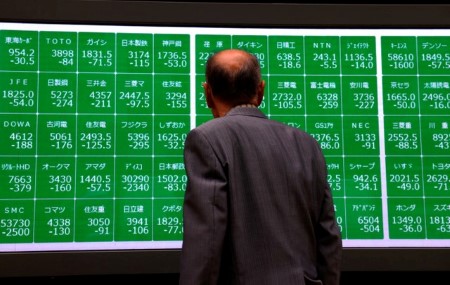

TOKYO, Nov 26 (Reuters) – Japan’s Nikkei share average is seen rising about 7% by June next year, supported by strong corporate earnings and economic growth driven by Prime Minister Sanae Takaichi’s government stimulus.

The cabinet last week approved a 21.3 trillion yen (USD 136 billion) economic stimulus package, the largest since the COVID-19 pandemic, to help households cope with persistent inflation.

Since Takaichi took office last month, expectations for aggressive economic stimulus have driven sharp gains in Japanese equities. In October, the Nikkei crossed the 50,000 mark for the first time and climbed 16.64%, its biggest monthly gain in 35 years.

Super-long bond yields have recently hit record highs and the Japanese currency 10-month lows. The Nikkei hit an intraday record high of 52,636.87 on November 4, but has since eased back.

The index is forecast to trade at 52,000 at the end of June in 2026, according to the median estimate of 16 analysts polled November 13-25, from Tuesday’s close of 48,660.

It is forecast to exceed all-time highs marked this month by the end of next year, rising to 55,000, up about 13%.

“The rally in October was too fast, and there was a risk of retreat,” said Kazunori Tatebe, chief strategist at Daiwa Asset Management.

“But the fundamentals have not worsened, and the market will continue to see positive market-moving cues, such as inflation, governance reforms, and corporate share buybacks”.

The index retreated from its peak in recent sessions as US stocks lost ground on divided views on the Federal Reserve’s rate path and concerns over valuations of artificial intelligence-related technology shares.

The latest Nikkei rally was supported by a few beneficiaries of the AI sector, such as chip-related Advantest and Tokyo Electron, as well as technology investor SoftBank Group.

Some strategists said there was a chance of a correction of more than 10% in the Nikkei in the next three months.

“The US market could fall as it is in the transition from the liquidity-driven market to profit-driven,” said Hiroshi Namioka, chief strategist at T&D Asset Management. “That decline may affect the Japanese market.”

(USD 1 = 156.7100 yen)

(Reporting by Junko Fujita; Additional reporting by Rocky Swift; Polling by Aman Kumar Soni and Jaiganesh Mahesh; Editing by Ross Finley and Louise Heavens)

DOWNLOAD

DOWNLOAD