Zooming in on external debt

The Philippines’ share of external debt to GDP remains the lowest among its ASEAN peers, and there is room to expand further. What are crucial are the mechanisms to keep it manageable and the productive channels to spur the country’s desired growth.

In our previous article, we emphasized that despite the country’s growing debt, the Philippines is not the next Sri Lanka, which continues to be beset by crisis.

It’s mainly because the country’s debt remains manageable and its dollar debt is backed up by dollar assets. Debt-wise, the Philippines is doing okay: its external debt—or the money owed to foreign lenders in foreign currency—is in a much better position compared to some of its ASEAN peers.

Much like in the Philippines, the COVID-19 pandemic pushed neighboring countries into deeper deficits, which prompted more borrowings to finance a pandemic response and fund recovery, subsequently pushing up debt-to-GDP ratios.

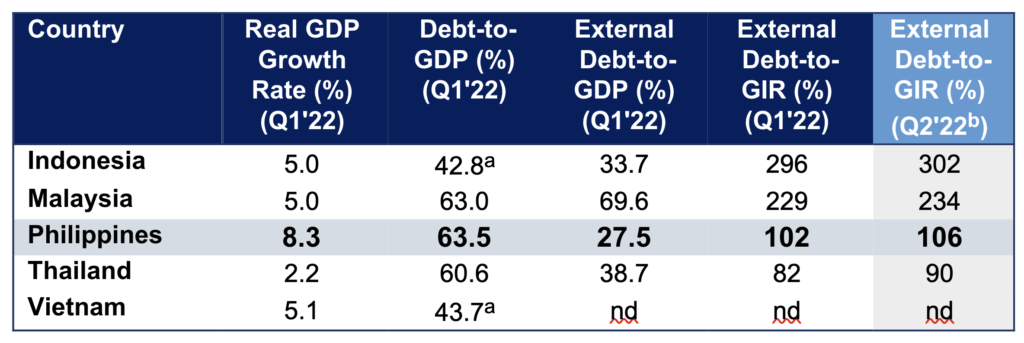

In terms of real GDP growth, external debt-to-GDP ratio, and external debt-to-GIR (gross international reserves) ratio, the Philippines is doing well compared to its ASEAN peers. ( a2021 data, bExternal Debt as of Q1’22, GIR as of Q2’22, nd: no recent data available; Source: BSP, various news sources)

It might seem alarming that the Philippines’ first quarter 2022 debt-to-GDP ratio is at 63.5%, but Malaysia and now Thailand are already at 60% levels as well. More importantly, the proportion of our external debt to our GDP remains the lowest among the group at 27.5%, which simply shows that we are less vulnerable to risks associated with external financing, keeping our foreign debt manageable.

Our gross international reserves (or GIR, a measure of the foreign currency assets of the country) are also at good levels, with an external debt-to-GIR ratio next to Thailand. To a foreign lender, it would be more appealing to lend to Thailand and the Philippines because of their sufficient dollar reserves, and more so to the Philippines because we are expected to have better economic growth versus our peers.

Stimulating faster growth

Our debt might be rising, but so is our ability to pay it off as the economy is growing and continues to recover. In fact, our debt service for our external debt is at 1.4% of GDP as of the first quarter of 2022 versus 4.6% during the same quarter last year. Thus, if the goal is to recover at a much faster pace, there is still room to seek external financing to fund programs and projects that can stimulate faster growth.

This is not to say that we should borrow more just because we can, but to borrow smarter because we should. We have earlier noted how infrastructure spending can be a catalyst for growth and therefore a productive medium to which we can channel the country’s debt.

There’s also the tourism industry that would benefit if given more financial support to facilitate recovery. Its recovery means growth not only in terms of foreign currency revenues, but more importantly, growth in local economies.

Right systems, right priorities

This then calls for the right systems to be in place for micro, small, and medium enterprises (MSMEs) to thrive and for initiatives to ease the country’s supply chains. There is a lot more to improve to bring us closer to growth, and these can be fulfilled with sufficient financing.

Some Filipinos are worried about the rising debt, and that is understandable. But what matters most is ensuring that debt remains manageable and anchored on the right priorities—to spur the country’s desired growth and improve future tax revenues. With that in mind, the country can definitely accommodate more external debt.

INA CALABIO is a Research & Business Analytics Officer at Metrobank in charge of the bank’s research on industries. She loves OPM and you’ll occasionally find her at the front row at the gigs of her favorite bands.

DOWNLOAD

DOWNLOAD

By Ina Calabio

By Ina Calabio