Will oil prices and inflation remain elevated?

The recent decline in global oil prices amid high inflation prints are, among other things, caused by worries over a recession. However, such demand reduction can simply be offset by lowered supply, bringing prices back up again.

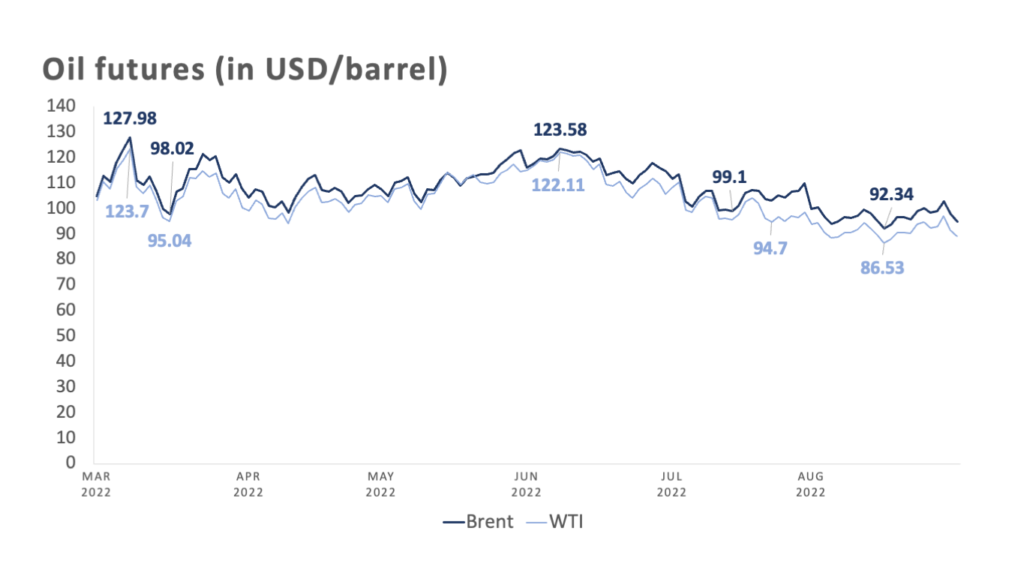

Since the onset of the conflict between Russia and Ukraine towards the end of February and the resulting supply chain restrictions and bottlenecks, major global oil benchmark prices such as Brent and West Texas Intermediate (WTI) Crude Oil Futures peaked in early March, both above the USD 120/barrel levels.

Since then, oil prices have become erratic as can be gleaned from the chart below. Of late, prices have substantially gone below the USD 100 level, leaving some to believe that the oil storm may have passed.

The dip of oil prices below the USD 100 level may be short-lived. (Source: Investing.com; data as of September 1, 2022)

However, the drop in oil prices back in July was mainly caused by worries over a possible recession and global economic slowdown fueled by high US inflation prints and rising COVID-19 cases in China, resulting in fears of a plunge in global demand.

Prices further dropped this August due to China’s slowdown represented by weak industrial production and retail sales growth and new lockdowns. There is a problem with that.

The Organization of the Petroleum Exporting Countries (OPEC+), through its leader, Saudi Arabia, said that the organization has the means to resolve falling oil prices—it can simply cut production.

This, combined with the still sizeable demand for oil (given that it is a necessity, especially this winter season), means that prices are highly likely to be on the upside, punctuated by blips here and there.

Mounting natural gas prices have already pushed some European countries like Germany to switch to oil to power their industries and supply for their heating needs in the winter. China could also eventually reopen and bounce back towards the second half of the year.

Moreover, oil withdrawals from the US Strategic Petroleum Reserve (SPR), the world’s biggest supply of emergency crude oil, are set to end in October 2022. All of these scenarios could drive oil prices up.

The only real solution to bring down oil prices is for other countries to step in and supply more oil to offset any OPEC+ cuts. At the moment, however, there are no swing players who would be willing to do that.

Philippine context

In 2021, 95.7% of the Philippines’ crude oil imports were from the Middle East; 64.2% came from Saudi Arabia while 16.06% was sourced from the United Arab Emirates (Department of Energy or DOE).

The DOE usually monitors Dubai crude, which is used by different Asian countries and is also one of the major crude oil benchmarks aside from Brent and WTI. However, they are generally correlated with each other. This crude oil is further refined into gasoline, diesel oil, and fuel oil, among others, thus the fall in oil prices in previous months, and resulting in the temporary easing of retail pump prices.

However, it should be emphasized that the high inflation environment in the country today is already due to second-round effects, which we wrote about here.

These second-round effects resulted from the upsurge in energy prices from March onwards, which means that the recent slowdown in oil prices would not necessarily translate to substantially lower inflation prints, especially since we expect low oil prices to be only temporary.

This is evidenced by diesel, kerosene, and gasoline price hikes implemented by fuel companies starting August 29, coupled with new jeepney fare hikes this September.

Despite the volatility, we expect oil prices to rebound and push inflation up towards yearend. Any fall in oil prices due to reduced demand will likely be offset by OPEC+ production cuts. Thus, the country’s inflation will likely remain at elevated levels, peaking at around the 4th quarter of this year as the winter season hits.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her Bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano