Unraveling the debt ceiling drama: What to do with your bond portfolio?

The continuing impasse in debt ceiling talks puts pressure on high-yield bonds, potentially leading investors to demand higher yields for higher-risk bonds. However, a barbell strategy for investment-grade bonds, especially those with higher ratings, looks promising.

In our previous article, the possible consequences of the US debt ceiling drama to the global economy, as well as to the Philippines, were laid out.

With about a week away from the reported x-date, or the date by which the US would be in default of its obligations, it should be interesting to see how the investment-grade (IG) and high-yield (HY) markets performed before and after a similar debt ceiling drama in the past.

An attempt will be made in this article with the help of Metrobank’s research partner, CreditSights, who published a report titled US Strategy: Debt Ceiling Defense on May 9, 2023. This may aid you in making decisions about your bond portfolio.

But let’s talk about bond spreads first. Bond spreads represent the difference in yields between riskier bonds, like HY or IG bonds, and safer investments, like US Treasuries. Spread widening occurs during periods of market uncertainty or economic distress, when investors demand higher yields for riskier bonds, resulting in wider spreads.

Revisiting 2011

It might be worthwhile to take a little trip down memory lane to 2011 when a similar debt ceiling drama occurred, reminiscent of the current situation. Back then, the US Congress postponed raising the debt ceiling until the last minute, leading to a not-so-pleasant consequence: a credit rating downgrade by S&P.

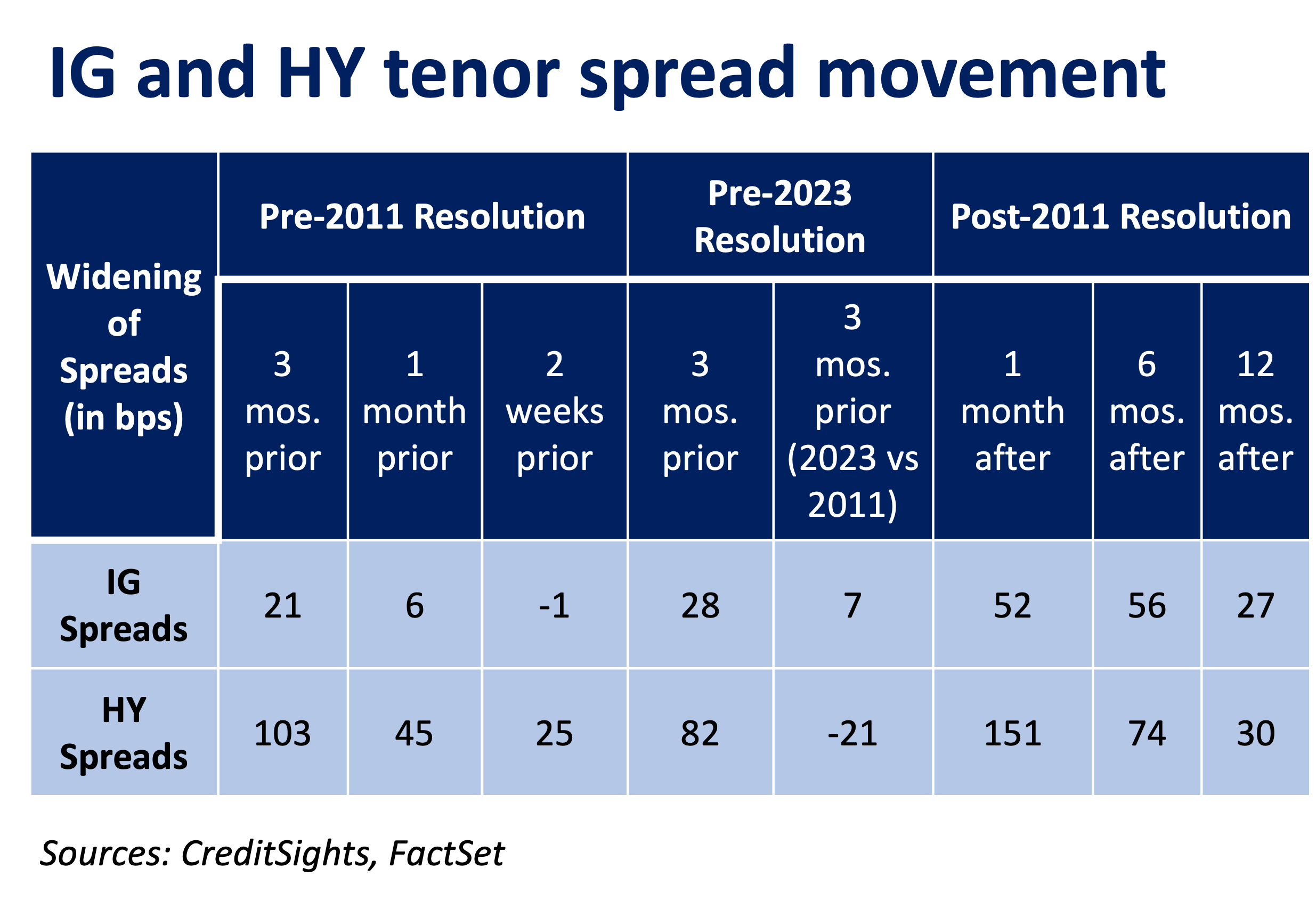

In the buildup to the 2011 debt ceiling deadline, the spreads for IG bonds initially widened three months before the x-date. However, as the deadline drew near, the pace of widening took a breather, gradually tightening up instead. (See table below.)

CreditSights found that IG spreads performed slightly worse in the past three months ending the 2nd week of May 2023, increasing by 28 basis points (bps) as against only 21 bps back in 2011.

This was primarily driven by lower-rated bonds, namely those rated A and BBB, due to concerns about the banking system and a potential recession this year, as opposed to 2011 when spreads for higher-rated bonds, such as AA, were affected the most.

In both instances, long-term IG bonds showed relative resilience compared to short-term and medium-term bonds.

In the high-yield market, spreads have also widened by 82 bps in the past three months ending the 2nd week of May, but less than the 103 bps in 2011. The recent widening has been more apparent in short-term bonds.

Among different credit ratings, lower-rated CCC bonds performed worse both in 2011 and recently. However, the performance of higher-rated bonds such as B and BB was relatively better than in 2011.

2023 debt ceiling crunch

With the deadline fast approaching, there’s a big possibility that negotiations on the debt ceiling might again stretch until the last minute. In such a scenario, there’s a chance for HY bond spreads, especially for lower-rated CCC bonds, to widen further.

This could have an impact on HY bonds across various tenors. However, it’s worth noting that IG bond spreads, particularly for higher-rated bonds, may fare relatively better in comparison. CreditSights said there is a possibility that IG spreads could demonstrate stronger performance amid a wider risk-off sentiment.

In the current IG market landscape, there’s an interesting phenomenon known as a flat yield curve. This means that the interest rates for short- and long-term IG bonds are pretty similar, like they’re on the same playing field. This situation opens up a potential opportunity for investors who want to shield themselves from volatility.

CreditSights said, given the current situation of flat yield curves and increased pressure on short-term spreads, it is advisable to be cautiously optimistic about shorter-term IG maturities compared to mid-term ones.

The credit research firm also suggested that investors seeking protection from debt ceiling volatility may find a barbell strategy beneficial. That means focusing on the two extreme ends of the maturities of IG bonds to strike a balance between higher yielding long-term bonds and the more flexible and liquid short-term bonds.

However, no two debt ceiling dramas are alike. The current economic landscape and market dynamics differ from those of 2011. It’s quite tricky to predict how the debt ceiling crisis will affect the market and the economy.

At the end of the day, you must still pay close attention to how the debt ceiling discussions go. You may also consult your investment advisor to craft a strategy that suits your needs.

ANNA ISABELLE “BEA” LEJANO is a Research & Business Analytics Officer at Metrobank, in charge of the bank’s research on the macroeconomy and the banking industry. She obtained her bachelor’s degree in Business Economics from the University of the Philippines School of Economics and is currently taking up her Master’s in Economics degree at the Ateneo de Manila University. She cannot function without coffee.

DOWNLOAD

DOWNLOAD

By Anna Isabelle “Bea” Lejano

By Anna Isabelle “Bea” Lejano