Inflation Update: Nowhere but up

DOWNLOAD

DOWNLOAD

Philippines Trade Update: Imports weaken on tepid demand

DOWNLOAD

DOWNLOAD

Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

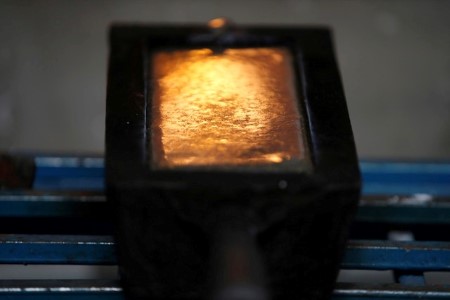

Supreme dollar rules the roost in gold market

Dec 30 (Reuters) – Gold is poised to fall for the second year running in 2022 as aggressive interest rate hikes from the Federal Reserve fueled a dollar rally that challenged the precious metal’s role as a safe place to park assets.

The Fed’s fight against inflation is expected to dictate sentiment in precious metals markets next year. Russia’s invasion of Ukraine, surging inflation, COVID-19 restrictions and slowing growth meant precious metals had a mixed 2022.

Spot gold at USD 1,821.50 an ounce at 19:28 GMT is on course to wrap up 2022 about 0.4% lower. This past year, bullion came very close during the early days of the Ukraine crisis to touching the all-time highs above USD 2,000 hit in 2020 as countries around the world locked down.

The US currency’s climb to 20-year peaks this year eroded demand for dollar-priced bullion, which is down USD 250 since the March peak.

“In light of the fact that gold is a zero-yielding asset, the precious metal’s traditional roles as a safe haven and as a hedge against inflation were greatly undermined by the Fed’s supersized rate hikes in 2022,” said Han Tan, chief market analyst at Exinity.

Top policymakers at the US central bank have made clear their intentions on inflation, surprising investors who recently bet on a slower rate-hike trajectory.

“We are convinced that the outlook for US monetary policy should remain in the driving seat (for gold),” Julius Baer said in its 2023 commodity outlook.

Among other precious metals, silver at USD 23.87 an ounce is set to end the year over 2% up. But the possibility of a global recession poses a risk to demand for silver for industrial applications, analysts at Citi said.

The metal is used both as a safe-haven asset similar to gold and by manufacturers of everything from solar panels and automobiles to electronics.

Prices of autocatalyst metals platinum and palladium were boosted by fears of Western sanctions on major producer Russia.

“It is assumed that Russian production continues to reach the market and Nornickel and PGMs are not sanctioned. Nornickel should also complete its smelter maintenance, allowing it to increase output,” according to Heraeus Precious Metals.

Platinum at USD 1,066.01 an ounce has managed to hold on to gains and was headed for an over 10% yearly rise. However, palladium at USD 1,783.35 is down nearly 6%, in its second straight annual decline despite prices touching record highs in March.

(Reporting by Bharat Govind Gautam and Swati Verma in Bengaluru; Editing by Pratima Desai and Matthew Lewis)

This article originally appeared on reuters.com

By Reuters

By Reuters