The Sweet and Salty Pair: Assessing the impact of proposed junk food taxes

The government’s junk food tax proposal, coupled with increased charges on sweetened beverages, could drive prices even higher.

A bag of chips and a can of soda are staples to a delightful movie night, and they are versatile pick-me-ups for any time of the day. However, the freedom to enjoy these snacks may be hampered, as the national government plans on boosting revenues through its targeted approach on junk food and sweetened beverages.

A proposal to implement taxes on junk food and sweetened beverages was recently proposed, with a goal to promote and improve overall public health by discouraging unhealthy food consumption.

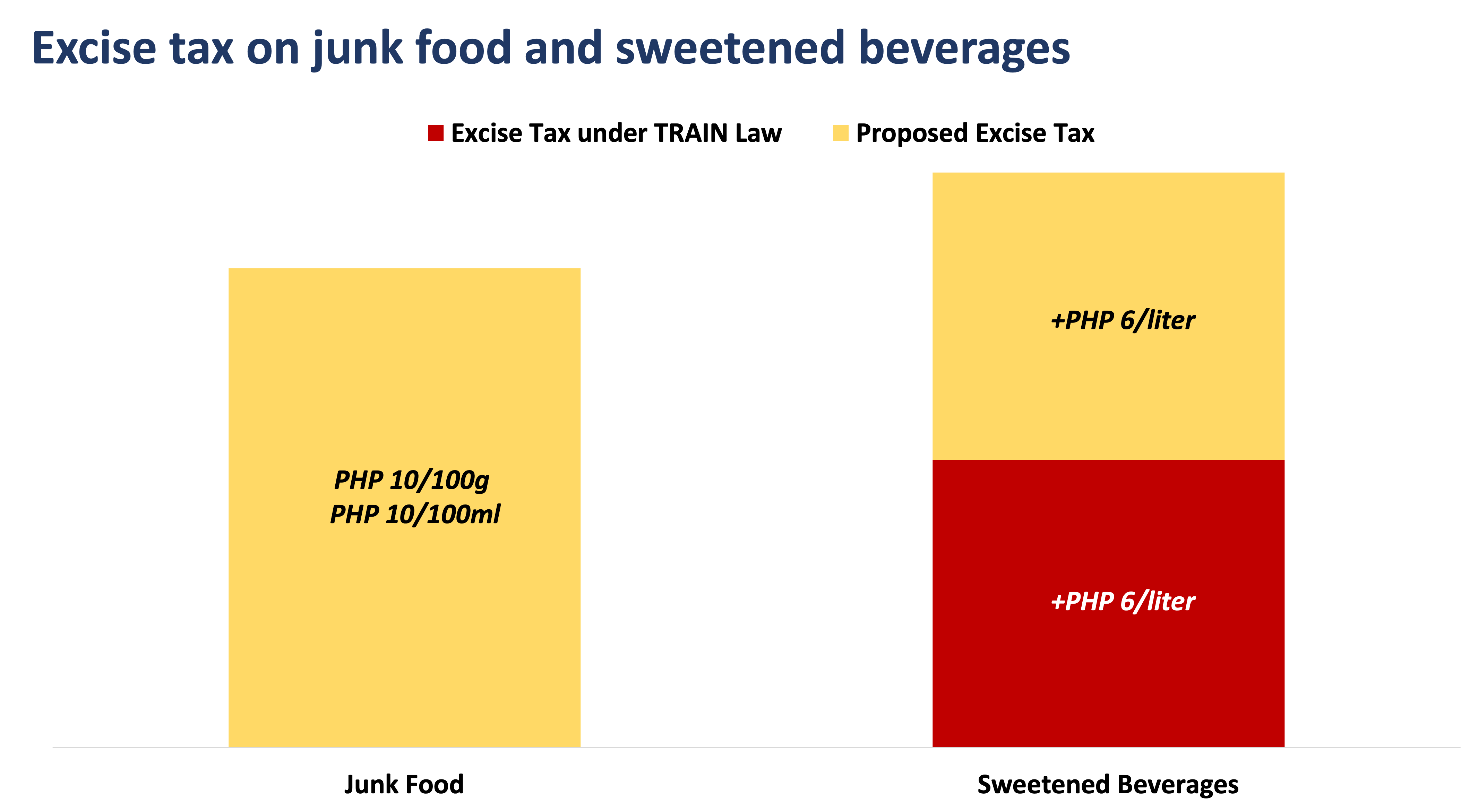

Under the said proposal, the government plans to levy a tax of PHP 10 per 100g or PHP 10 per 100mL on pre-packaged food that exceeds the Department of Health’s specified thresholds for fat, salt, and sugar content.

Instant noodles, however, are to be exempted from the said tax as it is considered as a Filipino household staple. Additionally, the tax on sweetened beverages will be increased to PHP 12 per liter, with most of the previous exceptions to be removed.

Hence, the proposed increase in the taxes of sweetened beverages includes all drinks with any kind of sweetener used (i.e., caloric, non-caloric, high fructose corn syrup, coconut sap sugar), not exempting milk and coffee mixes.

Department of Finance (DOF) Secretary Benjamin Diokno estimated that these taxes could generate up to PHP 76 billion in revenues and reduce junk food consumption by 21%.

Once approved, the junk food tax would stand as a unique measure in Asia, with no similar counterpart. The sweetened beverage tax would be regarded as one of the highest in the region.

Although the idea of implementing a junk food tax was suggested by the DOF in 2016, it has yet to become law. Excise taxes on sweetened beverages were already included in the TRAIN law, which was implemented in January 2018.

However, the TRAIN law excluded milk products, natural fruit or vegetable juices, meal replacements, medically indicated beverages, and coffee, in contrast to the current proposal. Overall, the proposed tax rates would account for approximately 20-40% of the price of savory snacks and 15% of sweetened beverages, potentially affecting smaller players in the Philippine market.

Overall Impact

Market participants are closely monitoring regulatory advancements on the tax proposal, with the DOF set to release a draft version of the bill for congressional approval later this year. In 2018, Universal Robina Corp. (URC) saw a 10% drop in sales due to the excise tax on sweetened beverages but recovered after a year on the back of robust consumer spending.

Estimates indicate a more significant decline in earnings this time around for consumer names that include snacks, sweetened beverages, and confectionaries in their product portfolio. URC and Monde Nissin (MONDE) share prices softened after the new taxation announcement, with MONDE appearing less scathed.

Historically, the tax implementation on sweetened beverages under the TRAIN law led to a temporary volume decline that reverted after a year. In neighboring countries like Thailand, the sugar tax pushed companies to reformulate their recipes, reducing the sugar content in sweetened beverages to avoid the excise tax. This resulted in a remarkable decline in sugar content from 16g to 6g per 100mL, thereby benefiting consumers as it allowed them to reduce their sugar consumption.

Consumption is still expected to display resilience despite the persistently high prices of goods, as the impact of excise taxes on consumption tends to diminish over time. Hence, demand is expected to recover in the medium- to long-term.

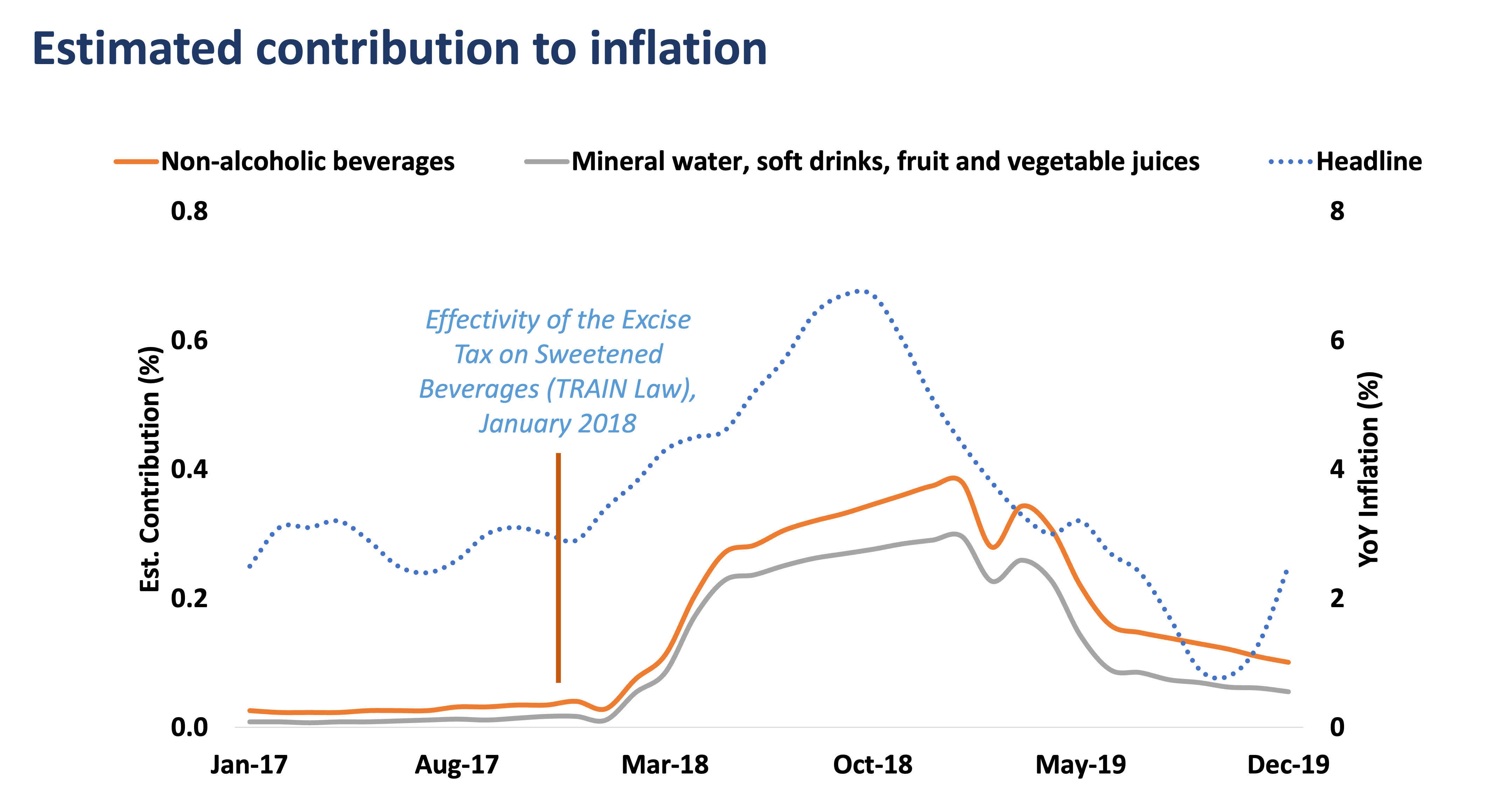

However, the proposed tax could nudge inflation higher due to the food items’ weight in the basket of around 3.5%. The TRAIN law implementation along with other supply shocks caused an inflation spike, with the contribution of non-alcoholic beverages increasing by around 35 basis points (bps). Specifically, soft drinks along with fruit and vegetable juices contributed 28 bps.

Considering the country’s ongoing recovery from an extended period of high inflation, the junk food tax to be implemented in 2024 may not be favorable, potentially placing undue strain on Filipino businesses and consumers.

The implementation of the sweetened beverage tax, coupled with other food supply shocks, caused inflation to spike in 2018.

Overall, the government’s proposed excise tax on junk food along with additional charges on sweetened beverages pose a potential upside risk to inflation. While this is a step in the right direction from a health perspective, the move could hurt ordinary consumers.

SOPHIA THERESE “PIA” BONIFACIO is a Trust Research Officer at Metrobank, covering macroeconomic research and the consumer sector. She obtained her Bachelor’s degree in Economics with a Specialization in Financial Economics from the Ateneo de Manila University. Outside of work, Pia spends her time with her best friend – a 9-year-old Chow Chow named Yao Ming.

DOWNLOAD

DOWNLOAD

By Sophia Therese “Pia” Bonifacio

By Sophia Therese “Pia” Bonifacio