Monthly Economic Update: Fed cuts incoming

DOWNLOAD

DOWNLOAD

Consensus Pricing – June 2025

DOWNLOAD

DOWNLOAD

Policy Rate Update: Dovish BSP Narrows IRD

DOWNLOAD

DOWNLOAD

TOP SEARCHES

TODAY’S REPORT

TODAY’S REPORT

The Gist

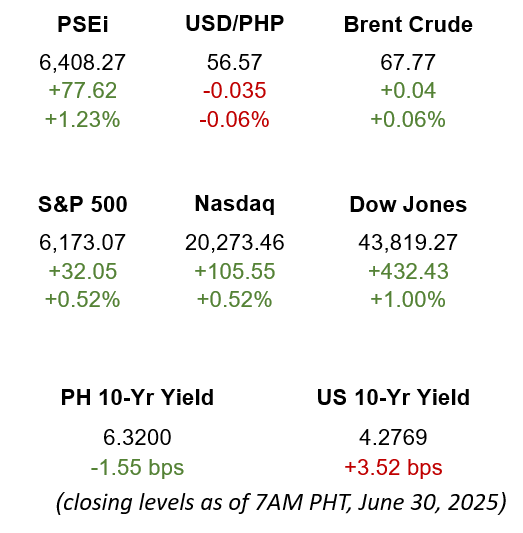

Your Morning Fix

- According to a BusinessWorld survey, June inflation in the Philippines likely rose slightly to 1.5% due to higher fuel costs, though stable food prices helped keep it below the central bank’s 2–4% target range.

- Business confidence in the Philippines dipped to 28.8% in the second quarter, as firms grew cautious over potential economic fallout from US tariff policies.

- Due to minor delays in selling state-owned assets, the Department of Finance drastically cut its 2025 privatization target by 95% to PHP 5 billion from PHP 101 billion.

- Senate Republicans advanced US President Donald Trump’s tax and spending bill, despite forecasts it could add USD 3.3 trillion of debt in about a decade.

- Global stocks hit record highs, as optimism over US-China trade talks and surging tech giants like Nvidia, Alphabet, and Amazon boosted markets, while the dollar hovered near a multi-year low.

The Gist

The Gist

EXCLUSIVE STORIES FROM METROBANK

EXCLUSIVE STORIES FROM METROBANK

Peso GS Weekly: Bonds firm on oil drop, Philippine auction clarity

Local bonds rallied last week, as easing geopolitical tensions and the Philippine government’s clearer Q3 borrowing path restored risk appetite.

By Metrobank Local Currency Trading Department and Janssen Roman June 30, 2025

Monthly Recap: Fed’s path, Philippines cuts outlooks

Here are the key economic events in June 2025 and what to look out for ahead.

By Metrobank Research June 30, 2025

Investment Ideas: June 30, 2025

Here are our latest picks and calls to help you create your ideal investment portfolio

By Metrobank June 30, 2025

Inflation Preview: Electric shock

Faster inflation in June is unlikely to be fanned by fuel prices.

By Marian Monette Florendo June 27, 2025

Investment Ideas: June 27, 2025

Here are our latest picks and calls to help you create your ideal investment portfolio

By Metrobank June 27, 2025

Investment Ideas: June 26, 2025

Here are our latest picks and calls to help you create your ideal investment portfolio

By Metrobank June 26, 2025

Money Sense

How can parents prepare financially for their children?

If you are a parent, you know having children can be a great source of happiness. If you want to secure a good future for them, here are some steps you can take right now.

Investing strategy shifts amid across-the-board tariffs

Our investment counselors outline their strategy, as Trump announces broad tariffs

Ask Your Advisor: Should I pull out of the US stock market?

When investors get anxious about turmoil in the markets, they seek sound advice and reassurance.

Should we talk about money before tying the knot?

Unless you want your marriage to be tied up in knots, you should be prepared to talk about money.

Beyond high returns: Why fund selection matters

The secret to outperformance in the Philippines is choosing the right strategy and the right fund to implement it.

7 tips to strengthen your relationship through joint financial planning

Learning how to work with your spouse concerning finances can help bring about a stronger, more satisfying relationship.

Explainer Articles

Explainer ArticlesWhat are sovereign bonds and how do they work?

Sovereign bonds can be a means for a government to secure funding from foreign investors to help fund its various projects and programs. Learn what they are here.

Key Points

- What are sovereign bonds?

- How do sovereign bonds work?

- Types of sovereign bonds

- How to buy sovereign bonds?

- Risks associated with sovereign bonds

- Is it a good idea to invest in sovereign bonds?

- Ready to invest in sovereign bonds?

Videos

VideosGet More Insights

Webinars

See All Webinars

2024 Mid-Year Economic Briefing: Navigating the Easing Cycle

In our most recent webinar, financial markets experts from Metrobank and our credits research partner CreditSights, discuss the possible effects on the investing environment amid an expected easing of inflationary pressures. June 21, 2024

Investing with Love: A Mother’s Guide to Putting Money to Work

In this webinar by First Metro Securities, you will learn about how a mother’s love can be related to investing. May 15, 2024

Investor Series: An Introduction to Estate Planning

In this webinar organized by the CFA Society Philippines, Wanda Beltran, Metrobank Head of the Accounts Management Division under the Trust Banking Group, shares some hard-earned lessons about poor estate planning and some tools and tips that can help people build an equitable legacy for their loved ones. September 1, 2023 Webinars

Webinars

Quarterly Economic Growth Release: 5.4% Q12025

Underwhelming growth to prompt more BSP rate cuts