Saving adequate reserves for the rainy days

Despite the decline in the country’s GIR, or Gross International Reserves, it remains in good shape as the BSP has built up higher buffers over the years for times like these.

Foreign currency reserves have been falling at the fastest pace globally since 2003, according to Bloomberg, a provider of financial news and analytics software.

These are assets held by central banks to back liabilities and which help manage external shocks that impact on their currencies (e.g., preventing their respective currencies from rapidly devaluing or depreciating). And central banks have been intervening to lend support to their currencies.

Bloomberg data show that reserves have declined by about USD 1 trillion, which is partly attributed to devaluation changes as the dollar continues to strengthen, posing an impact on various currencies globally.

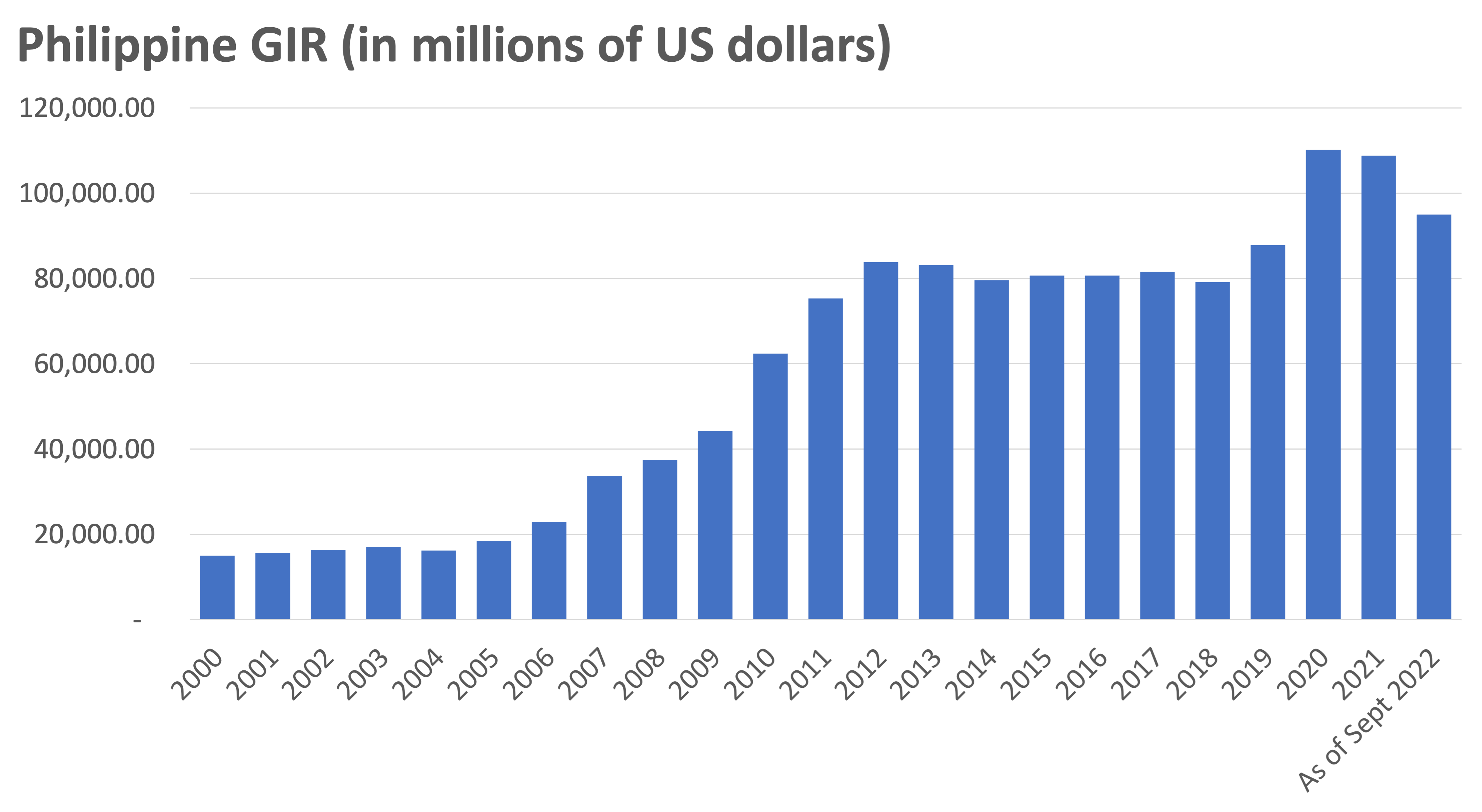

For the Philippines, the GIR is likewise in decline, currently for the 7th consecutive month, posting USD 95 billion by the end of September 2022 (BSP preliminary data). The decline is attributed mainly to the country’s payments of its foreign currency debt obligations and an adjustment in the value of gold holdings as the price of gold fell in the international market.

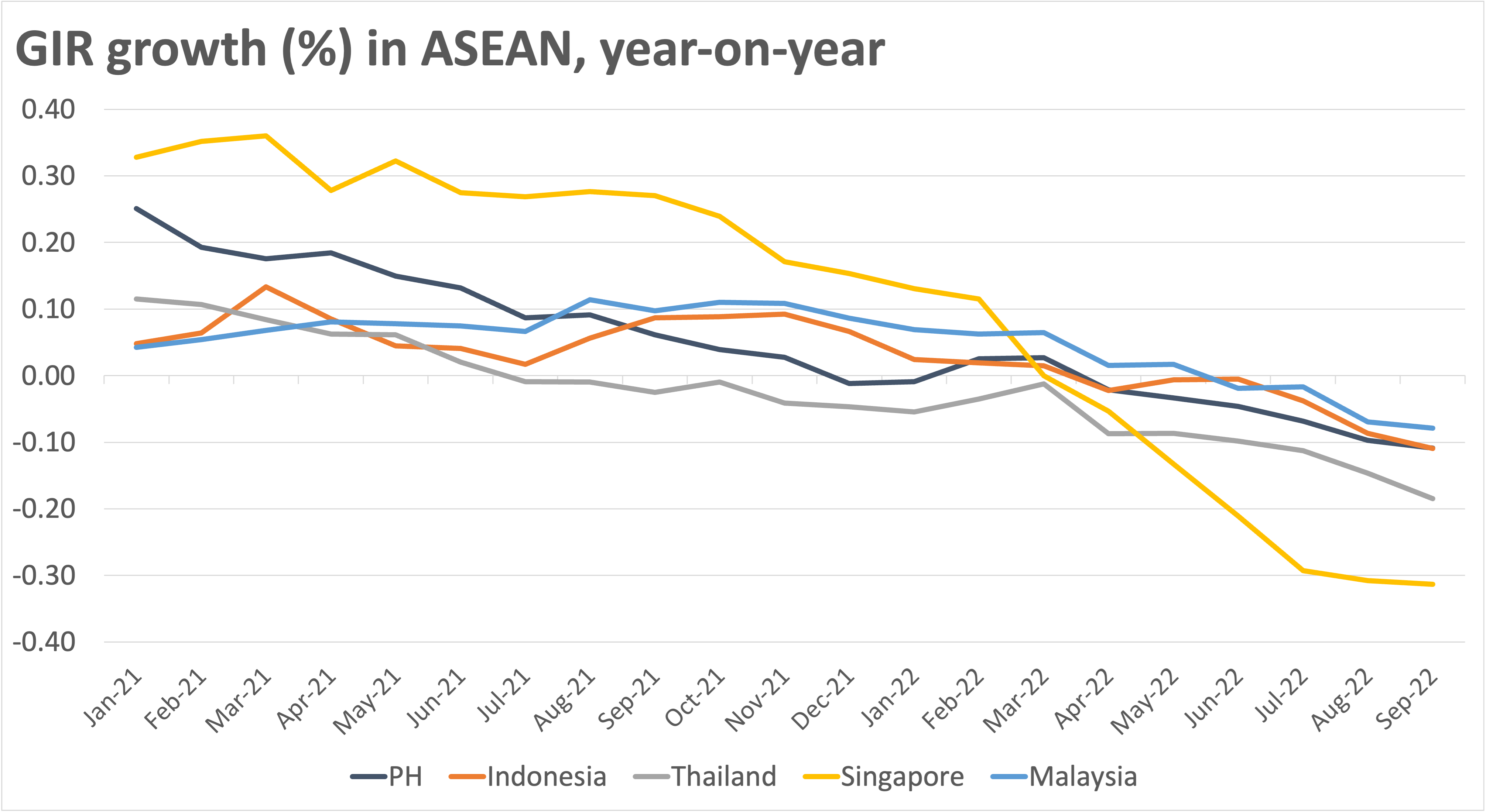

Some ASEAN economies (see table below) are in a similar situation. Their foreign currency reserves went down rapidly, owing to increased imports, foreign debt payments, and foreign exchange interventions to defend their currencies, among others.

In Thailand, for instance, the accelerated depletion of reserves was due to its increased imports of oil to store ahead of winter. For Indonesia, the recent fall in its foreign reserves was likewise due to its foreign debt payments and its central bank’s intervention to stabilize its currency.

A host of factors have forced central banks of ASEAN countries to use up their GIR.

Managing volatility, balance of payments

The BSP holds international reserves to support the foreign exchange requirements of the country when the supply of foreign exchange from commercial banks is limited to meet demand, thereby managing volatility in the exchange rate. It also serves as a stand-by fund to finance any deficit in the country’s balance of payments (BOP).

Thus, whenever the BOP deficit widens and needs financing from the reserves, the level of reserves is consequently reduced. Alternatively, when there are surpluses arising from the net inflow of foreign exchange in the country’s external transactions, the level of international reserves builds up.

For instance, a surplus from BSP’s purchases of foreign exchange from its FX operations, higher income from its foreign investments, and an increase in the net foreign currency deposits of the national government all increase the country’s foreign reserves.

In the same manner, the country was able to significantly shore up its reserves in the past years, hitting all-time-high levels during the pandemic. This can be attributed to gains from the BSP’s foreign exchange operations, income from foreign investments, foreign currency deposits of the national government with the central bank, and additional allocation of Special Drawing Rights (the international reserve asset created by the IMF to support its member countries), given the IMF’s efforts to boost global liquidity amid the pandemic.

Now that the country is faced with external volatility, it has tapped into this buffer.

The Philippines’ GIR levels (in millions of US dollars) are still substantial compared to pre-pandemic levels.

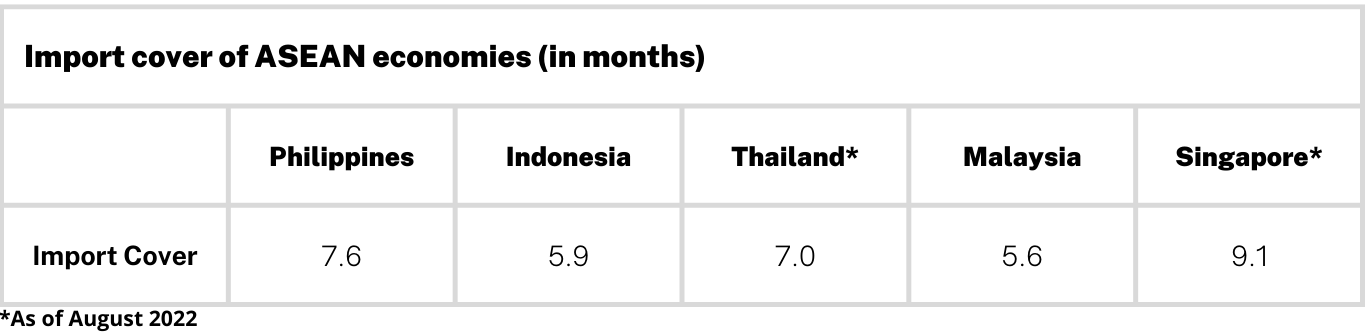

The traditional gauge of the GIR’s adequacy is if it can finance at least three months’ worth of the country’s imports of goods and payments of services and primary income. Thus, while the country’s GIR faced another dip recently, it is still more than adequate to cover 7.6 months’ worth of imports of goods and payments of services and primary income.

Compared to its neighbors, Indonesia and Malaysia, the Philippines is in better shape.

With all the market volatility right now, the wisdom of having substantial foreign currency reserves has become more apparent.

INA CALABIO is a Research & Business Analytics Officer at Metrobank in charge of the bank’s research on industries. She loves OPM and you’ll occasionally find her in the front row at the gigs of her favorite bands.

DOWNLOAD

DOWNLOAD

By Ina Calabio

By Ina Calabio