Philippine infrastructure spending fell for the fourth straight month in October, as disbursements for the Department of Public Works and Highways (DPWH) continued to decline amid the corruption scandal and adverse weather.

The latest data from the Department of Budget and Management (DBM) showed expenditures on infrastructure and other capital outlays dropped by 40.1% to PHP 65.9 billion in October from PHP 110 billion a year ago.

Month on month, it also fell by 16.2% from PHP 78.7 billion in September.

October marked the fourth straight month that expenditures fell on an annual basis, since the 25.3% drop in July after a corruption scandal involving flood control projects was made public.

The scandal has dampened economic activity and public spending, particularly on infrastructure.

The DBM said the year-on-year drop in infrastructure spending “resulted largely from the contraction in DPWH disbursements.”

The DBM noted that the slower budget release for public works was due to “non-submission of billions from contractors amid ongoing validation of the status of implementation and completion of flood control projects.”

The DPWH is at the center of a corruption scandal after department officials, lawmakers and contractors were accused of getting kickbacks from flood control projects that were either nonexistent or substandard.

The pending release of final payments due to delays in securing the Bureau of Internal Revenue Tax Clearance by contractors also factored in the drop in disbursements, the DBM said.

Contractors must obtain an updated tax clearance before final settlement of any government contract; otherwise, the contract may be suspended.

“(This includes) delays in the renewal of contractors’ Philippine Contractors Association Board (PCAB) licenses, which affected the submission of progress billings by contractors and subsequent processing of payments,” the Budget department said.

Adverse weather conditions also weighed on the release of the DPWH infrastructure budget, the DBM said.

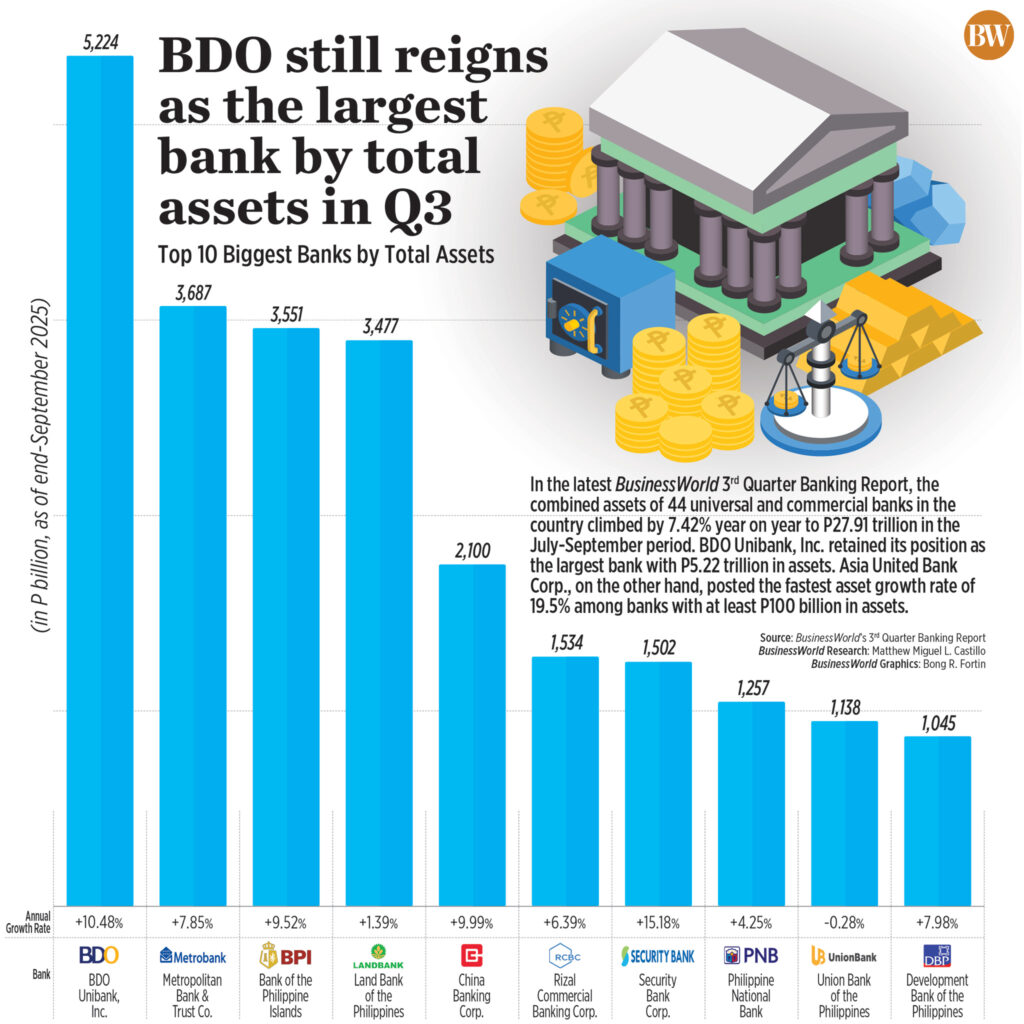

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said political noise around infrastructure projects, particularly flood control, pulled down spending in October.

10-month period

In the first 10 months, overall infrastructure and capital outlay disbursements stood at PHP 943 billion, down 13.7% from PHP 1.09 trillion a year ago.

This accounted for 62.33% of the PHP 1.51-trillion full-year program.

“Infrastructure spending contracted since the onset of the flood control issues of the DPWH, which resulted in delays in the settlement of progress billings for its completed infrastructure projects,” the DBM said.

Data from the DBM showed that overall infrastructure disbursements, which include infrastructure components of subsidy and equity to government corporations and transfers to local government units, slipped by 11.5% to PHP 1.13 trillion in the end-October period from PHP 1.28 trillion a year ago.

For the rest of the fourth quarter, the DBM said lower infrastructure spending is expected to further weigh on overall government disbursements.

At the same time, the DPWH is ramping efforts to address corruption issues by creating a transparency portal that provides information on the agency’s projects.

The DPWH is also discontinuing defective flood control projects due to poor planning, as well as deleting duplicate projects.

In the coming months, Mr. Ricafort said infrastructure spending is expected to recover by early 2026 as part of the government’s catch-up spending plan.

“For the coming months, infrastructure spending could pick up in view of the catch-up spending plan by early 2026, hinged on the policy priority on anti-corruption measures/reforms and other reforms to further improve governance standards,” he said in a Viber message on Dec. 26.

Economic managers have insisted the spending slump is only temporary as reforms and investigations are underway.

Overall government disbursement reached PHP 4.91 trillion as of end-October, up by 3.9% from PHP 4.73 trillion in the same period last year. This represented 80.8% of the PHP 6.08-trillion full-year expenditure program. — Aubrey Rose A. Inosante, Reporter

DOWNLOAD

DOWNLOAD