US dodges default. What’s next?

Now that a default crisis in the US has been averted, we look at how this resolution could move short-term US yields in the near term, and the opportunities that await investors.

Read this content. Log in or sign up.

If you are an investor with us, log in first to your Metrobank Wealth Manager account.

If you are not yet a client, we can help you by clicking the SIGN UP button.

After months of soured risk sentiment due to heightened uncertainty surrounding the recent debt ceiling impasse, investors now cheer the Senate approval of a deal that will steer the US away from another grave risk of default until January 2025.

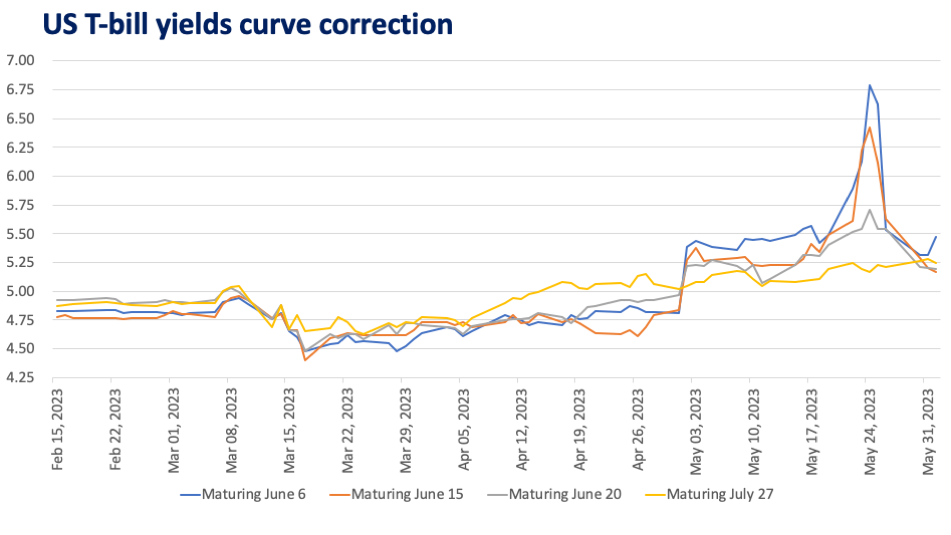

At the height of the political gridlock, the yield on the US T-bill maturing on June 6 peaked at 6.79%–much higher than the later-dated bill maturing on July 27, which hovered at 5.17% on the same day. This is as investors grew reluctant to hold bills dated near the June 5 deadline, lest the US fail to come to an agreement on time.

Since the bipartisan deal passed the US House of Representatives, the pricing distortion in the US T-bill yield curve corrected (Chart 1).

Now that the hardest hurdle is over, our regular investors ask: Do we expect an

Read More Articles About:

DOWNLOAD

DOWNLOAD

By Patty Membrebe and Geraldine Wambangco

By Patty Membrebe and Geraldine Wambangco