Technical Analysis: Charting uncertainty in the second quarter of 2025

Rising economic policy uncertainty in 2Q 2025 drives investors to seek safe assets like gold and U.S. Treasuries as equities face pressure amid growth concerns.

Panic swept across global markets after the United States rolled out a wave of sweeping tariffs against its trading partners on April 2. Branded as “Liberation Day,” marking what supporters and officials call toward economic independence, but is also a stark provocation to some of its long-time allies.

Tariff wars, which could prompt systematic and economic shocks, have pushed the S&P500 to fall into bear market territory (20% decline from its peak) before slightly recovering. Odds of a global recession increase the longer trade disputes remain unresolved or unnegotiated.

Looking at how different asset classes behave can provide insights to the economy’s trajectory, allowing investors to cushion any adverse impact.

Source: Bloomberg, Metrobank’s Trust Banking Group

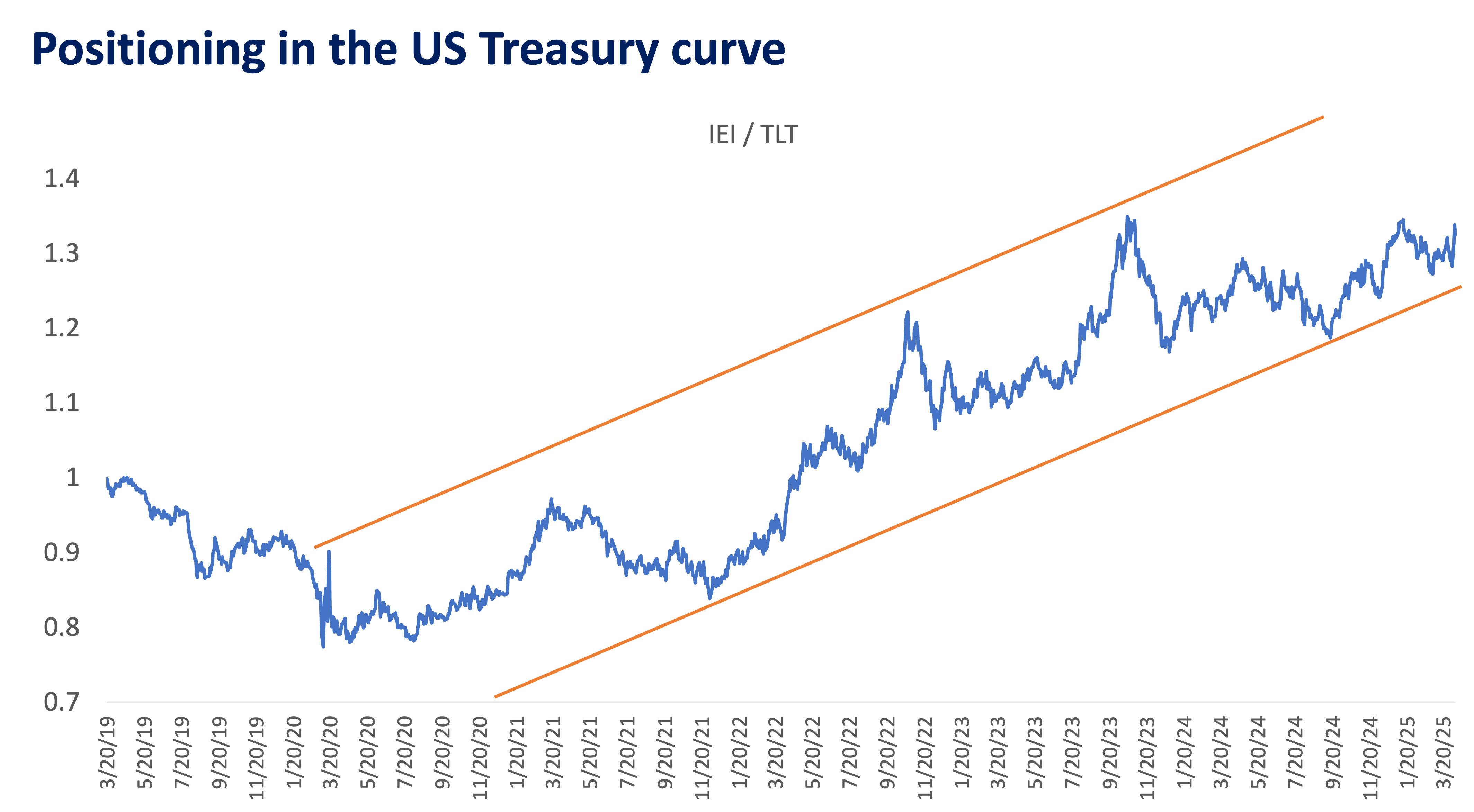

The big question now is if the recession fears are valid? Quick answer, maybe or maybe not yet. Recession would prompt investors to flock into safe-haven U.S. Treasuries specifically, in the long-end under expectation that yields will fall due slowing growth. The graph above depicts the relative performance of IEI ETF (US 3-7Yr Treasury Bond) versus the TLT ETF (US 20Yr Treasury Bond). A rising line indicates IEI outperformance and TLT underperformance.

This has been the base case trend under the soft-landing scenario. Since the line remains in a solid uptrend, recession appears unlikely to be the base case and the belly bonds continue to provide better risk-return for now. The story can change if this uptrend breaks.

Source: Bloomberg, Metrobank’s Trust Banking Group

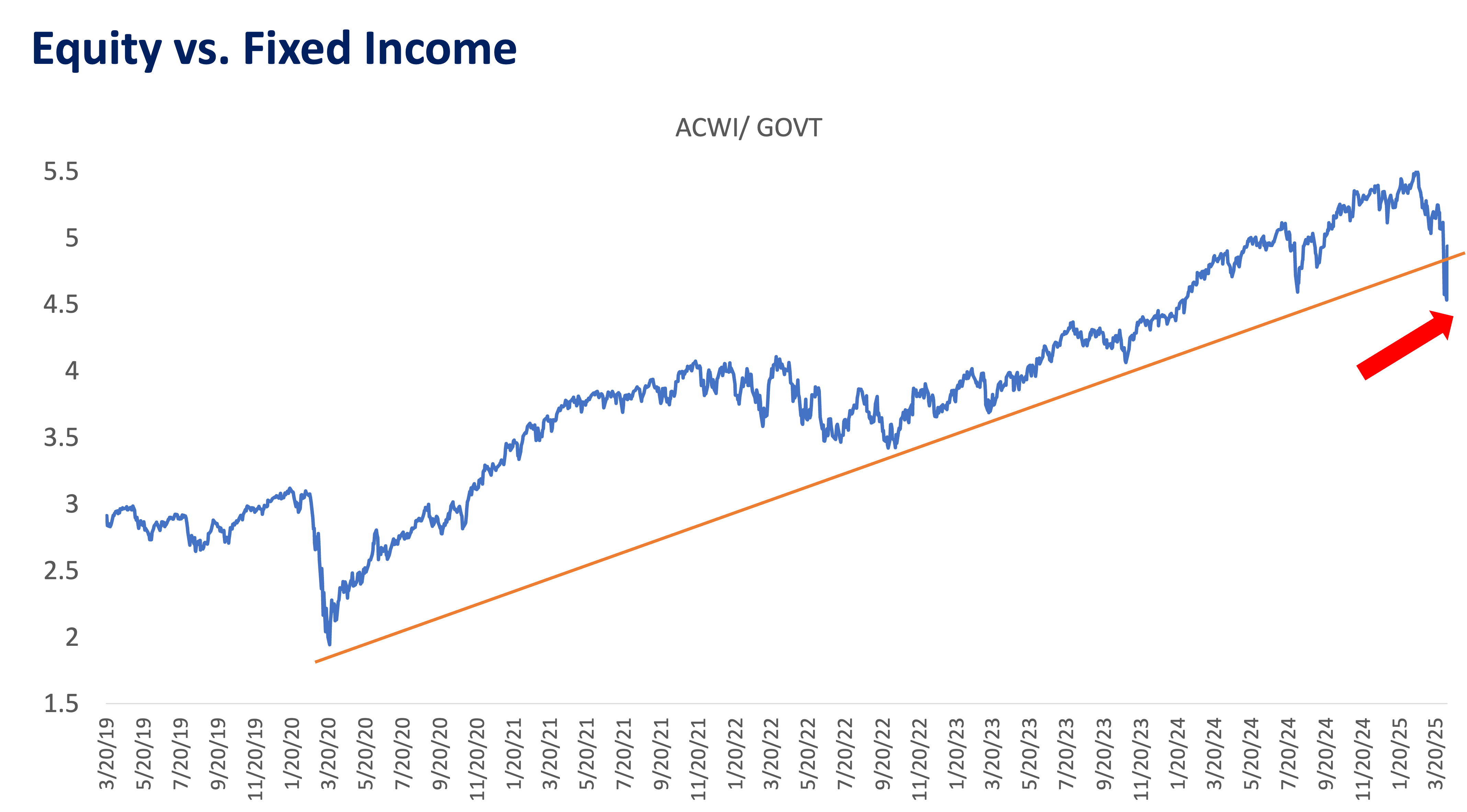

The graph above depicts the relative performance of ACWI ETF (Equity: All Country World Index) versus the GOVT ETF (Fixed Income: US 1 to 30Yr Treasury Bonds). A rising line indicates ACWI outperformance and GOVT underperformance.

As can be seen, the uptrend that started from the pandemic low has been broken, signaling a shift away from equities toward fixed income. Falling equity prices are a leading indicator of moderating growth.

Source: Bloomberg, Metrobank’s Trust Banking Group

The graph above depicts the relative performance of GLD ETF (Gold) versus the ACWI ETF (Equity: All Country World Index). A rising line indicates gold outperformance and ACWI underperformance.

Gold versus ACWI has now reached the highest relative resistance level since the Covid-19 pandemic. A breakout from this area of resistance would suggest greater economic uncertainty ahead. Gold, a safe haven asset, does particularly well when there is economic uncertainty and geopolitical tensions.

Managing uncertainty

During volatile periods, the Metro$ Money Market Fund and Metro$ Short Term Bond Fund offer protection and liquidity, allowing investors to stay flexible and capitalize on market shifts.

Take-away

- The studies above suggest tariff disputes may slow growth and disrupt supply chains resulting in sticky or rising inflation in the longer term.

- Until growth concerns materialize, US Treasuries in the 3 to 7 Yr provide better risk-return versus long duration bonds.

- Global equities did very well in 2023 and 2024, shifting to fixed income should reduce portfolio volatility given the escalating risks.

- Outperformance of gold is a leading indicator to increasing risk and a cycle reset.

- Shifting to the right asset during a transitioning risk regime will allow investors to compound returns at a faster rate as cycles shift.

(Disclaimer: This is general investment information only and does not constitute an offer or guarantee, with all investment decisions made at your own risk. The bank takes no responsibility for any potential losses. UITFs are governed by BSP regulations but are not deposit products, hence are not covered by the PDIC. Being an investment product, there is no guaranty on the principal and income of the investments.)

KYLE TAN, MSFE, CMT, CFTe, CSS is a Portfolio Manager at Metrobank’s Trust Banking Group, managing the bank’s global Unit Investment Trust Funds (UITF). He holds a Master’s degree in Financial Engineering from the De La Salle University, a Chartered Market Technician, a Certified Financial Technician (CFTe), a PSE Certified Securities Specialist (CSS). He spends his free time working out, training at the gun range, or hunting for rare Star Wars collectibles.

DOWNLOAD

DOWNLOAD

By Kyle Tan

By Kyle Tan