Technical Analysis: Gold looking shiny again

Is gold a good investment? Geopolitical uncertainties have shaken the value of gold, but our analysis shows there are emerging opportunities for it to rise again.

Conquistadors, pirates, and the Vikings looted it. Relics made of this yellow metal can be found all over the world. The royals adorned themselves with it. Gold represents wealth, power, and beauty.

What about in the 21st century? Is gold still a good investment?

Today, we are told gold has two primary uses, namely, as an inflation hedge and a precious metal (store of value). Overall, investing in jewelry provides stability, and gold is top tier when classifying safe haven assets. It retains or even increases in value during geopolitical and economic uncertainties.

Since 2011, gold has been stuck in a long-term consolidation range of USD 1,000 to USD 2,100, failing to create new significant highs, prompting doubts on the growth in value of the asset. Gold as an inflation hedge has not done well in the modern era given its inverse relationship to the US dollar. When inflation rises, the US Fed raises rates, triggering dollar strength and causing gold to fall.

The high interest rates environment and a “higher for longer” Fed pause implies that the downside of gold may be capped with greater upside. Current economic conditions of sticky inflation could potentially generate negative real rate of returns, while ongoing geopolitical conflicts and tensions increase the demand for tangible or physical assets.

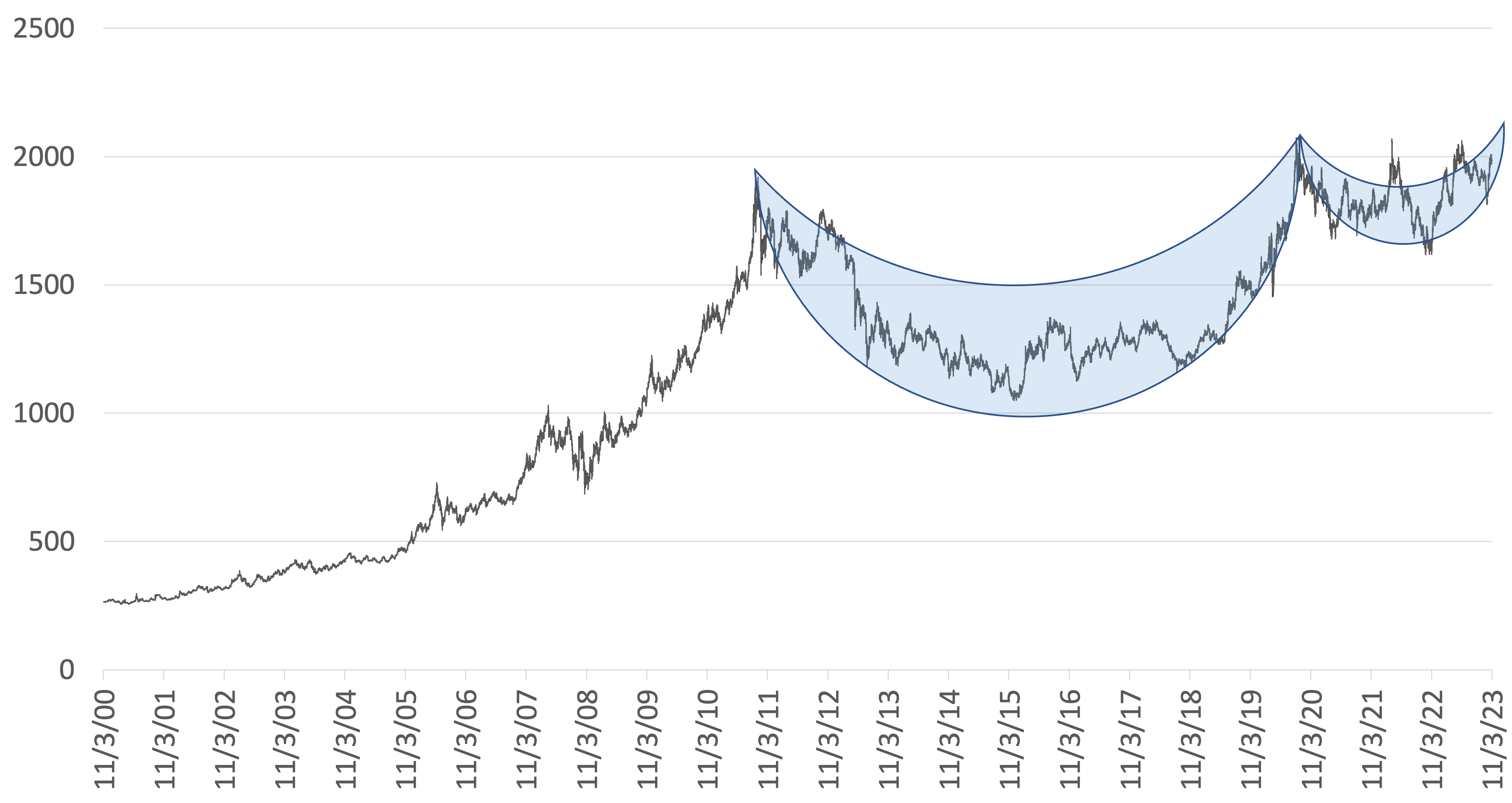

Long-term movement of gold

A. From 2011 to 2020, a U-pattern can be identified, creating a rounded bottom.

B. From 2020 to 2023, a U-pattern can be identified, creating another rounded bottom. A & B seen together form a higher low, called a “cup-and-handle”. The cup-and-handle is a bullish pattern that emerges following a prolonged downtrend and consolidation.

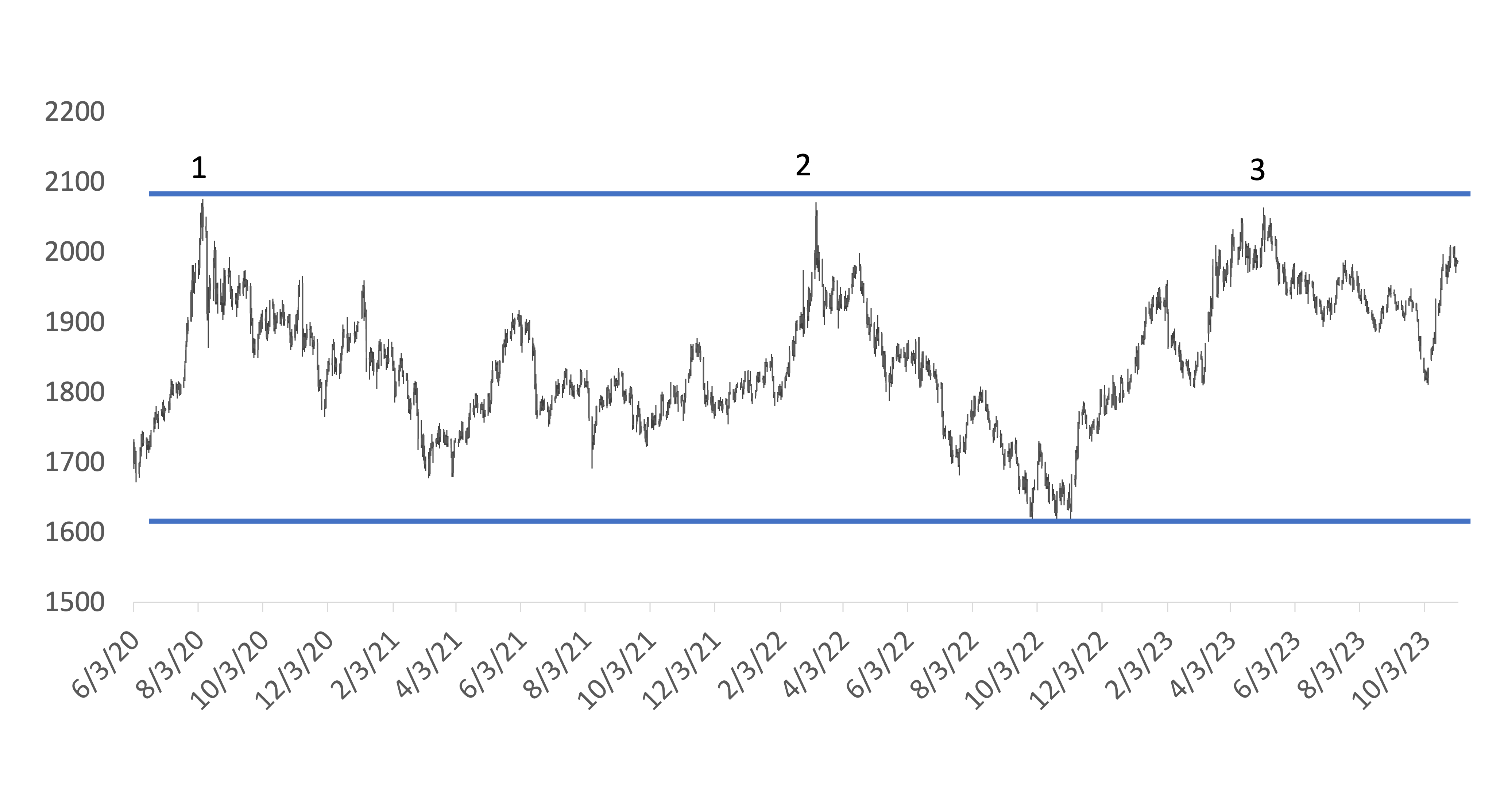

Medium-term movement of gold

The second rounded bottom (B), which was formed after the COVID pandemic, has created a higher consolidating range of USD 1,600 to USD 2,100. The long consolidation (point 1, 2, and 3) implies that the long-term bullish pattern remains intact and is just taking a breather.

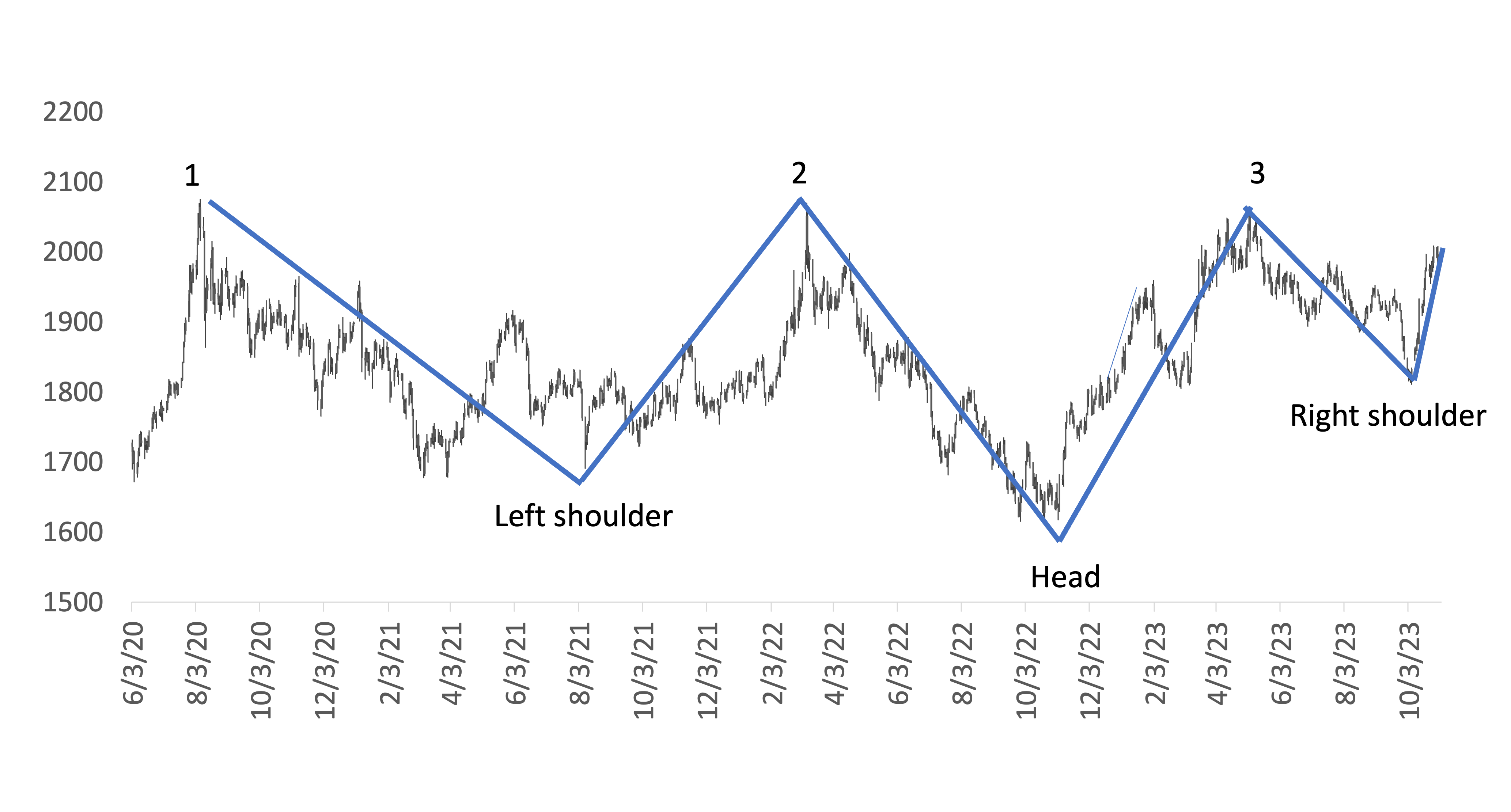

Some may argue that the long consolidation may be a bottoming formation called an inverted head and shoulders (H&S) pattern. The inverted H&S implies a potential target of USD 2,500 if the price breaks above the USD 2,100 long-term resistance.

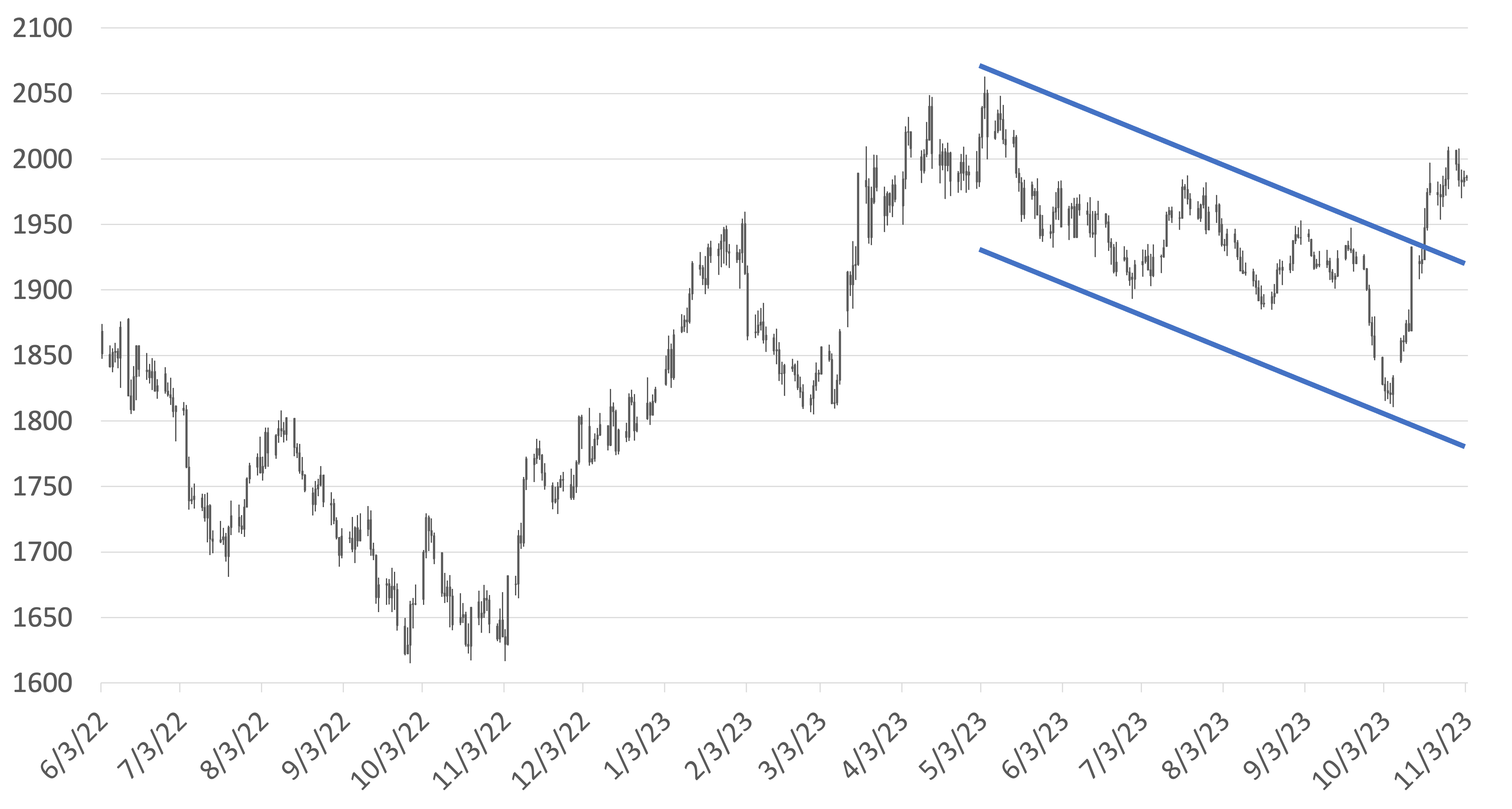

Short-term movement of gold

In May, gold has bounced off the third resistance point and dropped from USD 2,100 to USD 1,800 due to the strong rise in yields. However, the sudden attack of Hamas on Israel risks dragging neighboring countries and allies into a bigger conflict, triggering gold to run up to USD 2,000.

So far, the short-term run-up looks to be extended and due for correction. The technical entry for the commodity would emerge between USD 1,950 to USD 1,900.

Downside to gold

Gold will do well in the “higher for longer” stance of the US Fed, as markets prepare for the rate pivot. The landmine for the asset would be a hard recession, wherein investors run to liquidity (US dollars), dropping gold and other risk assets.

A hard recession would imply that the sticky inflation problem of the Fed would quickly turn into disinflation, and rates would need to be cut. After a liquidity crisis owing to a recession, gold will likely begin to rise once again.

This seems to be the trend for silver, making it a good investment as well.

Takeaway: Should I invest in gold?

The world has entered trying times. Prices keep rising. Debt-to-GDP ratios are reaching war-time levels. De-globalization has become an emerging trend, with conflicts and geopolitical tensions growing between the superpowers. Given modern society’s path, holding gold may be prudent as new uncertainties slowly emerge.

KYLE TAN is an Investment Officer at Metrobank’s Trust Banking Group, managing the bank’s offshore Unit Investment Trust Funds (UITF). He holds a Master’s degree in Financial Engineering from the De La Salle University and is a Level 2 passer of the Chartered Market Technician (CMT) certification course. He spends his free time working out, training at the gun range, or hunting for rare Star Wars collectibles.

DOWNLOAD

DOWNLOAD

By Kyle Tan

By Kyle Tan