Technical Analysis: When noise becomes the norm

A combination of monetary and fiscal easing creates a foundation for economic optimism and risk taking

As economic growth slows, trade policies shift, and geopolitical tensions rise, how do we sort out the signal and the noise in the markets?

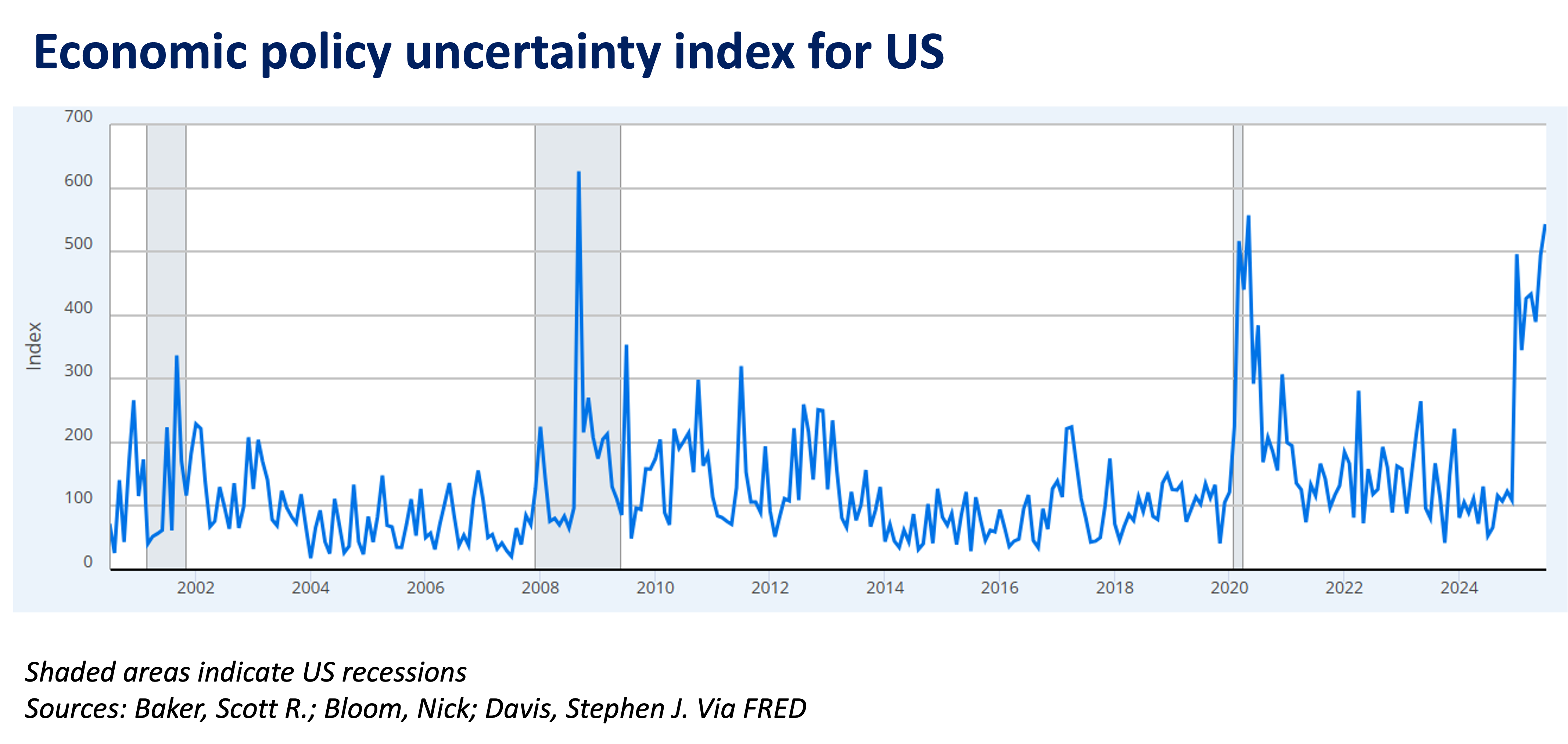

The US Economic Policy Uncertainty (EPU) Index reflects an unprecedented level of anxiety among investors and businesses. Historically, spikes in the EPU Index have often preceded US recessions.

The current surge suggests heightened uncertainty—potentially signaling not a clear bull or bear market, but rather a volatile, range-bound environment. This so-called “kangaroo market” may present tactical trading opportunities.

K-Shaped US economy

Since the US Federal Reserve began raising interest rates in 2022, the US economy has taken on a “K-shaped” trajectory. The letter “K” symbolizes a divergence—one leg pointing upward (A) and the other downward (B)—illustrating how economic outcomes have become increasingly imbalanced across social classes, market segments, and industry sectors.

The proposed One Big Beautiful Bill Act (OBBBA) is likely to deepen this divide. Its benefits (green arrow) are expected to favor high-income earners and large corporations through improved capital efficiency.

In contrast, low-income households (red arrow) are likely to see minimal gains, facing higher borrowing costs and diminishing public support. Moreover, the OBBBA is anticipated to accelerate the growth of US federal debt, placing upward pressure on long-term Treasury yields.

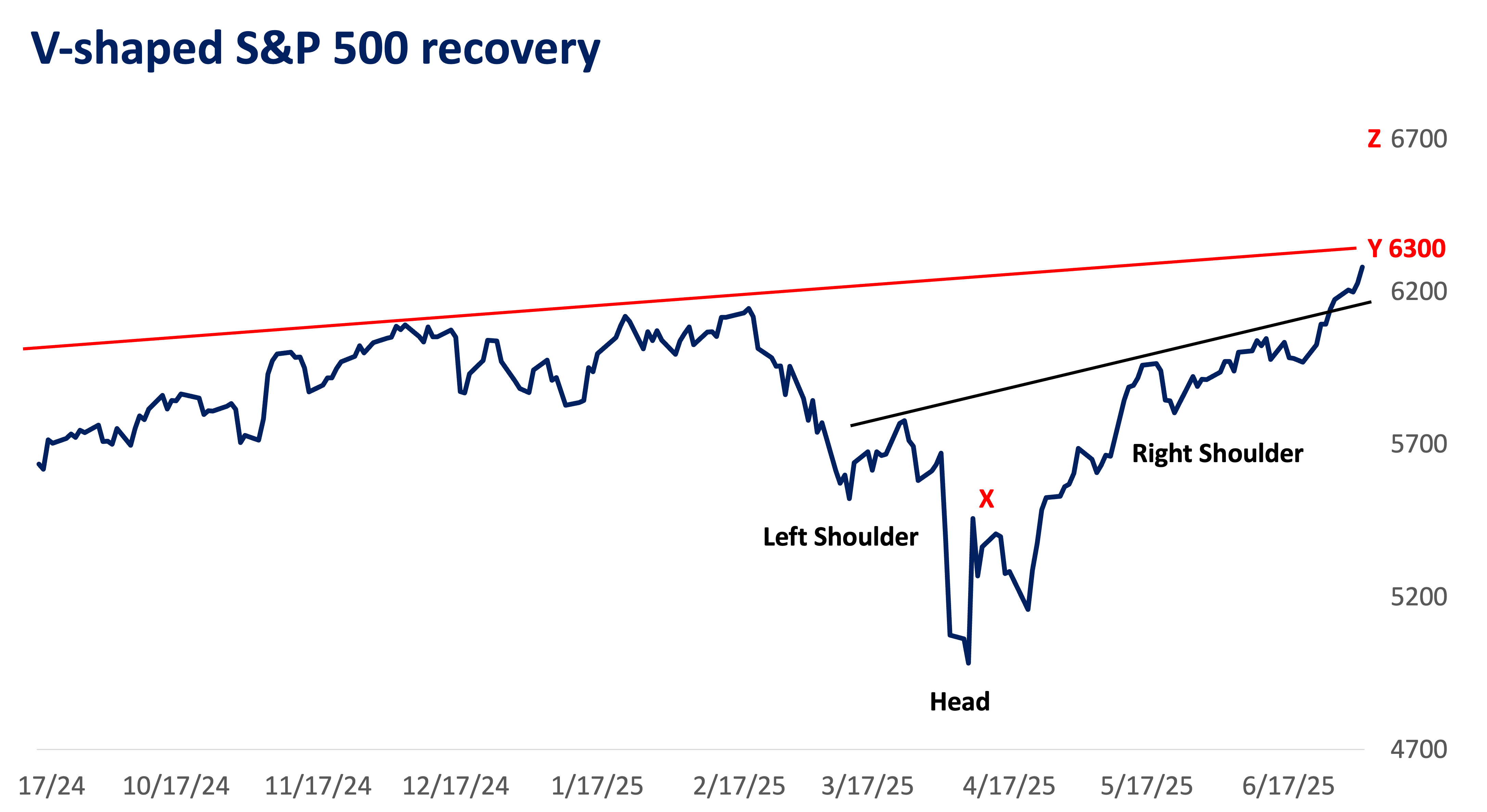

Following the tariff-related volatility in March and April, the S&P 500 staged one of the fastest recoveries in history. The sell-off reversed sharply after the announcement of a 90-day reciprocal tariff pause.

With the passage of the OBBBA, the S&P 500 is participating in the upper leg (A) of the K-shaped recovery. The index has completed an inverse head and shoulders pattern (X), with projected upside targets of 6,300 (Y) and 6,700 (Z), respectively.

Despite lingering growth uncertainties, markets are trading on expectations and forward-looking optimism. While the recent rally has been strong and may be due for a near-term pullback, seasonal trends suggest continued risk-taking through July if a mild pullback occurs.

A deeper correction is likely to emerge towards August to September. Strong resistance is seen at 6,300, with initial support at 6,100—the breakout zone of the head and shoulders formation.

However, if the OBBBA fails to translate into tangible economic gains, the current optimism in markets may quickly dissipate, causing upward momentum to reverse sharply.

Key takeaways

1. There are too many unknowns. Kangaroo markets—characterized by frequent swings without a clear long-term trend—are, by nature, trader-friendly environments. Navigating such volatile regimes requires a high level of expertise, discipline, and a robust investment framework.

2. Consider dynamic exposure across industries, allowing for the capture of upside potential while mitigating drawdowns, especially compared to traditional buy-and-hold approach. You may look for funds such as the Metro Multi-Themed Equity Fund-of-Funds.

3. Nevertheless, current market conditions remain supportive of US risk assets. Consider seeking passive exposure. To take advantage of this, you may invest in funds such as the Metro$ US Equity Feeder Fund for an efficient way to participate in the S&P 500’s performance.

(Disclaimer: This is general investment information only and does not constitute an offer or guarantee, with all investment decisions made at your own risk. The bank takes no responsibility for any potential losses. UITFs are governed by BSP regulations but are not deposit products, hence are not covered by the PDIC. Being an investment product, there is no guaranty on the principal and income of the investments.)

Kyle Tan, MSFE, CMT, CFTe is a Portfolio Manager at Metrobank’s Trust Banking Group, where he oversees the bank’s global Unit Investment Trust Funds (UITFs). He holds a Master’s degree in Financial Engineering from De La Salle University and is both a Chartered Market Technician (CMT) and a Certified Financial Technician (CFTe). Outside of the markets, Kyle enjoys working out, training at the gun range, and hunting for rare Star Wars collectibles.

DOWNLOAD

DOWNLOAD

By Kyle Tan, MSFE, CMT, CFTe

By Kyle Tan, MSFE, CMT, CFTe