Why the BSP isn’t likely to match the US Fed

Will the BSP take cues from the Fed’s decisions, or will it take a different direction?

Last month, the US Federal Reserve hiked its policy rate by 25 basis points (bps) to 5.00-5.25% while the Bangko Sentral ng Pilipinas (BSP) paused at 6.25%.

The question on everyone’s mind is what are both central banks planning to do next June? The Fed is set to have its Federal Open Market Committee (FOMC) meeting on June 14 followed by the BSP’s monetary board meeting on June 22. We think that BSP, seeing some positive movement in the economy, may move independently with regard to their decision. Here are the reasons why:

1. The Fed faces stickier US inflation while the BSP already anticipates a downward trend back to target for the PH.

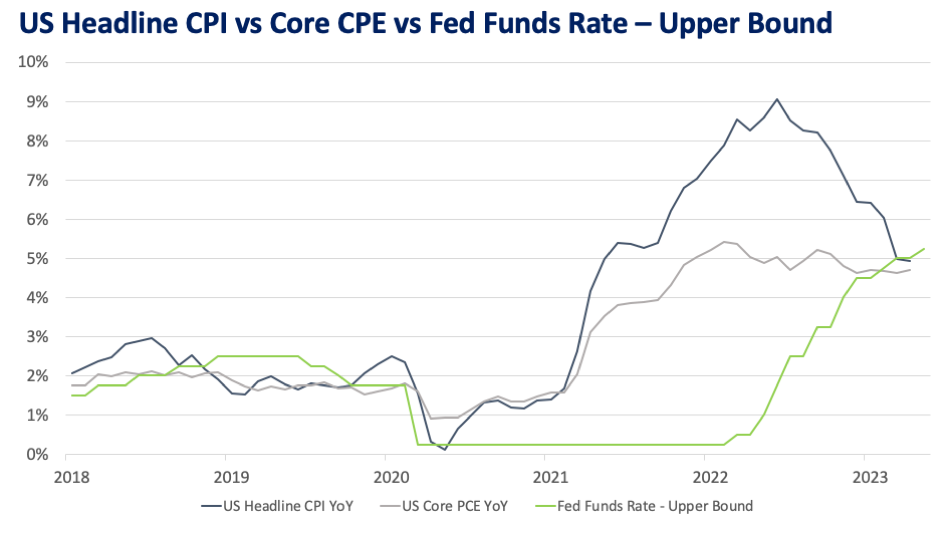

The previous Fed minutes of the meeting show that officials are split on whether to hike or pause in future policy rate meetings. Hawkish officials believe that inflation is still elevated. Despite printing lower than expected, the US Consumer Price Index (CPI) only slowed down to 4.9% year-on-year in April from 5% in March. The Core Personal Consumption Expenditure (PCE), which excludes volatile food and energy prices, also came out higher at 4.7% year-on-year in April vs. 4.6% forecast.

The US headline CPI experienced a slowdown in April this year while the PCI had a 4.7% growth

Fed officials who support a rate pause cite the lagged effect of interest rates on an economy. The housing and manufacturing sectors in particular are already starting to feel the pressure of higher borrowing costs. The recent May 2023 Non-Farm Payrolls (NFP) report also showed that despite an increase in 339,000 new jobs, unemployment increased from 3.4% to 3.7%, and average hourly earnings decelerated from 4.4% year-on-year to 4.3%.

Tightening too much could potentially push the US economy closer to recession. A few officials have even touted the possibility of a “Fed skip” which will allow the central bank to continue monitoring economic data before considering another rate hike in July.

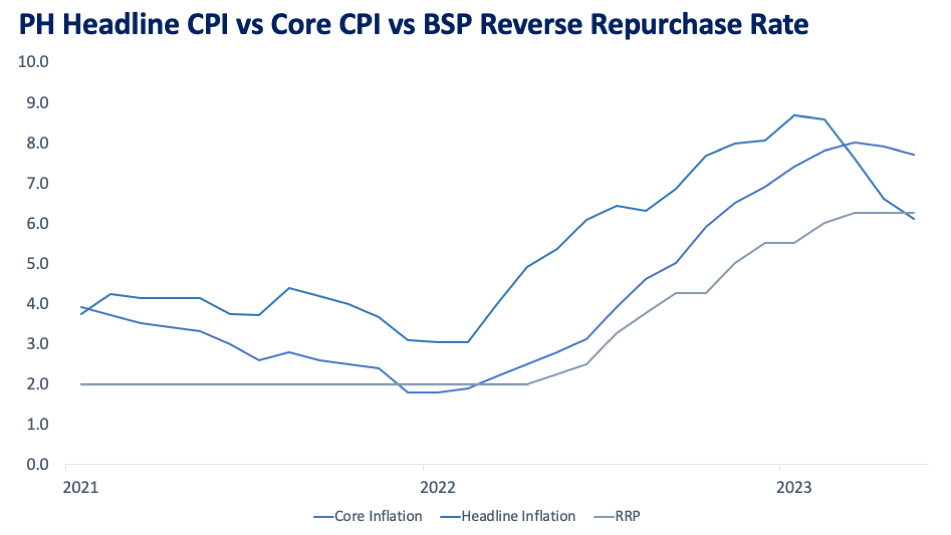

Meanwhile, the Philippine Headline CPI for May came down as expected to 6.1% year-on-year from April 6.6% as reduced transport costs, as well as normalization in oil and food supply, resulted in lower prices. Core CPI which also excludes the aforementioned oil and food prices is 7.7% from April 7.9%, still due to second-round effects causing businesses to keep their prices high but this already seems to be easing. This is expected to ease further as higher borrowing costs impact on consumer demand.

The Philippine headline CPI was at 6.1% due to lower commercial product prices.

Whichever path the Fed decides to take, we maintain our view that the BSP will not be pressured by an additional Fed rate hike and will instead continue its pause. After its last meeting, the BSP mentioned that its policy rate will remain unchanged in the next two to three meetings as it expects inflation to fall within its target band of 2% to 4% by the third quarter of 2023. As long as there are no more supply shocks that may cause inflation to spike, there is more room for the BSP to pause in the next few months.

2. It’s not just the IRD.

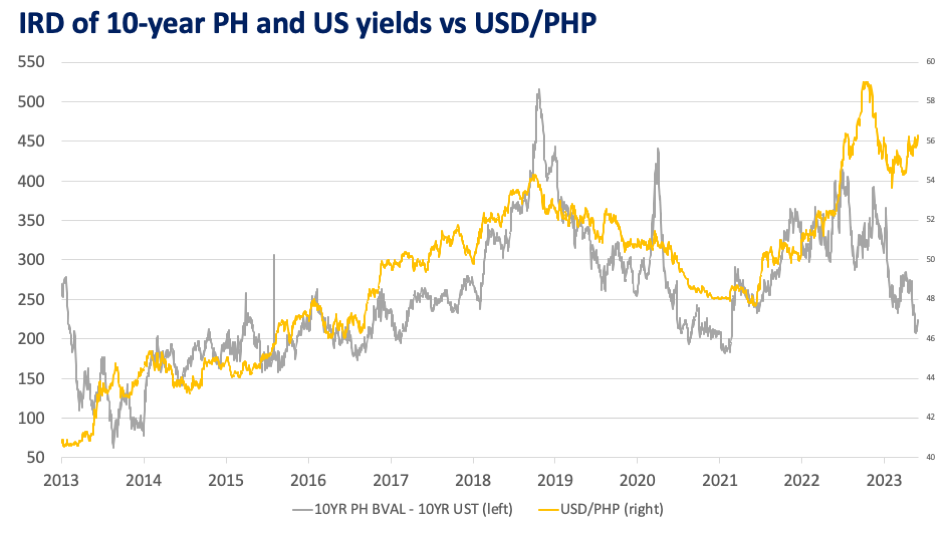

The BSP also looks at how its policy rate affects foreign exchange rate trends in addition to managing inflation. A wide interest rate differential (IRD) between the Philippine peso and the US dollar normally incentivizes foreign portfolio investors to place in higher-yielding peso investments.

Over the last ten years, the IRD between the two currencies averaged 200 bps but it has since then tightened to 100 bps. Local markets are concerned that an even tighter interest rate differential will result in hot money flowing back to the relatively more stable US dollar, thereby causing the peso to weaken.

However, we observed that the USD/PHP rate is not solely influenced by central bank policy rates. The exchange rate is also negatively correlated with the IRD between 10-year peso government securities and US treasury bonds and the level of the Philippines’ Gross International Reserves (GIR).

When comparing 10-year Philippine and US yields, the IRD between the two currencies has remained well above 200 bps and much closer to its 10-year historical average of around 250 bps. The yield premium helps attract foreign portfolio investors to long-term peso government securities which tempers the USD/PHP, especially now that both the BSP and Fed are at or near the end of their tightening cycles. Investors want to lock in yields on long-term bonds before the central banks start cutting their policy rates when inflation normalizes.

The interest rate differential in PHP/USD has recently tightened to 100 bps.

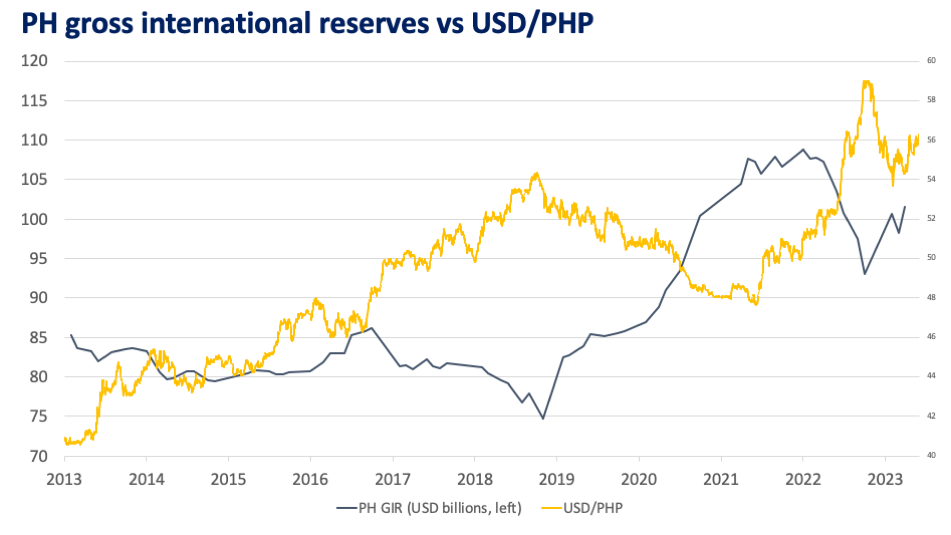

On the other hand, GIR which represents all of the Philippines’ foreign currency reserves generated from the government’s overseas investments, export proceeds, and remittances from Overseas Filipino Workers (OFWs), affects USD/PHP movement as higher levels of it put BSP in an optimal position to intervene in the currency exchange market.

In 2022, it is estimated that the BSP sold USD 3 billion in open market operations in order to protect the USD/PHP from breaching key resistances, including the all-time high of 59.00. Even with USD/PHP once again above 56.00, it seems like this is still an exchange rate level that the BSP is willing to tolerate. Moreover, the GIR level remains strong at USD 101.76 billion as of April 2023, enough to support the peso and manage volatilities (read more about GIR here).

The Philippine GIR is strong enough to manage volatilities.

Even if the IRD between the policy rates of the BSP and Fed were to tighten to 75 bps, we believe that the USD/PHP will not test the record highs set in 2022 because last year’s substantial peso depreciation was driven by a strong US dollar on the back of a hawkish US Federal Reserve monetary policy stemming from soaring US inflation.

3. Easing pressure on the exchange rate.

The wider IRD in long-term peso and dollar bonds will continue to attract local and foreign investors to higher-yielding peso government securities. Moreover, the BSP has the capacity to intervene not through monetary policy alone as there are other operational avenues where it can influence market movements, just like how it intervened in the foreign exchange market in 2022 to support the peso. Philippine GIR is also returning to its previous levels and the BSP has more dollars to work with in the event of sudden peso depreciation.

Banks and economists alike have also forecasted the USD/PHP to reach the 56-level this second quarter on rising import demand and this looks to be a level that BSP is also comfortable with. With the exchange rate pressure of the previous year seemingly behind it, the BSP may pause its tightening cycle and let its policy rate work its way through the economy to stamp out elevated inflation.

EARL ANDREW “EA” AGUIRRE is a Market Strategist at Metrobank’s Financial Markets Sector and has 10 years of experience in foreign exchange, fixed income securities, and derivatives sales. INA CALABIO and ANNA ISABELLE “BEA” LEJANO are Research & Business Analytics Officers at Metrobank. Ina is in charge of the bank’s research on industries, while Lejano is in charge of the bank’s research on the macroeconomy and the banking industry.

DOWNLOAD

DOWNLOAD

By EA Aguirre, Ina Calabio, and Anna Isabelle “Bea” Lejano

By EA Aguirre, Ina Calabio, and Anna Isabelle “Bea” Lejano