Hiking to reach the “price stability” summit

Can future rate hikes by Bangko Sentral ng Pilipinas help fight inflation while managing economic growth? Can a difference of 75 basis points between the Philippines’ overnight rates and the US Federal funds rate do the job?

Central banks globally have raised interest rates to help curb inflation (as explained in more detail here). In the Philippines, the Bangko Sentral ng Pilipinas (BSP) has been hiking the overnight reverse repurchase rates (RRP) to bring inflation back to the target range of 2% to 4% in the medium-term.

Aside from controlling inflation, another purpose of these hikes is to ensure orderly market conditions and to manage the volatility of exchange rates (without necessarily setting the exchange rate itself) since depreciation is an inflationary concern.

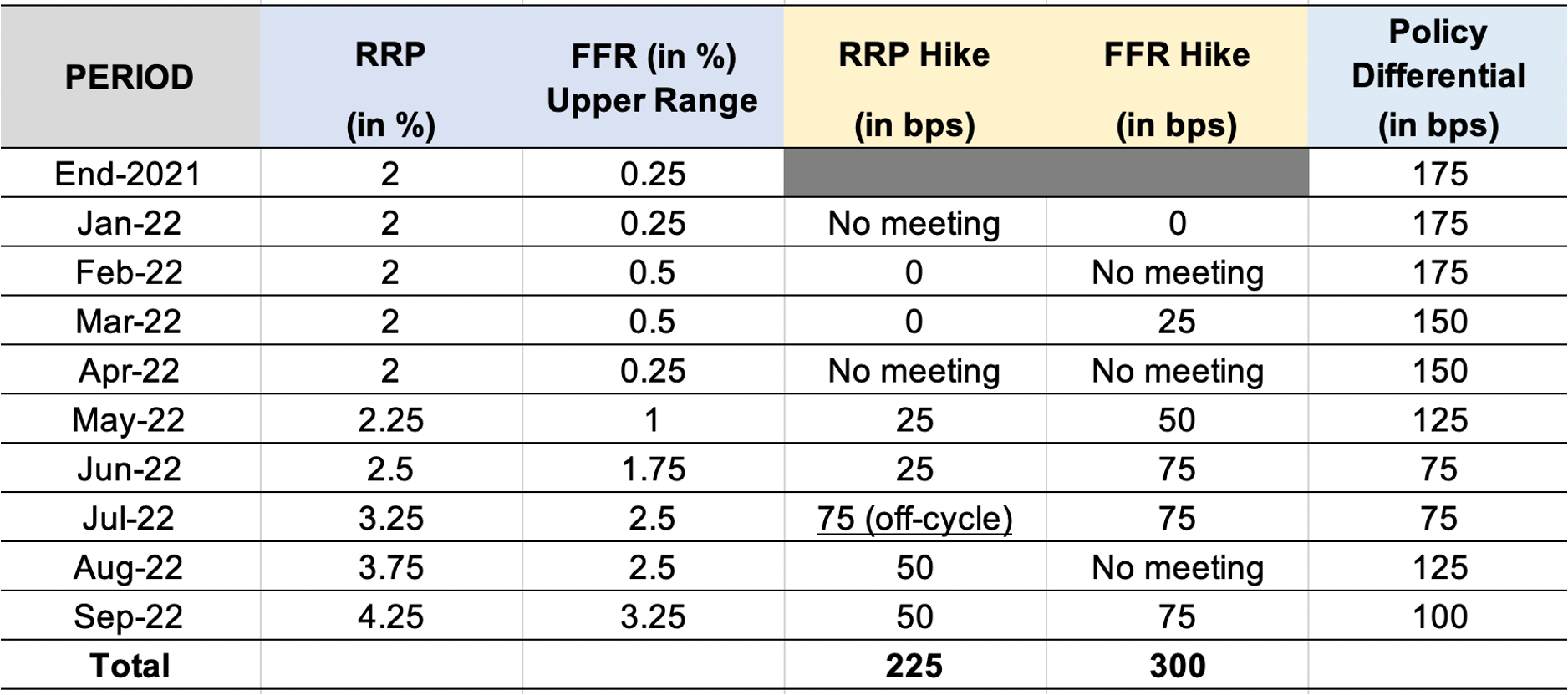

Like many other central banks, the United States Federal Reserve (Fed) is hiking the Federal Funds Rate (FFR) to quell inflation. However, the Fed has been more aggressive than the BSP; the former has so far hiked key rates by 300 bps (or by 3.0%) since January, while the latter has hiked by only 225 bps.

Policy rate differentials

The BSP appears to be taking care of maintaining a comfortable policy differential between the RRP and the US Fed Funds Rate (FFR); not doing so would mean the possibility of capital flight due to higher rates of return for US investments, as these are seen as a safe haven. When this happens, the peso would depreciate further, and this would add to inflationary pressures.

As stated by BSP Governor Felipe Medalla in a September interview with Bloomberg; “Clearly the Fed’s policies have affected our choices. We don’t want to match the Fed but, at the same time, we have to respond.” This is because the BSP needs to ensure price stability without damaging the growth of the country—a tough balancing act.

The table above also appears to show that the BSP is comfortable with a 75-basis point policy differential, at the very least. Note that on July 14, the BSP announced a surprising off-cycle rate hike by 75 bps, just a little after US data showed that inflation spiked to 9.1% in June, which was the highest since 1981. This was also amid Fed officials signaling a hike of 75 bps in their July 27 meeting.

The off-cycle 75-bp hike announced early on was likely done to avoid parity between the RRP and the FFR, since there was no scheduled BSP Monetary Board meeting that month. This can also imply that the BSP would only allow a 75-bp differential at the very least.

Terminal rate outlook

At the Federal Open Market Committee (FOMC) meeting in September, the Fed funds terminal rate outlook rose to 4.4% in 2022 and 4.6% in 2023. This would put rates in the 4.25% to 4.5% range in 2022 and the 4.5% to 4.75% range in 2023, since the Fed sets its fund rate in quarter-point increments. Thus, additional FFR hikes totaling 125 bps in 2022 and 25 bps in 2023 are to be expected.

If we consider at least a 75-bp differential between the RRP and FFR, this will bring the RRP to a rate of 5.25% by the end of 2022, and 5.50% by the end of 2023. This entails a total of 100 bps of remaining RRP hikes in 2022 and 25 bps in 2023.

We expect the BSP to continue hiking rates because we forecast that inflation will peak around the 4th quarter of 2022. Risks to the calls would include a lower 3rd quarter GDP growth, a slower acceleration of inflation in the coming months, and the strengthening of the peso in the 4th quarter, which corresponds to the export season and the seasonal increase in OFW remittances.

All of these could translate to lower RRP hikes than estimated.

Of course, the hope is that the RRP hikes will enable the Philippines to reach the “price stability” summit at the soonest possible time, without doing substantial damage to the economy.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her Bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano