November 2023 Updates: Upward tilt of inflation still a possibility

Despite higher GDP growth in Q3, higher costs in transport, oil, and power rates can cause an upward tilt to near-term inflation.

The Philippines’ Gross Domestic Product (GDP) for the third quarter expanded at a faster pace by 5.9% year-on-year versus the previous quarter’s 4.3% growth, driven by a recovery in government spending and growth on exports.

Meanwhile, Philippines’ October headline inflation came in lower than the consensus forecast at 5.6% and Metrobank Research’s 6% estimate. This suggests a sharper deceleration from the upside surprise seen in the past two months, when rice and transport prices soared amid export restrictions, extreme weather conditions, and fare hikes.

The Bangko Sentral ng Pilipinas (BSP) kept key interest rates unchanged at 6.5% as it deemed current policy settings “sufficiently tight” following its off-cycle hike last October 26. However, it maintained its tighter-for-longer stance as it established a new set of risk-adjusted inflation forecasts.

We maintain our view that the near-term risks to inflation continue to tilt to the upside due to the potential impact of higher transport fares, electricity rates, international oil prices, as well as minimum wage adjustments outside NCR.

Lastly, a continued downtrend in the dollar amid lower US yields as markets double down on expectations that the Fed is done hiking rates, and a stronger peso on account of OFW remittance inflows supports our year-end forecast of PHP 55.1/USD 1 in 2023, and PHP 54.4/USD 1 in 2024.

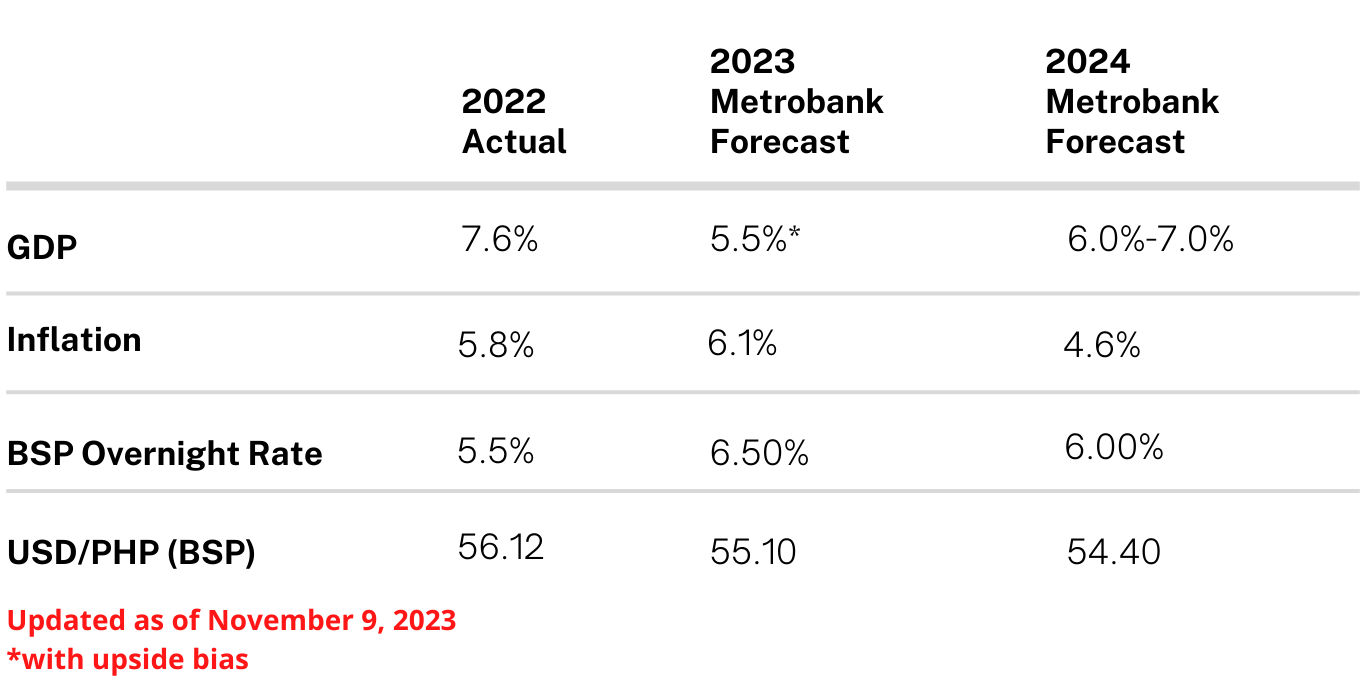

Considering these developments, we have made revise to the following key macroeconomic indicators:

For more information on the performance and outlook for several macroeconomic indicators, as well as local macroeconomic news, please download the full report below.

November 2023 Updates: Upward tilt of inflation still a possibility

Research sees catch-up spending to continue in the coming months, which should provide further boost to economic growth in the fourth quarter.

DOWNLOAD

DOWNLOAD

By Metrobank Research

By Metrobank Research