REIThinking: Playing the bond game in equities

With a turn in policy rates, we think it is time to revisit the Real Estate Investment Trust (REIT) sector.

Since their Initial Public Offerings (IPOs) in 2020-2021, REITs have steadily provided value for investors with their dividends. However, headwinds have materialized that dampened the sector’s prospects. The weakness in the property market brought on by mobility restrictions, a shift to work-from-home, and the waning of Philippine Offshore Gaming Operators (POGOs) and Business Process Outsourcing (BPO) companies also didn’t help.

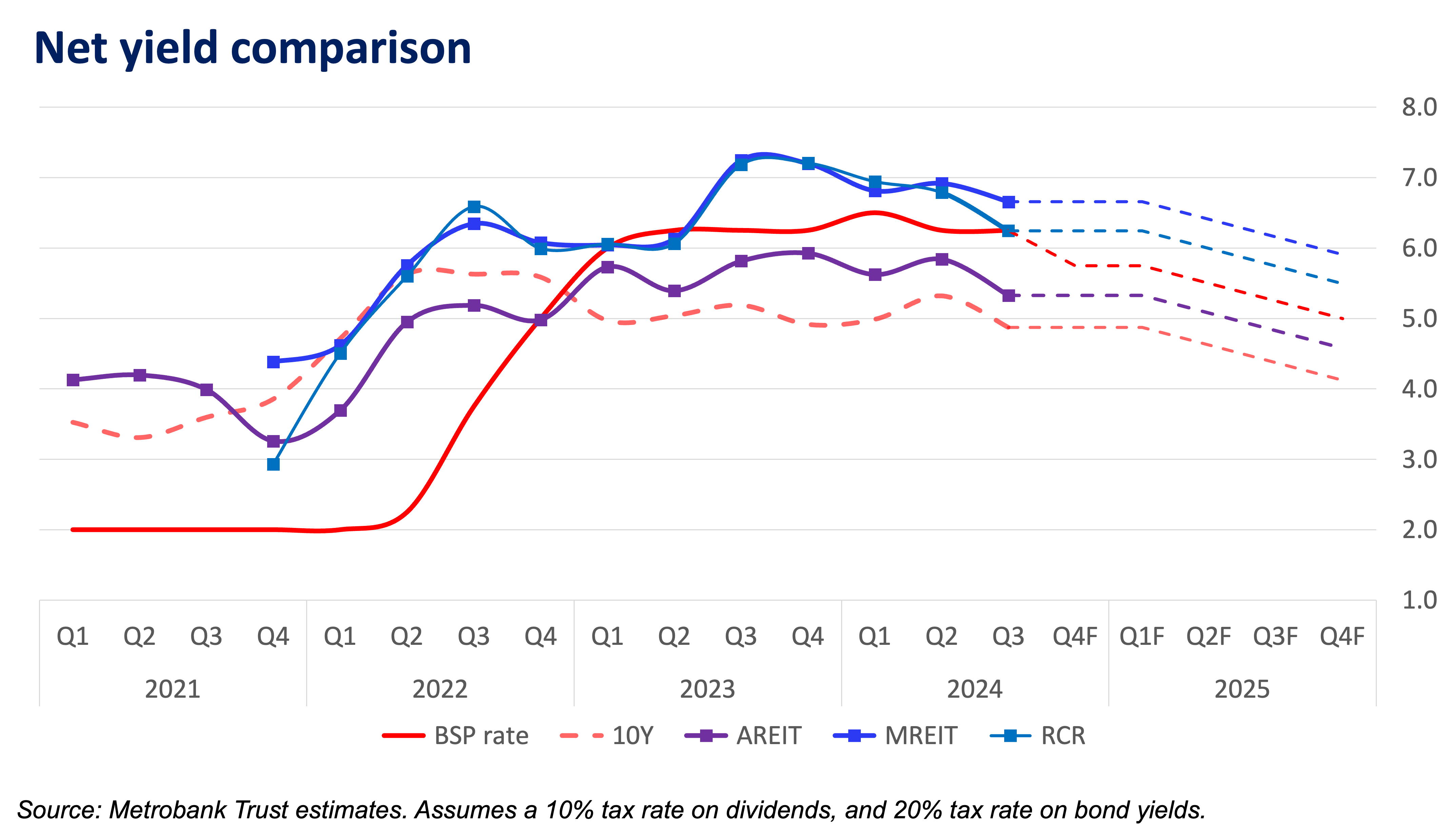

In 2022, we advised clients to hold off on REIT investments as inflation and interest rates shifted demand to less risky fixed-income products. With a turn in policy rates, we think it’s time to revisit the sector as we see REITs becoming a strategic alternative to bonds.

Like bonds, REITs offer regular income through dividends. However, as equities, they also have the potential for capital appreciation and dividend growth. In a falling interest rate environment, REITs can potentially offer higher total returns than traditional fixed-income investments.

A matter of quality

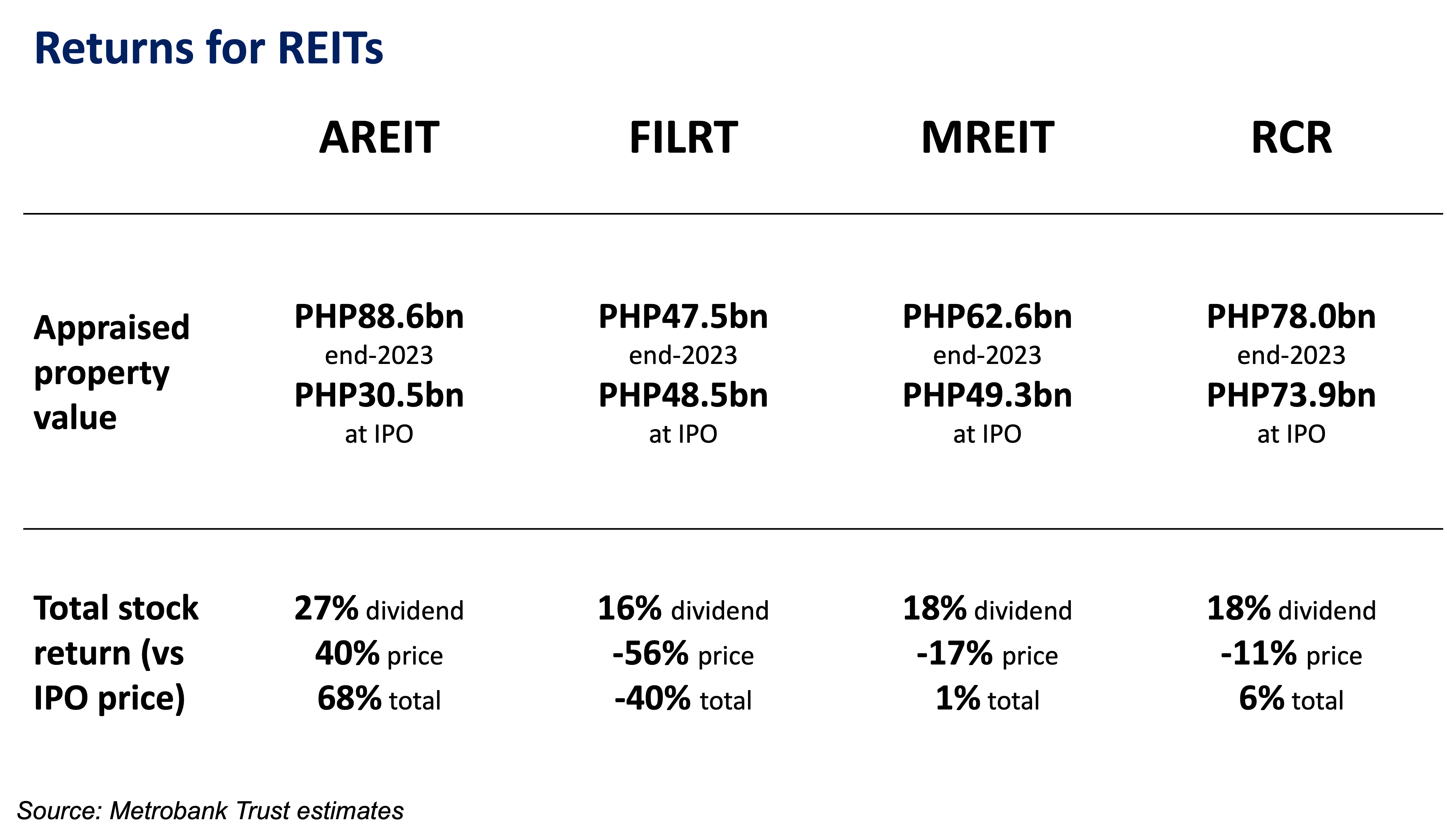

The most striking difference between REITs has been the growth of their property portfolio and resulting total stock return. Let’s examine the first four REITs to enter the market. We see REITs that grew their portfolio such as Ayala Land REIT (AREIT) and Megaworld REIT (MREIT), and those that did not such as Filinvest REIT (FILRT) and Robinsons Land Commercial REIT (RCR). This is reflected in the wide variance in the total return for these REITs – both in terms of dividends and price appreciation of these stocks.

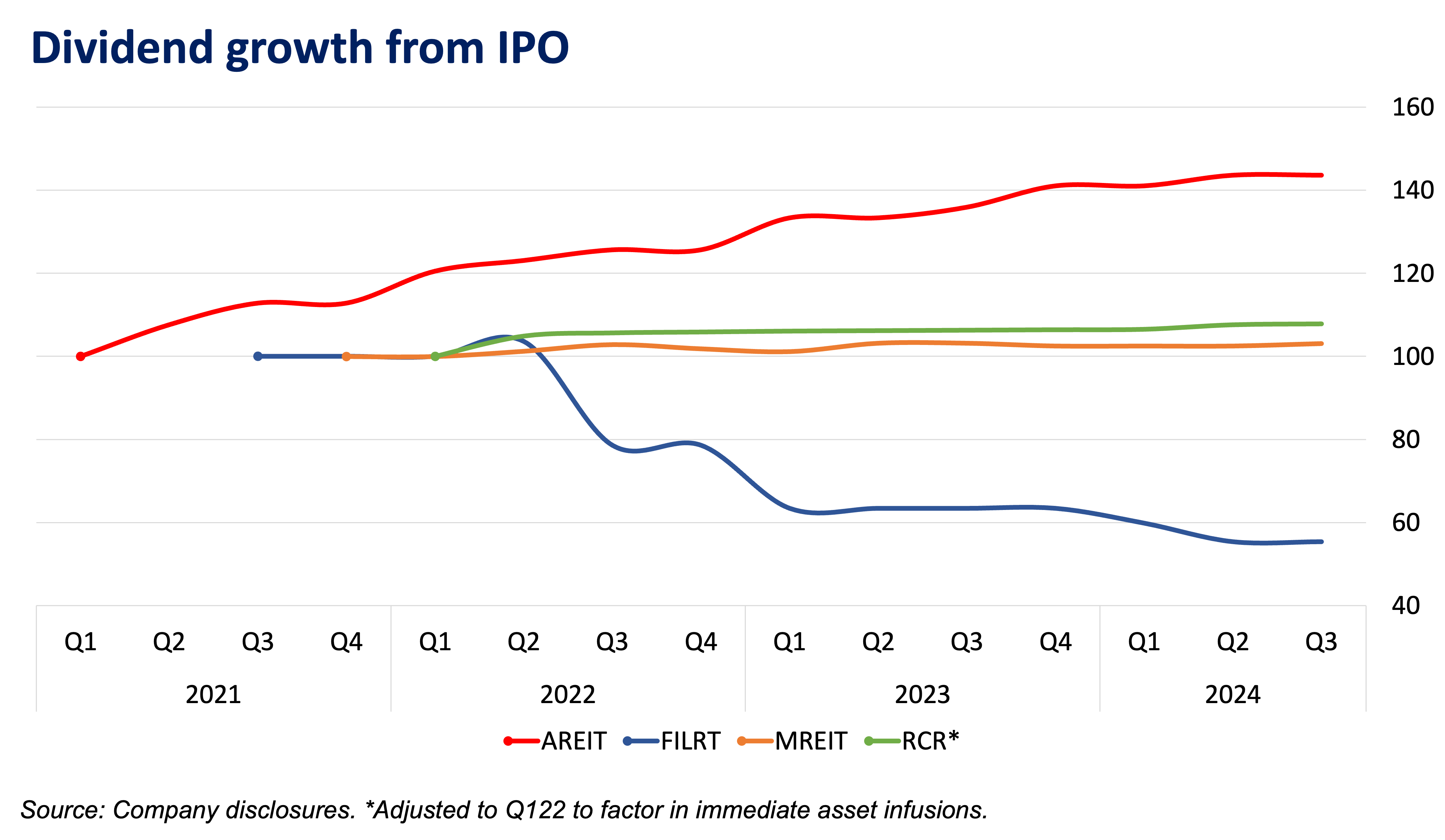

These REITs launched with predominantly office-oriented investment property portfolios. However, their trajectories have diverged significantly. From 2021, AREIT has consistently grown its dividend per share by around 10% every year, MREIT and RCR remained flat, and FILRT dropped to 60% of its original dividend starting in 2023.

While we saw some property sector weakness carry over to REITs, the quality of assets in their investment property portfolio dictated how impactful it was to their operations and dividends. We observed pockets of resilience in certain market segments and saw quality shine through. This was an emergent trend in Q4 2023 which we have seen sustained as of Q2 2024.

Even though they were all office-oriented at the start, the underlying strength of each brand, location, building specification, and tenant relationships determined the success of each REIT.

Blueprint for growth

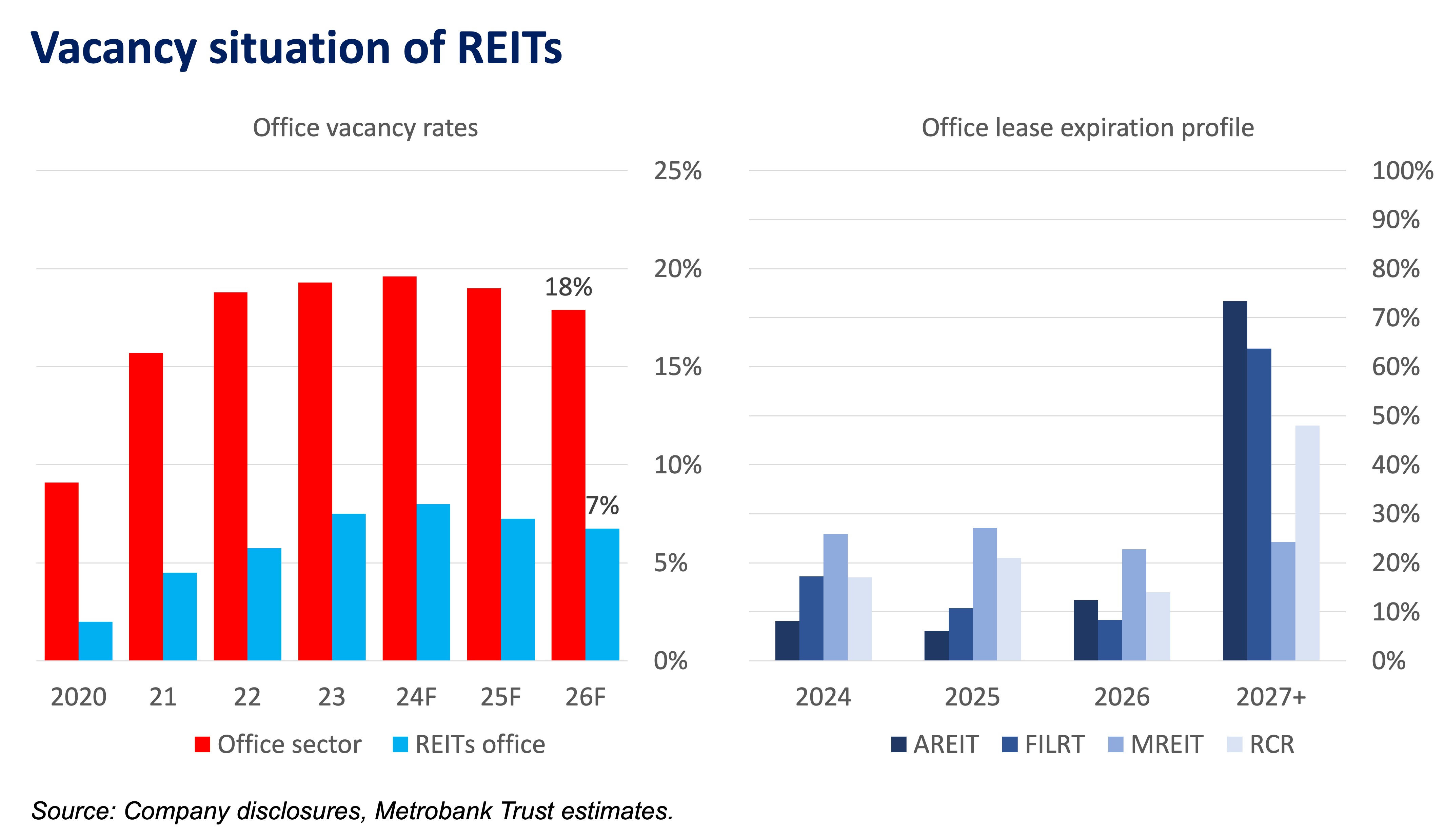

Broadly, we anticipate office vacancies to remain elevated until 2026. A combination of lower demand (POGO exits, BPOs right-sizing operations) and new supply (office spaces finishing construction) will naturally dampen rental rates. However, REITs have not experienced this trend to the same extent.

Tenants remain sticky as the cost to fit out a new location and possible employee friction remains prohibitive to moving offices. As a result, market weakness doesn’t directly translate 1:1 to REITs.

In fact, while vacancies are projected to remain elevated, REITs have most of their lease contracts expiring beyond the next 3 years. They essentially avoid some of the difficult years in the market. This allows REITs to renegotiate contracts in better market conditions in the future.

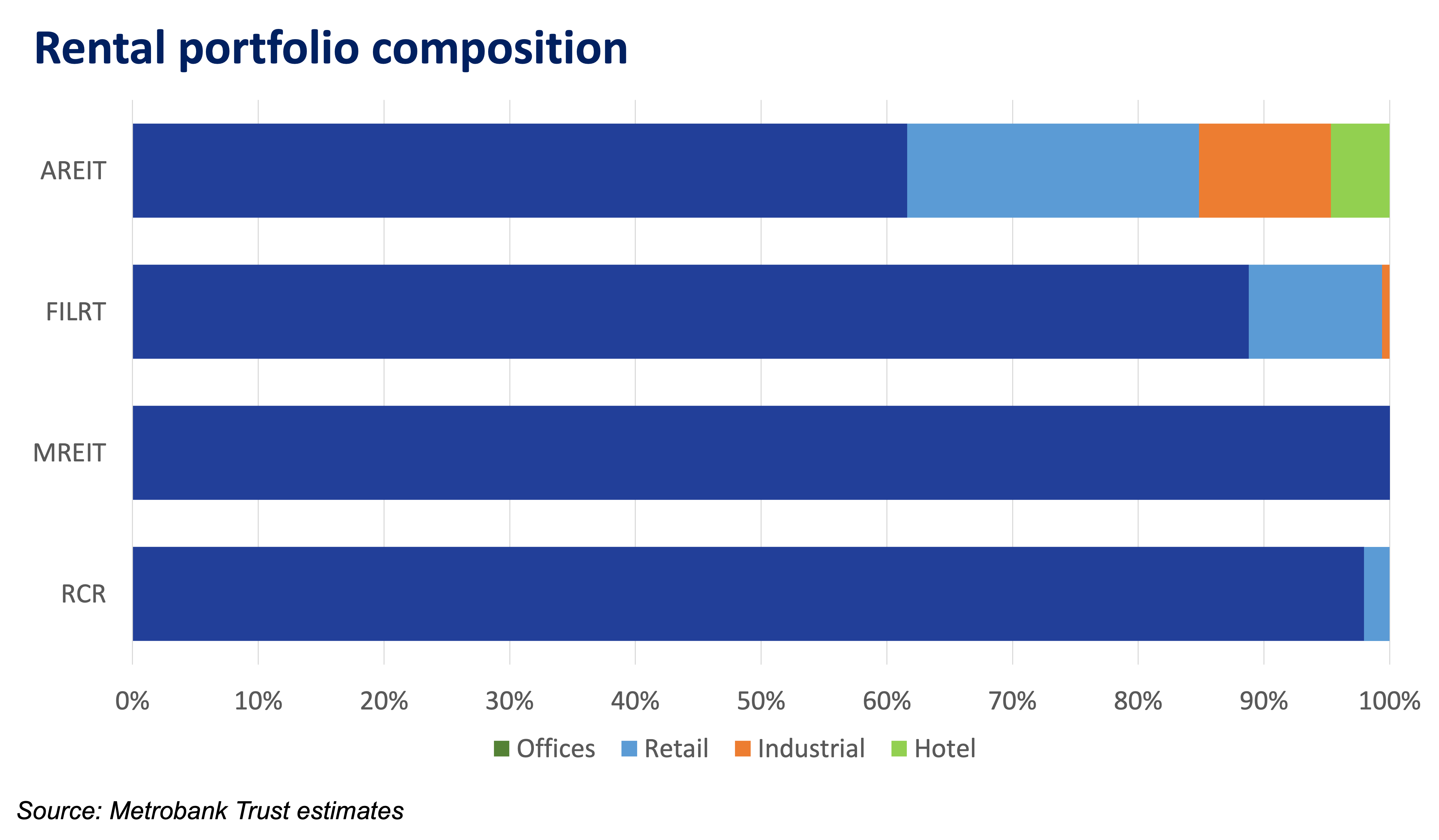

Beyond office assets, the sustained recovery in mall and retail revenues provides another source of growth for REIT investment property portfolios. Sponsor companies have unlocked prime mall assets as the next runway of growth for their REITs. This diversifies their rental exposure and affords the potential to earn on the variable component of mall tenant leases.

For example, Ayala Land added Glorietta 1 and 2 to AREIT in 2023. Robinsons Land added various provincial Robinsons Malls into RCR in 2024.

We anticipate interest rates coming down over the next 12 months as inflation cools. Remember the old adage of inverse relationship between fixed-income and equities – as yields fall, equity prices rise. This will open up a path of revaluation for REITs. Relatively speaking, high-dividend paying stocks will provide the highest total return to investors in an easing environment.

Dividends should remain intact as quality tenants and new asset infusions offset weakness in the overall office segment.

For most investors looking for yield, the capacity for growth in REIT dividend yields is what makes them attractive compared to fixed-income Yield to Maturity (YTM). However, this is where the caveat emptor comes into play. The yield is not all there is to this investment. Knowing that not all REITs are equal, we look to the track record of management and the runway of additional assets that may be infused in the future to determine which REITs are the most attractive.

Investors looking at REITs should understand the uncertainty in both share prices and dividend payouts. By law, REITs are only required to pay out at least 90% of their prior period earnings. There is no guarantee on the frequency and amount of dividend payments in the future.

Thus, it is important to ensure that all of the following factors are taken into consideration:

- Sponsor track record

- Management quality

- Investment property portfolio quality

- Growth pipeline

Based on these metrics, we believe AREIT (Ayala Land REIT) and RCR (Robinsons Land Commercial REIT) warrant a closer look.

(All prices and yields are indicative. For more information and actionable ideas, please reach out to your investment advisor or relationship manager.)

EMUEL OLIMPO is the Head of Equities for Metrobank Trust Banking Group. He formulates strategies for the local market across a broad set of mandates from high-net-worth individual and institutional clients, as well as the bank’s UITF portfolios. He covers the consumer and real estate sectors. Emuel holds a BS in Applied Corporate Management from De La Salle University – Manila. He’s an avid cyclist out and about on weekends, an upstart runner on weekdays, and an enthusiastic gamer the rest of the time.

DOWNLOAD

DOWNLOAD

By Emuel Olimpo

By Emuel Olimpo