Could robust Philippine growth in 2022 herald a better year ahead?

The Philippines had one of the most remarkable growth stories in 2022. How will 2023 fare?

The Philippine economy expanded by 7.6% annually in 2022, the highest in almost half a century. This figure even exceeded the government’s Development Budget Coordinating Committee (DBCC)’s forecast of 6.5% to 7.5%. Full-year gross domestic product (GDP) at constant prices last year already exceeded pre-pandemic (2019) levels.

Consumption primarily boosted output last year, along with the Services sector, amid the country’s full re-opening as COVID-19 cases plunged. (See our report here where we discuss FY 2022 GDP at length.)

Momentum is shifting

The recently released Q4 2022 GDP data recorded a surprising 7.2% growth, which went beyond median analyst forecasts. Among Asian economies that have already released their 4th quarter GDP figures, the Philippines grew the fastest. Despite this, Q4 data is already showing some signs of a shift in momentum in the economy:

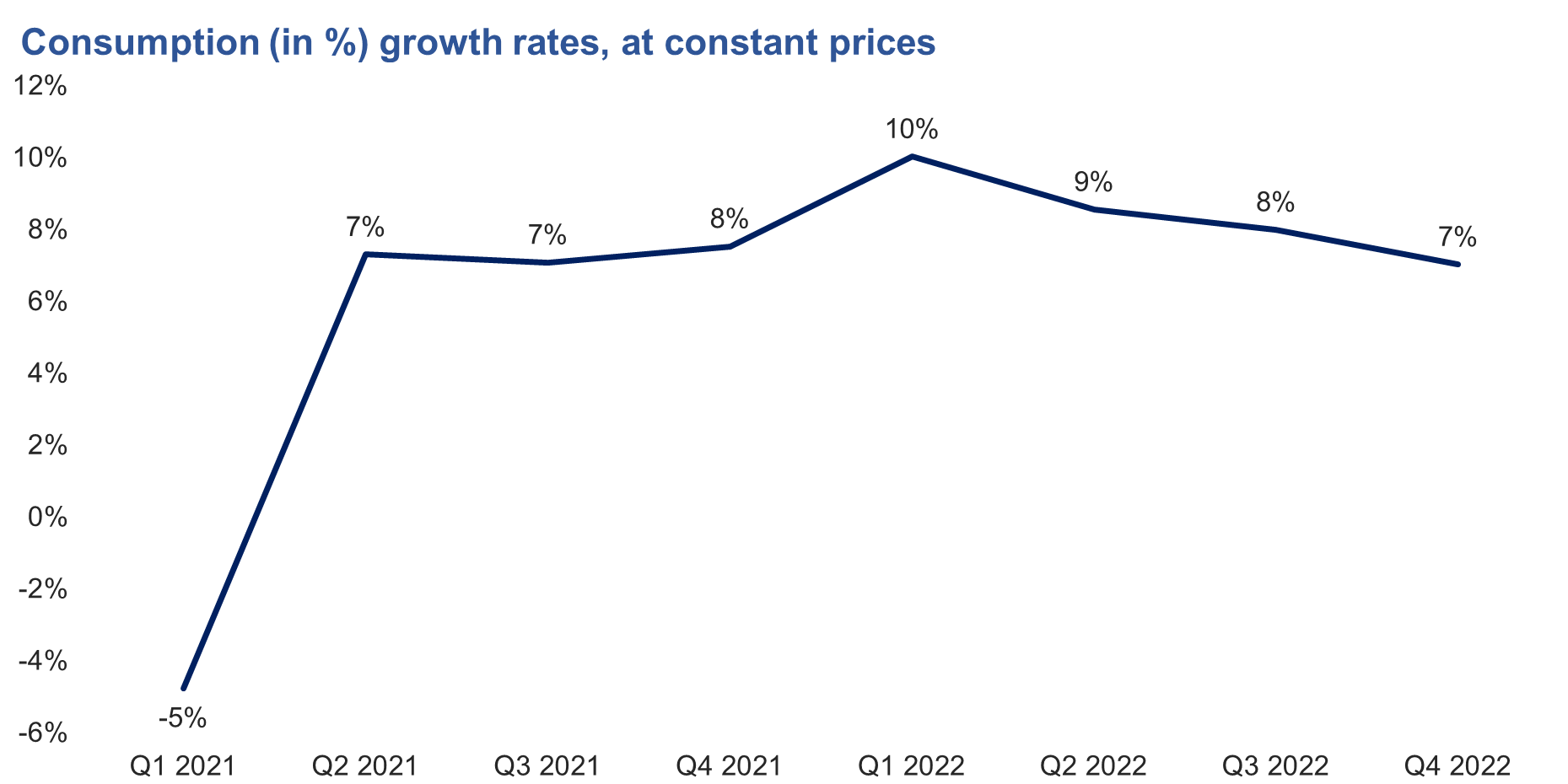

Consumption grew by 7.0%, slower than the prior quarters in 2022 and slower than 7.5% during the same period in 2021.

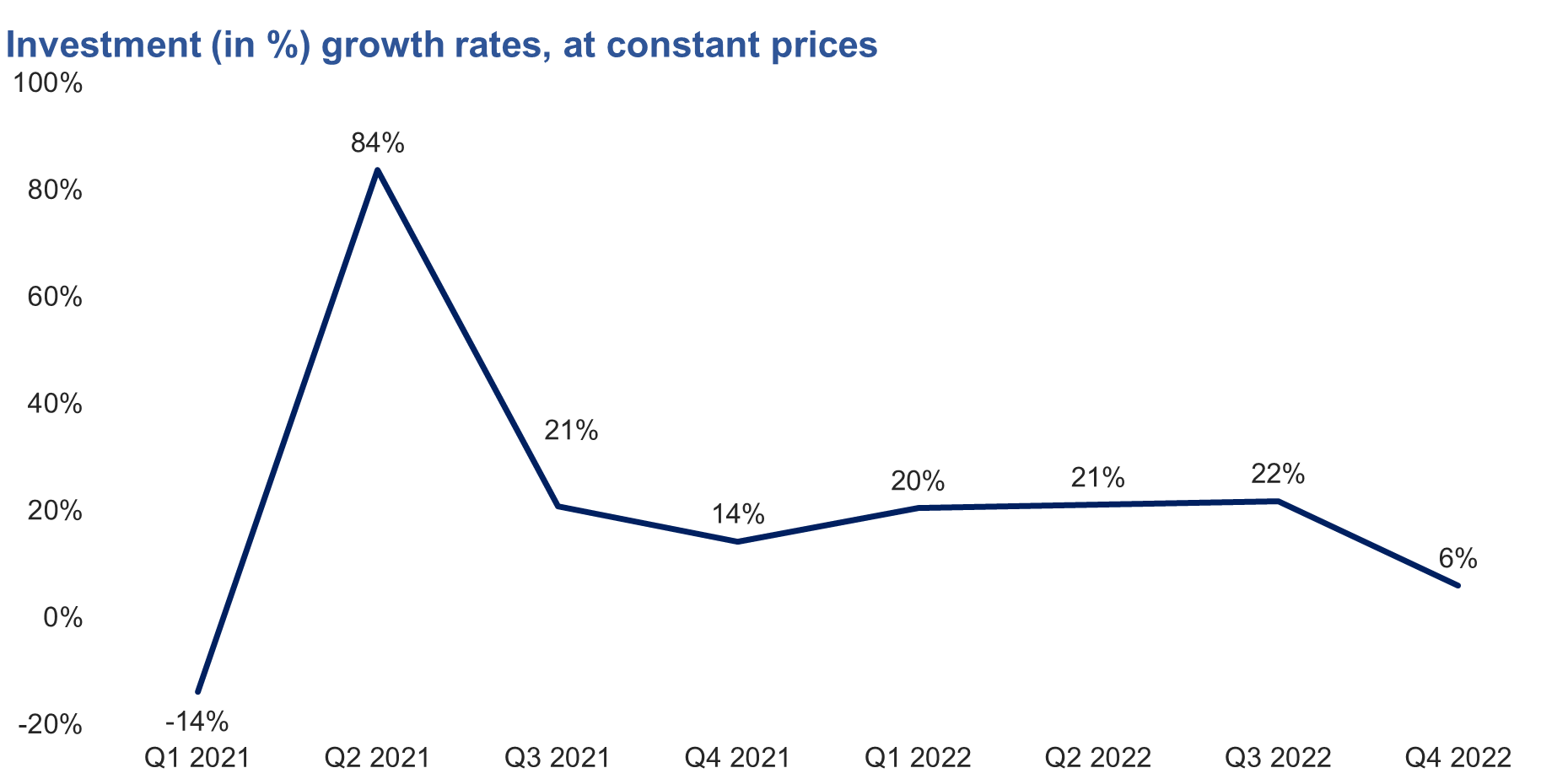

Investment spending accelerated at a much-muted pace by 5.9% in the 4th quarter, compared to the 20%+ levels from Q1 to Q3 of 2022 and compared to the substantial 14.2% growth in Q4 2021.

Imports clipped a lackluster growth of 5.9%, compared to 14.3% during the same period in 2021 and versus double-digit growths in the first three quarters of 2022.

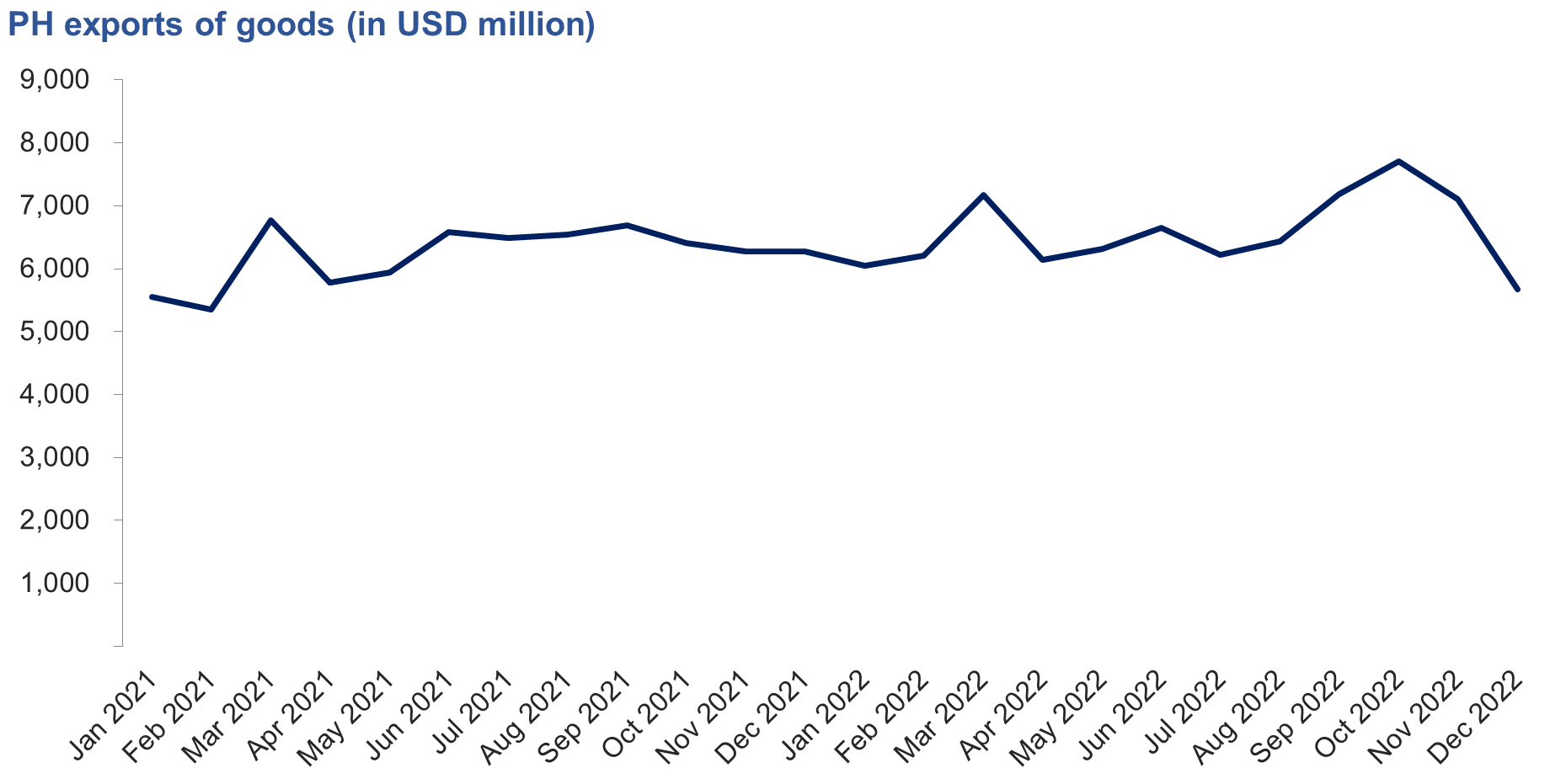

Though exports were considerably bolstered by 14.6% in Q4 2022 versus 7.7% during the same period in 2021, monthly trade data showed that December exports hit an all-time low since February 2021, and trade deficit as of yearend 2022 grew by about 38% compared to that of 2021.

The above observations could be tell-tale signs of the following:

Consumption

While consumption growth got boosted in 2022, pent-up demand is likely fading already, as the effects of inflation bite into the purchasing power of individuals, coupled with rising interest rates. Last year’s high consumption was mainly driven by the country’s re-opening along with base effects. With inflation seen to persist this year, the country’s consumption performance in 2022 will be difficult to exceed or even sustain this year.

Investments

One of the notable figures in the Q4 2022 GDP data was the sharp plunge in the growth of investments. This could already reflect the effect of the aggressive monetary tightening of the Bangko Sentral ng Pilipinas (BSP). As further rate hikes are in the cards, this might further affect investment prospects.

Imports

An easing of imports may be an indicator that there is a slowdown in domestic demand, given that the Philippines is an import-dependent economy. Because imports and investments have recently slowed, this may hint, again, that the contractionary monetary policy is already taking effect.

Exports

There may be a tapering of demand for the Philippines’ exports given the continued Russian-Ukraine conflict and the possible recession in Europe and the US, as well as the slowdown of advanced economies.

To add, because of the foreseen drop in economic growth in some countries, remittances to the Philippines might likewise be affected.

Bright spots and areas for improvement

Inflation may further peak by Q1 of 2023. Though prices are expected to be elevated due to second-round effects, continued supply chain disruptions, and the global energy crunch, among others, inflation is seen to be on a downward trajectory throughout 2023. This could signal the end of the rate hikes of the BSP by 1st half of 2023.

Hopefully, this will translate to a gradual strengthening of consumption, barring any further external headwinds, though 2022 consumption will most possibly not be replicated this year.

Additionally, the booming tourism and business process outsourcing (BPO) industries in 2022, among others, can hopefully help bolster growth this year as well, and continued infrastructure spending by the government is expected to buoy the economic performance of the country in 2023.

Though it might be a difficult year ahead for the Philippines, the hope is that the resilience of the country in the face of rising costs, interest rates, and heightened geopolitical tensions last year could still manifest this year.

This is with the help of the planned interventions of the government to sustain high levels of growth as outlined in the Philippine Development Plan (PDP) 2023-2028, such as promoting competition and improving regulatory efficiency, promoting trade and investments, enhancing inter-industry linkages, and advancing R&D, technology, and innovation to hopefully revitalize industry, reinvigorate services, and modernize agriculture and agri-business. Thus, our forecast of GDP growth for 2023 is at 6%-7%, though this is biased towards the lower end of the range, as the aforementioned risks loom.

Still, it is hoped that in 2023, the story for the Philippines would be better than expected, like 2022 was.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her Bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano