Category: Spotlight

Meta Platforms, Inc.: Click “like” for good risk reward value

Do you find yourself spending precious time scrolling through Facebook and Instagram? Why not accrue interest while you’re at it?

Access this content:

If you are an existing investor, log in first to your Metrobank Wealth Manager account.

If you wish to start your wealth journey with us, click the “How To Sign Up” button.

Meta Platforms, Inc. (META) is a relatively new US dollar bond issuer with its first bond deal in August 2022. It has returned to the market in 2023 with an USD 8.5-billion issuance across 5-, 7-, 10-, 30-, and 40-year maturities.

The company is rated A1/AA- by Moody’s and S&P, respectively. Its high cash balance and low overall leverage is the likely reason for its high-grade rating.

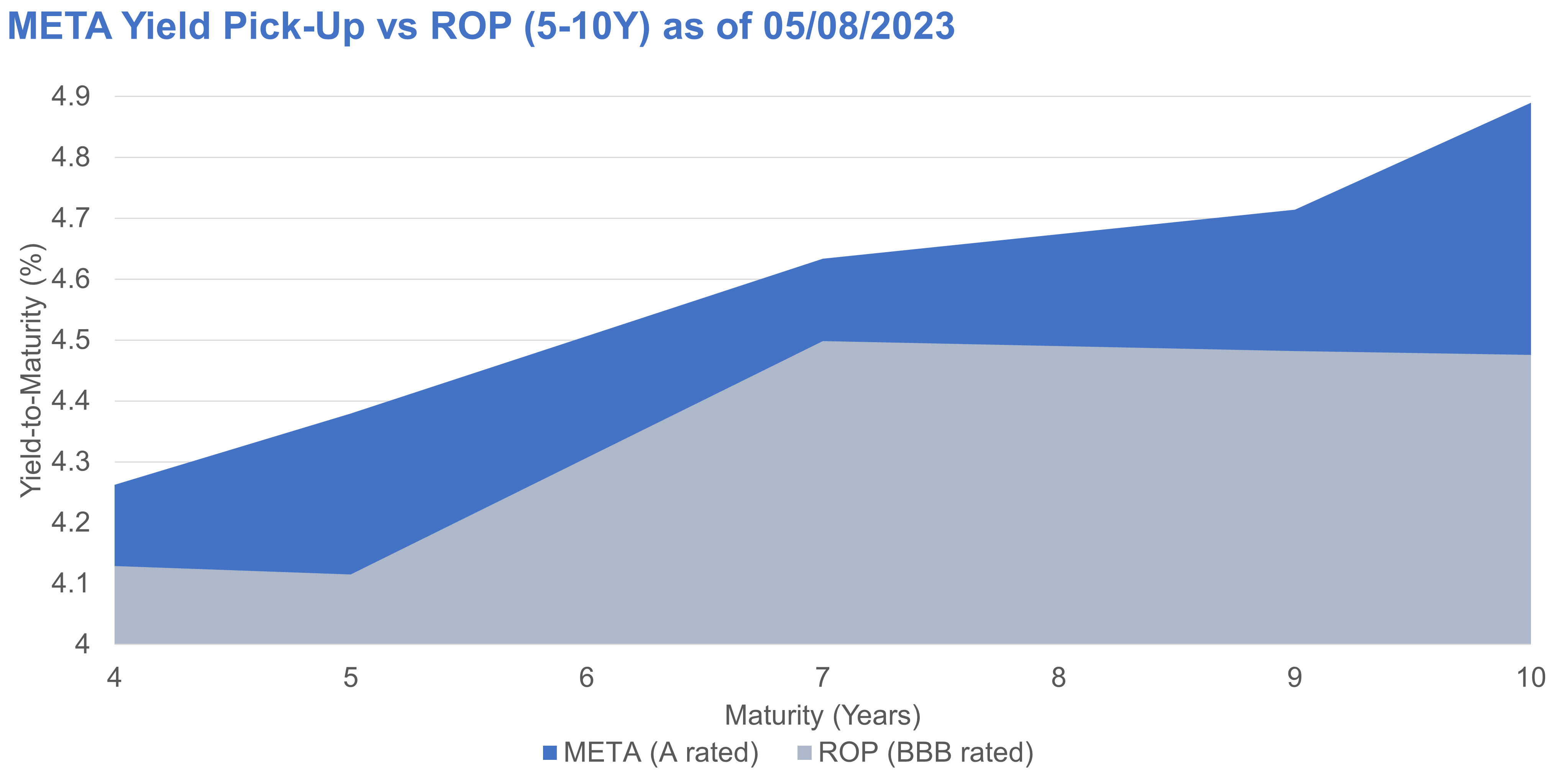

We see META as a relative value pick over ROPs (Philippine government bonds) as META bonds offer higher yields to ROPs despite having a higher credit rating.

USD Credit Strategy:

- US dollar yields have settled within a range as expectations of tighter credit conditions from the ongoing regional bank crisis in the US have capped expectations for higher rates. This despite economic data still pointing towards

Read More Articles About:

DOWNLOAD

DOWNLOAD

By Metrobank

By Metrobank