Learn about the inflation risk you should beware of

While inflation appears to be on the way down, there are inflation risks that keep investors wary.

Local inflation has recently eased back within the Bangko Sentral ng Pilipinas’ target range of 2-4% for the first time in nearly two years.

Is the battle finally over? Not quite. Persistent supply-side pressures remain. While inflation is expected to bottom in the first quarter of 2024 due to favorable base effects, it could still shoot up above the target in the middle of the year.

As said in our previous article, rice price shocks present an upside risk to inflation. While prices of various food commodities are gradually moderating, rice inflation surged 19.6% year-on-year in December 2023, the highest annual growth since March 2009.

The continued increase of both local and global rice prices since mid-2021 can be attributed to supply disruptions that affected rice trading worldwide.

The uptrend in rice prices may continue into 2024, fueled by the prolonged El Niño phenomenon that is expected to reach its peak in the first half of the year.

Approximately 80% of the country’s provinces could experience elevated temperature levels. Consequently, rice stock could remain below its historical average, with inventories in 2023 averaging around 1.8 million metric tons (MT), a notable decline from the 10-year pre-pandemic average of 2.5 million MT.

With these challenges, there are fiscal efforts directed at mitigating the impact on food costs. These include the extension of temporary tariff cuts on rice imports and the potential implementation of a suggested retail price (SRP) for rice to stabilize price fluctuations.

El Niño and Geopolitics: A Local Inflation Risk to watch out for

The El Niño is particularly concerning local inflation risk, especially when exacerbated by geopolitics. Trade disruptions have emerged with plunging water levels and escalating geopolitical tensions, driving up shipping costs. Consequently, both sea and air cargo costs are on the rise.

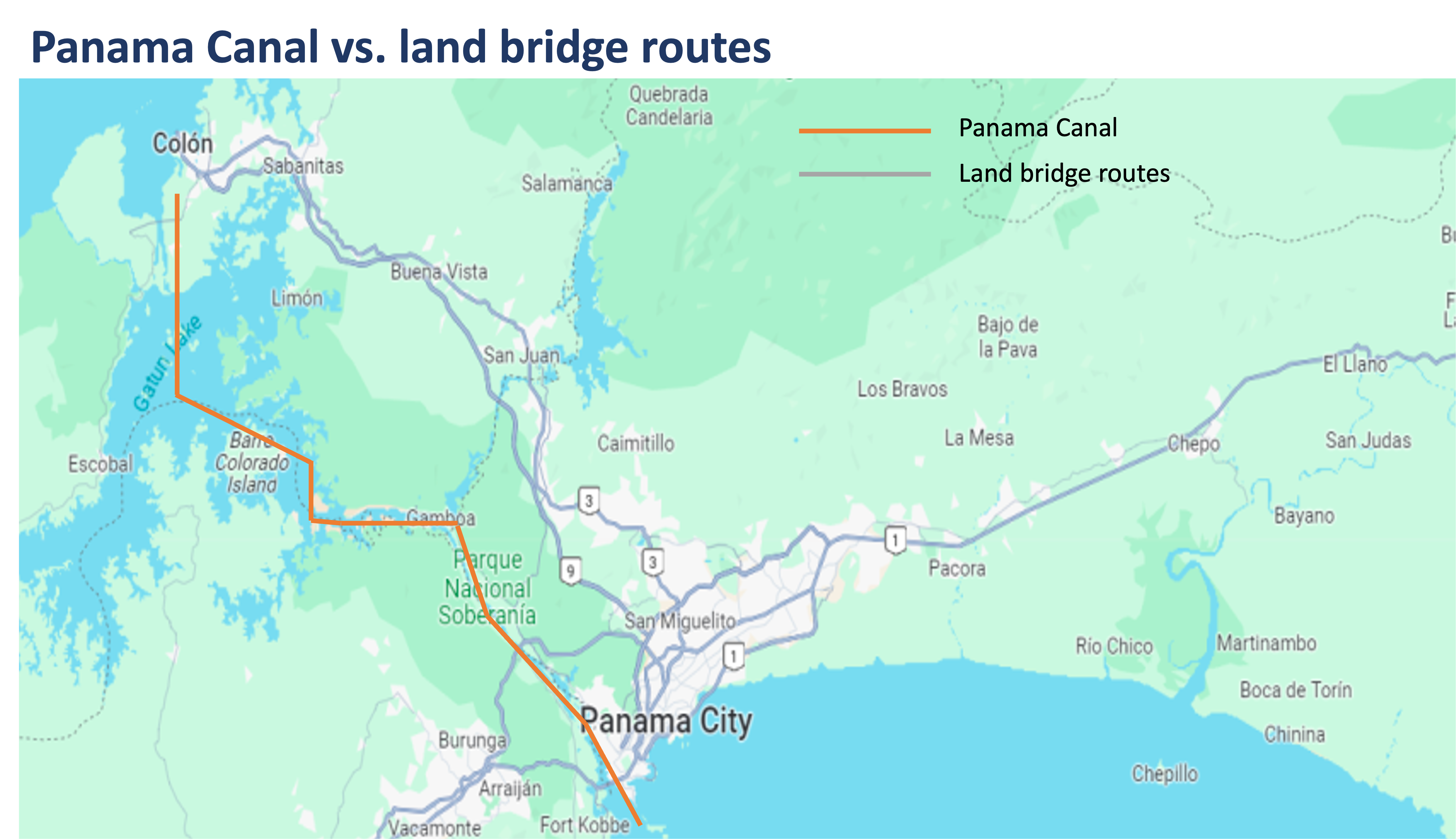

In the Panama Canal, authorities reduced ship crossings by almost 40% due to increasing bottlenecks caused by the drought. With some ships enduring up to a 20-day wait at the choke point, alternative routes have been implemented.

These include land bridges facilitating cargo movement across Panama without navigating dry waterways.

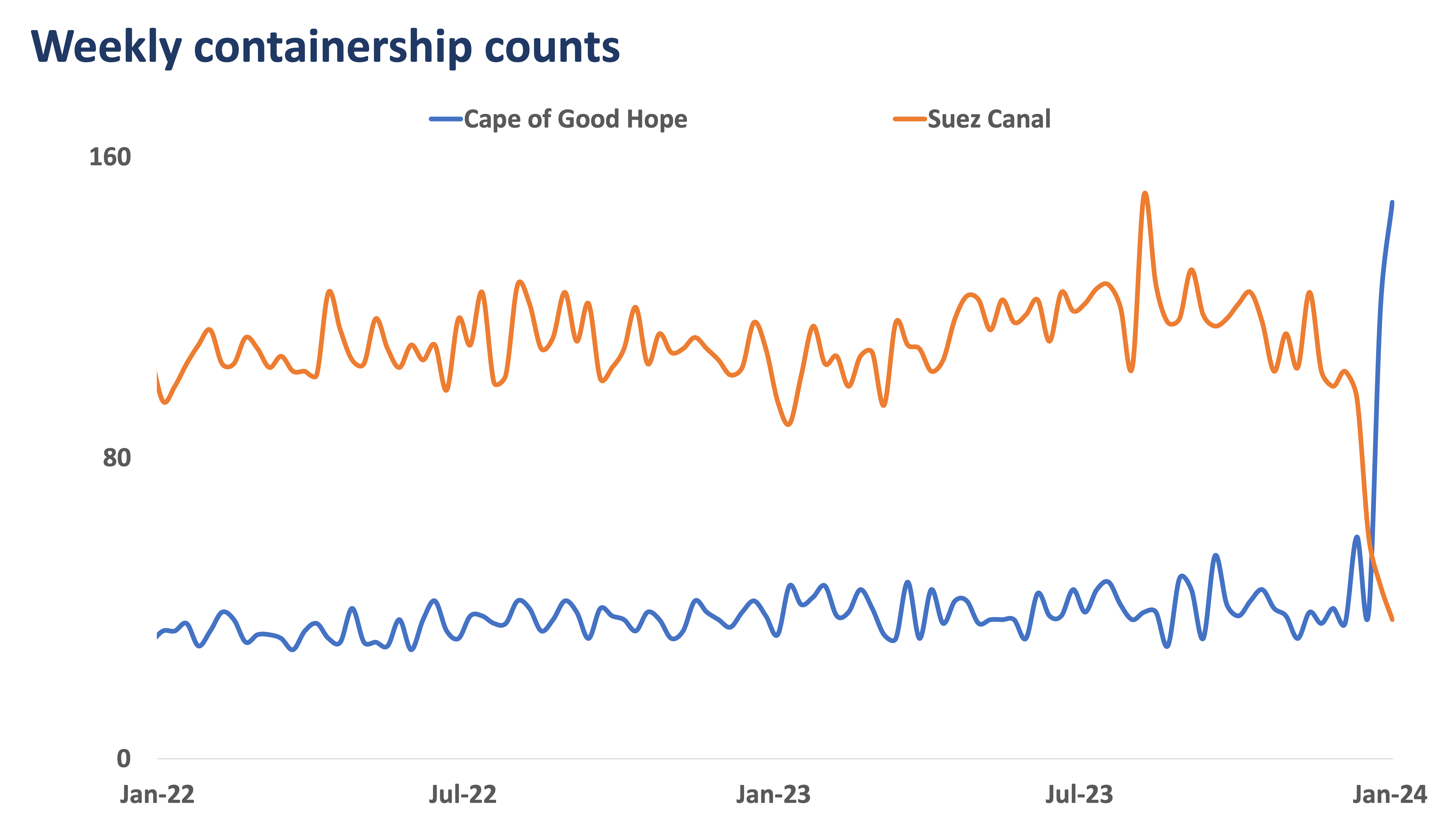

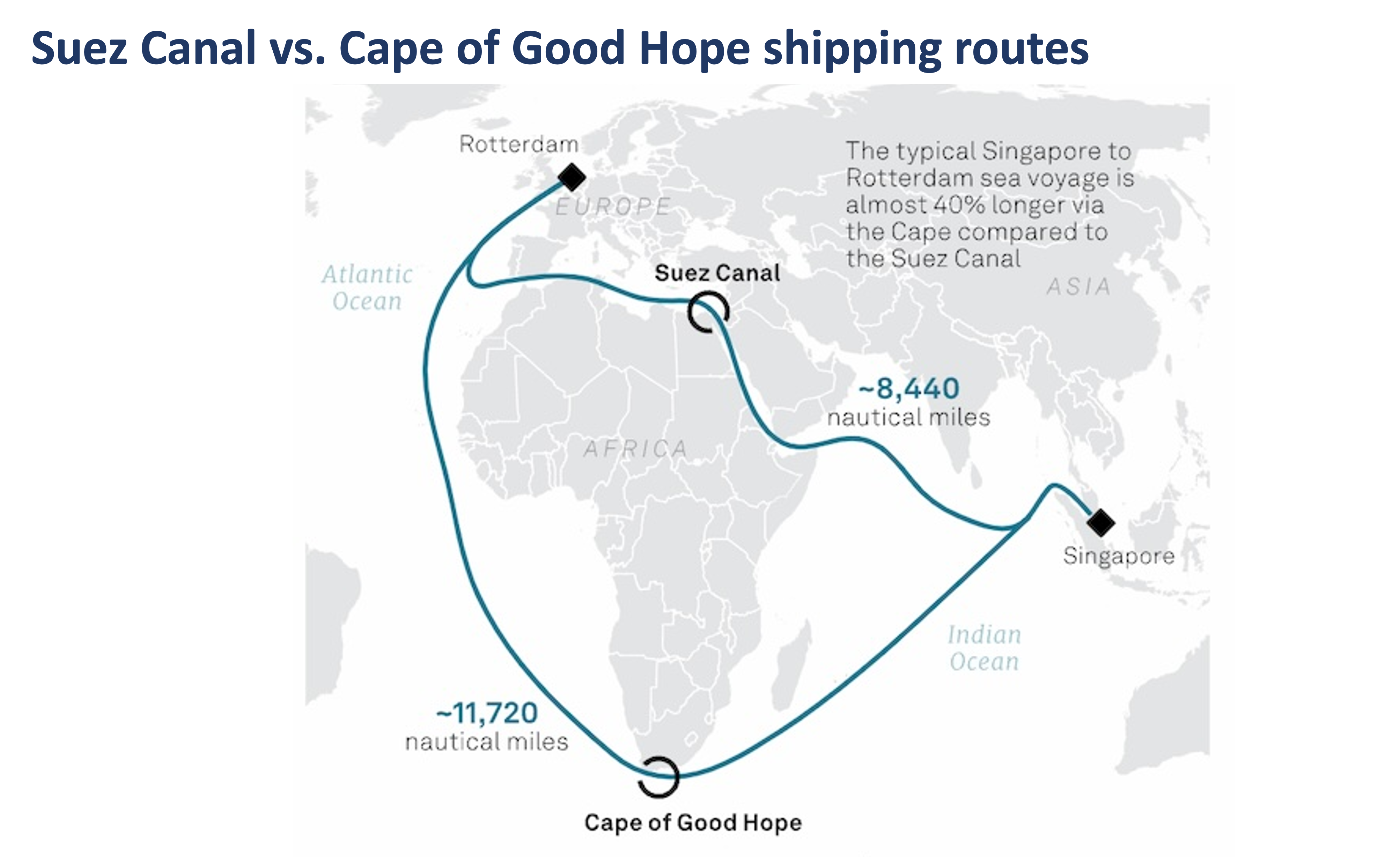

On the other hand, the Suez Canal’s shipment volume has plummeted to less than 40 containerships per week, down from the usual 100 ships as Houthi rebels target merchant ships in the Red Sea.

Carriers are redirecting vessels to the Cape of Good Hope, which adds around 10 days of travel time, and longer by more than 3,000 nautical miles.

These disruptions are significantly impacting the global trade of key commodities such as crude, cereals, and palm oil.

In the Philippines, rice price shocks may worsen as the El Niño progresses, along with several factors disrupting global trade of essential grain and oil commodities, with cereals and energy directly comprising over 20% of the local inflation basket.

These inflationary risks are mostly beyond our control. For this reason, the Bangko Sentral ng Pilipinas remains wary of cutting interest rates prematurely.

What now?

More government action to implement more strategic fiscal measures is needed. Subsidies, government spending, and debt management are just some of the tools.

With prudent action and a more favorable geopolitical environment, conquering inflation may come sooner than expected.

(Bookmark and visit Metrobank Wealth Insights at www.wealthinsights.ph daily for investment insights and ideas. If you are a Metrobank client, please get in touch with your relationship manager or investment specialist for assistance in accessing exclusive content. Not a client yet? Please sign up here so you can begin your wealth journey with us.)

ANNA DOMINIQUE CUDIA, MBA, CSS, is the Head of Markets Research at Metrobank’s Trust Banking Group, spearheading the generation and presentation of financial markets insights to internal and external clients. She used to be with Metrobank’s Investor Relations, where she brought in international awards and took part in various multi-billion peso and dollar capital raising activities. She has a Master of Business Administration (Finance) degree, with distinction, from the University of London, and a Bachelor of Science in Business Administration degree, cum laude, from the University of the Philippines. She also passed the CFA Level I exam and is a Licensed Fixed Income Market Salesman (FIMS), a Certified UITF Sales Person (CUSP) and a Certified Securities Specialist (CSS). She is a naturally curious person and likes to travel here and abroad.

SOPHIA THERESE “PIA” BONIFACIO is a Research Officer at Metrobank’s Trust Banking Group, covering local and offshore macroeconomic research. She obtained her Bachelor’s degree in Economics with a Specialization in Financial Economics, cum laude, from the Ateneo de Manila University and is a Certified UITF Sales Person (CUSP). On the daily, Pia spends her time with her best friend – a 9-year-old Chow Chow named Yao Ming.

DOWNLOAD

DOWNLOAD

By Anna Cudia and Sophia Bonifacio

By Anna Cudia and Sophia Bonifacio