Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

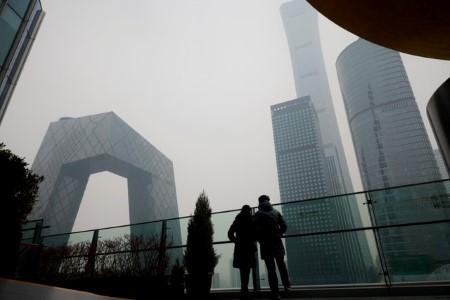

China misery deepens, US curve steepens

Asia’s economic calendar is remarkably light on Tuesday, allowing markets to take their cue from broader drivers such as China’s deepening economic malaise, the shifting outlook for US monetary policy, and the Q2 earnings season on Wall Street.

Investors also continue to digest the fallout from the attempted assassination on Saturday of former US President Donald Trump, who is favorite to win the White House in November and who on Monday nominated his vice presidential running mate.

So far, the most visible ‘Trump trades’ appear to be rising stocks, gold, and bitcoin, higher long-dated Treasury yields, and a steeper yield curve, as investors price in the prospect of wider budget deficits and stronger inflation down the line.

That’s a mixed bag for Asian assets. Higher US yields and a buoyant dollar will likely weigh on Asian and emerging sentiment, but this is countered by the growing likelihood US interest rates will be cut earlier and further than expected.

Wall Street’s big three indices closed between 0.3% and 0.5% higher on Monday, and US stock futures are pointing to a similar-sized rise at the open on Tuesday.

Japan’s markets reopen on Tuesday after Monday’s holiday, with the yen’s direction likely to set the tone for the day across all assets following last week’s apparent yen-buying intervention.

The dark cloud over Asian markets, however, refuses to lift, and if anything it is getting darker: China.

The batch of top-tier economic data from Beijing on Monday was hugely underwhelming, especially second quarter GDP growth of only 4.7%, which was well below expectations of 5.1% and Beijing’s broader goal of around 5%.

The need for greater fiscal or monetary support – or both – is intensifying, and investors will be hoping for positive signals from the ruling Communist Party’s third plenum, which opened on Monday.

This is the major closed-door meeting held roughly once every five years to map out the general direction of the country’s long-term social and economic policies.

Monday’s data prompted many economists to cut their growth forecasts. Barclays reckons growth in the second half of the year will average only 4.5%, while JP Morgan cut their full-year outlook to 4.7% from 5.2%.

Some of the language used in SocGen’s analysis was striking: the economy is showing “severe imbalances”, domestic demand is “very depressed”, and Beijing’s overall policy mix right now is “highly deflationary”.

As they summed up: “the imbalance of the Chinese economy is increasingly dangerous, given rising trade tensions from all directions and a very likely Trump return. A course correction will be inevitable at some point.”

China’s economic surprises index on Monday slumped to its lowest since September, registering its steepest fall in over a year.

Here are key developments that could provide more direction to markets on Tuesday:

– China’s third plenum

– South Korea import, export prices (June)

– Japan tankan non-manufacturing index (July)

(Reporting by Jamie McGeever)

This article originally appeared on reuters.com

By Reuters

By Reuters