Is inflation decelerating?

The Philippines’ February inflation inched down, for the first time in six months. Is this a sign that inflation has already peaked?

Recall that towards the end of last year, economists, analysts, and government officials were projecting inflation to peak in December, as this is usually the time of heightened consumption because of the holidays and the seasonal increase in OFW remittances. Inflation then reached 8.1%, which was the highest in 14 years, driven mainly by food & non-alcoholic beverages.

Unexpected peak

However, January’s whopping 8.7% inflation figure shocked many Filipinos, among them analysts who had a median estimate of 7.6% according to a BusinessWorld poll. This print also went beyond BSP’s projections of 7.5% to 8.3% at the time. What drove it this time?

Unexpectedly, the primary driver was housing, electricity, and other utilities as landlords adjusted rental rates to reflect the economic reopening and as energy prices rose, while the main contributor remains to be food & non-alcoholic beverages.

Also, the upsurge in said month’s inflation also continued to showcase the impact of second-round effects as core inflation continued to accelerate.

Another surprise in February

Though only inching down from the previous month’s reading, the February inflation rate of 8.6% was welcome news, as some were even expecting inflation to reach the 9% level during said month. Even BSP forecasted a range of 8.5% to 9.3%, and analysts’ median estimate was at 8.9% based on a BusinessWorld poll.

Transport-related prices were the driver for this deceleration which stemmed from a decline in gasoline and diesel prices.

Though some might have breathed sighs of relief, note that core inflation has still risen, jumping from 7.4% in January to 7.8% in February. Core inflation excludes volatile commodities such as food and energy, and so the upsurge in its numbers may manifest the persistent impact of second-round effects.

Sign of deceleration on the way?

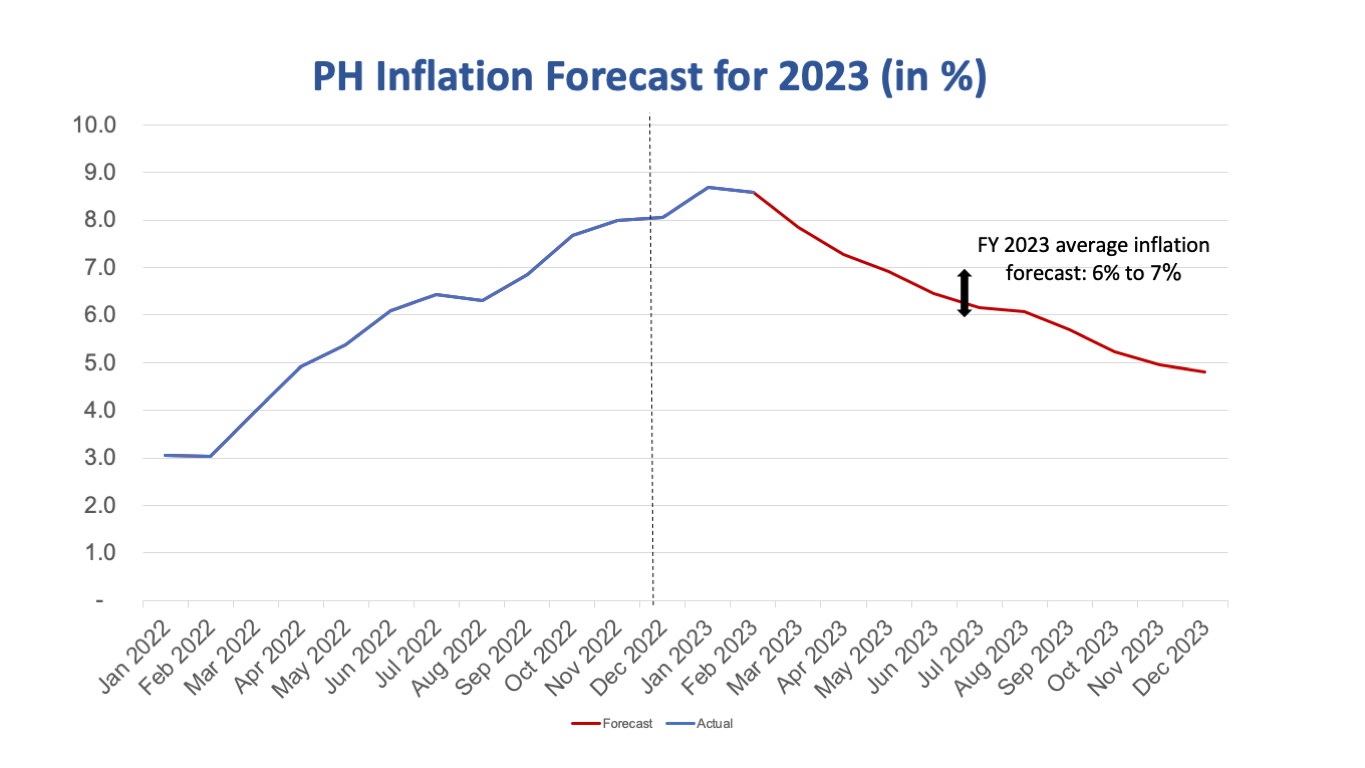

Metrobank Research is expecting that inflation has already peaked last January 2023, barring any new supply and price shocks, and owing to base effects and moderating consumption amid high interest rates. The inflation trajectory for the remainder of the year is projected to be on a downward trend already, mirroring the inflation trend in 2022 (see below) but in reverse and starting from a higher level.

However, do not expect inflation to go down drastically – prices will most likely remain sticky and deceleration will happen at a gradual pace due to the second-order effects of inflation. Metrobank Research forecasts inflation, on average, to be at a range of 6% to 7% for the full-year 2023.

Upside risks

Upside risks to the call would be heightened second-round effects as inflation continues to be broad-based. A new bill seeking to increase the minimum wage across different regions for the private sector, on top of the continued tranches of wage hikes that started last June 2022 nationwide, could exacerbate second-order effects.

This could result in a wage-price spiral, which is a phenomenon where additional wages will be passed on to consumer prices by businesses, hence the term “spiral”.

China rebounding substantially owing to its zero-COVID exit late last year would also further aggravate inflation, reflected in higher prices of key commodities such as oil.

Downside risks

The expected slowdown in global economic growth, especially in the US and Europe, due to high interest rates could dampen inflationary pressures. Likewise, the lower-than-forecasted GDP print of China could also mean that global demand for goods would not rebound significantly and would not worsen price pressures.

So yes, we are expecting that deceleration is in sight, but let’s hope no more new supply shocks, geopolitical and external events, and other unforeseen circumstances come our way for a more smooth-sailing ride toward price stability.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her Bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano