Imported inflation: Upward pressures from global rice prices

India’s recent rice export ban triggered major rice exporters to bump up their prices, which will affect importer countries like the Philippines. How will this impact our already-easing inflation?

The Philippines’ lower July headline inflation (4.7% vs 5.4% in June) further supported our previous calls that local prices will continue to track this downward trend in the coming months as higher base effects kick in.

This time around, easing price pressures came from utilities, food and non-alcoholic beverages, and transportation.

Despite this good news, on-going developments in the global rice sector pose upside risks to this view apart from higher transport costs and lingering food supply constraints that could stem from El Niño.

High global prices, India’s export curbs

Recently, the Indian government imposed a ban on non-basmati white rice after retail rice prices climbed 3% in a month after heavy monsoon rains caused significant damage to crops.

What does this mean for global rice prices?

As the world’s top rice exporter, India’s export curbs may cause significant constraints in the global rice supply. Moreover, this is anticipated to prompt other major rice exporters such as Thailand and Vietnam to bump up their prices.

Last year, we already saw a real potential concern from the other two major rice exporters, Thailand and Vietnam, who have jointly sought to make their rice export prices more competitive to aid their farmers amid rising cost of production. This is why exporters from these nations are set to gain from tightening global rice supply as they can re-negotiate their sales contracts to get higher prices.

In fact, the average export prices of Thailand and Vietnam have been on the rise, with growth more pronounced in the first half of 2023. From January to June, average growth of rice prices from these countries is at 15% and is anticipated to go even higher given the impact of India’s export restrictions to supply.

As of August, Thailand’s 5% broken rice prices have climbed up to USD 625 per metric ton while Vietnam rice prices have reached USD 590 per metric ton from an average of USD 410 levels last year.

How will this impact inflation?

Despite the upward trend in rice prices and gradually accelerating rice inflation, one might ask why headline inflation has been going down still (see chart below). We cite two reasons for this: 1) because slowdown in prices of other key commodities still offset the gradual increase in rice prices, and 2) due to the lagged effects of these gradual price upticks to overall inflation. Meaning, it takes time before these price increases from our rice exporters manifest into our headline inflation.

From our deep dive, we saw that changes in global rice prices seep into rice inflation after a month (1 lag) and for rice inflation to reflect its acceleration in the headline inflation 3 months after (3 lags). Thus, the more pronounced upsurge in global rice prices this August may start trickling down into our economy within four months’ time and manifest its effects to headline inflation data by December.

Rice import prices can affect headline and rice inflation.

Shocks in our model

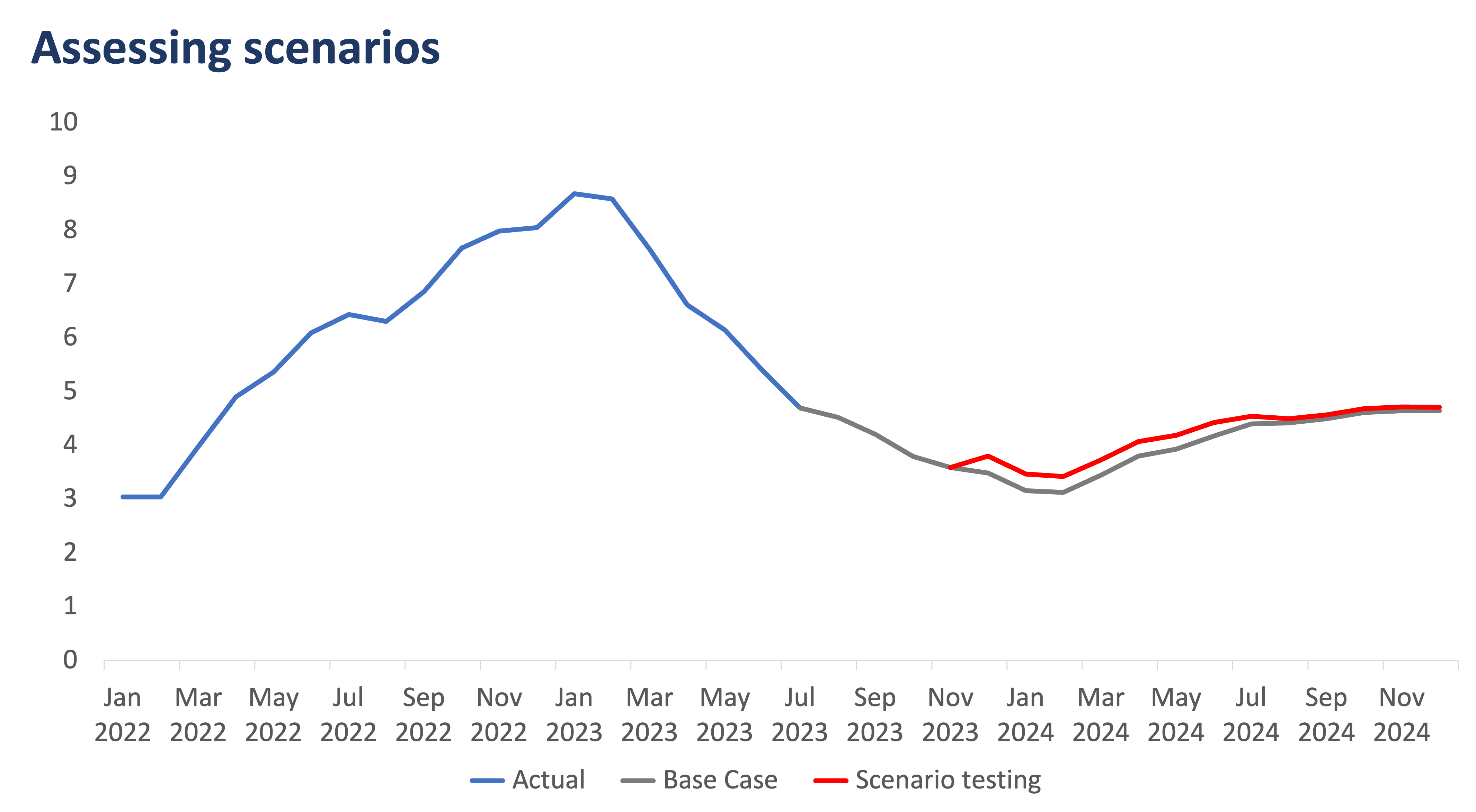

Our base case scenario has always anticipated inflation to continue going down in 2023 with the assumption of the absence of price and supply shocks.

Given upside risks stemming from the global rice market, we introduced this shock into our model assuming 1) a consistent USD 600 price level of Vietnam and Thailand throughout the year, and 2) status quo in domestic production, and our estimates show a 30-bp increase in headline inflation in December which will continue to seep into 2024 inflation.

This chart shows how these supply and price pressures can affect inflation.

Not out of the woods… yet

As of latest data (July 27), our rice imports are at 1.9 million MT, still ~1.8 million MT short if last year’s total imports of 3.8 million metric tons would be the benchmark.

Local rice buffers are also running low as the current local inventory held by the National Food Authority (NFA) is well below the nine days-worth of domestic consumption targeted by the agency (currently at 1.56 days’ demand equivalent), due to efforts to temper high domestic buying prices. Moreover, the Department of Agriculture already sought the help of the private sector to increase rice imports, in hopes of importing 1.3 million metric tons (MT) of rice. All these amid higher global rice prices.

Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona came on the wires just before the July data release and said the country is not yet out of the woods, highlighting that the BSP is ready to hike as soon as the August 17 Monetary Board meeting.

While price pressures have significantly tempered for 2023, we think these upside pressures from global rice prices and domestic rice inflation will be a major consideration for the BSP, alongside the looming impacts of El Niño on food prices.

While we don’t see hikes in the horizon given our projections for 2023, the current developments may push inflation expectations higher, which we anticipate will encourage the BSP to continue holding interest rates steady until price pressures settle down.

INA JUDITH CALABIO is a Research & Business Analytics Officer at Metrobank in charge of the bank’s research on industries. She loves OPM and you’ll occasionally find her at the front row at the gigs of her favorite bands.

GERALDINE WAMBANGCO is a Financial Markets Analyst at the Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank. She provides research and investment insights to high-net-worth clients. She is also a recent graduate of the bank’s Financial Markets Sector Training Program (FMSTP). She holds a Master’s in Industrial Economics (cum laude) from the University of Asia and the Pacific (UA&P). She takes a liking to history, astronomy, and Korean pop music.

DOWNLOAD

DOWNLOAD

By Ina Calabio and Geraldine Wambangco

By Ina Calabio and Geraldine Wambangco