Peso GS Weekly: Prospects amid higher inflation

We think that any uptick in domestic prices will be temporary and any sell off in the near term will be viewed as buying opportunities.

Access this content:

If you are an existing investor, log in first to your Metrobank Wealth Manager account.

If you wish to start your wealth journey with us, click the “How To Sign Up” button.

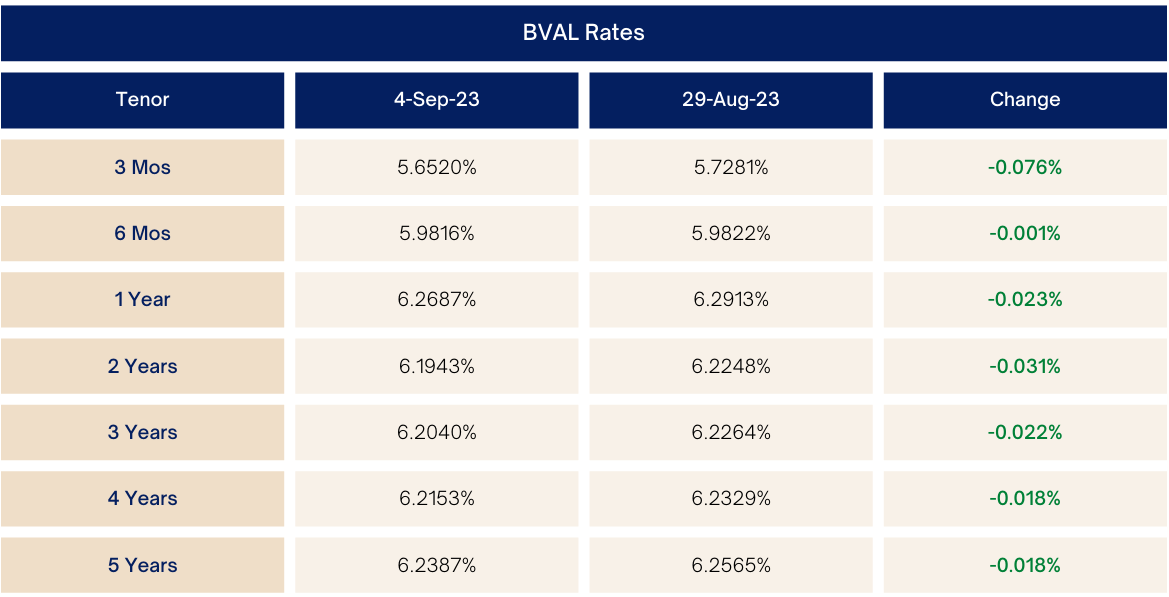

Market Levels (week-on-week)

Market Updates

Last week:

Despite the shortened trading week, it was a good way to end the month of August as the peso government securities (GS) market rallied. Following the rebound in global yields, buying interest spurred in the local bond market. However, some clients took advantage of the rally to lighten up positions.

On Wednesday, the Bureau of the Treasury (BTr) fully awarded the reissuance of the 5-year Fixed Rate Treasury Note (FXTN) 10-64 auction at an average of 6.22% and a high of 6.25% or well within market indications.

Later in the day, the BTr released the borrowing program for September wherein they will issue bonds in the 3-, 7-, and 10-year tenor buckets. The announcement of BSP’s August Inflation forecast at 4.8% to 5.6%, vs July’s 4.7%, h

Read More Articles About:

DOWNLOAD

DOWNLOAD

By Geraldine Wambangco

By Geraldine Wambangco