 per ounce on May 20.

US consumer prices unexpectedly fell and the annual increase was the smallest in a year, reinforcing views that the disinflation trend was back on track and drawing the Fed another step closer to cutting interest rates.

Interest-rate futures prices reflected about an 85% chance of a rate cut at the Fed’s September meeting, compared with about a 70% chance seen before the data.

Non-yielding bullion’s appeal tends to shine when interest rates fall.

Following the US inflation data, the dollar dropped to a more than one-month low, making gold more attractive for other currency holders, while the benchmark US 10-year Treasury yield fell to a four-month low.

Fed Chair Jerome Powell, over his two days of commentary before the Senate and House committees that oversee the central bank, indicated the Fed was edging closer to a rate cut decision.

“Given the overall trajectory on monetary policy and gold demand I think the bull run is not over yet,” said Zain Vawda, market analyst at MarketPulse by OANDA.

Meanwhile, spot silver climbed 2% to USD 31.44 per ounce, its highest since May 31. Platinum rose 1.4% to USD 1,002.86 and palladium gained 0.7% to USD 992.75.

(Reporting by Brijesh Patel in Bengaluru; Editing by Shounak Dasgupta and Mohammed Safi Shamsi)

DOWNLOAD

DOWNLOAD