Technical Analysis: Silver prices vs. gold prices

Is silver a good investment? Silver will have its resurgence in the commodities market. We take a look at how silver prices will perform vs. gold here.

Also referred to as “poor man’s gold,” silver has earned a place just a notch short of the top spot. In sports, gold has long been given to the most successful athletes, while silver went to those with significant achievement just below the pinnacle of triumph.

But does silver really deserve the 2nd place in the podium?

Silver shares the two primary uses of gold, namely, as an inflation hedge and a precious metal (store of value), and as a vital component of things that we use every day. Unlike investing in antique furniture where the value lies in rarity, historical significance, and aesthetic appeal, investing in silver primarily relies on its intrinsic value as a precious metal. Adding to its value is the fact that it is a metal that makes modern electronics, automotive, and medical technologies possible.

So, is silver a good investment?

The industrial uses of silver make it highly sensitive to economic conditions, and therefore more volatile and susceptive to the push-pull factors of supply and demand. Basically, prices of silver are gold prices on steroids.

Performance of silver prices vs gold prices

It can be observed in the past two economic cycles that silver has outperformed gold in an expansionary phase but underperformed towards the end of the cycle. In general, hard commodities linked to industrial production perform well in a growth phase as demand overpowers supply, driving commodity prices higher.

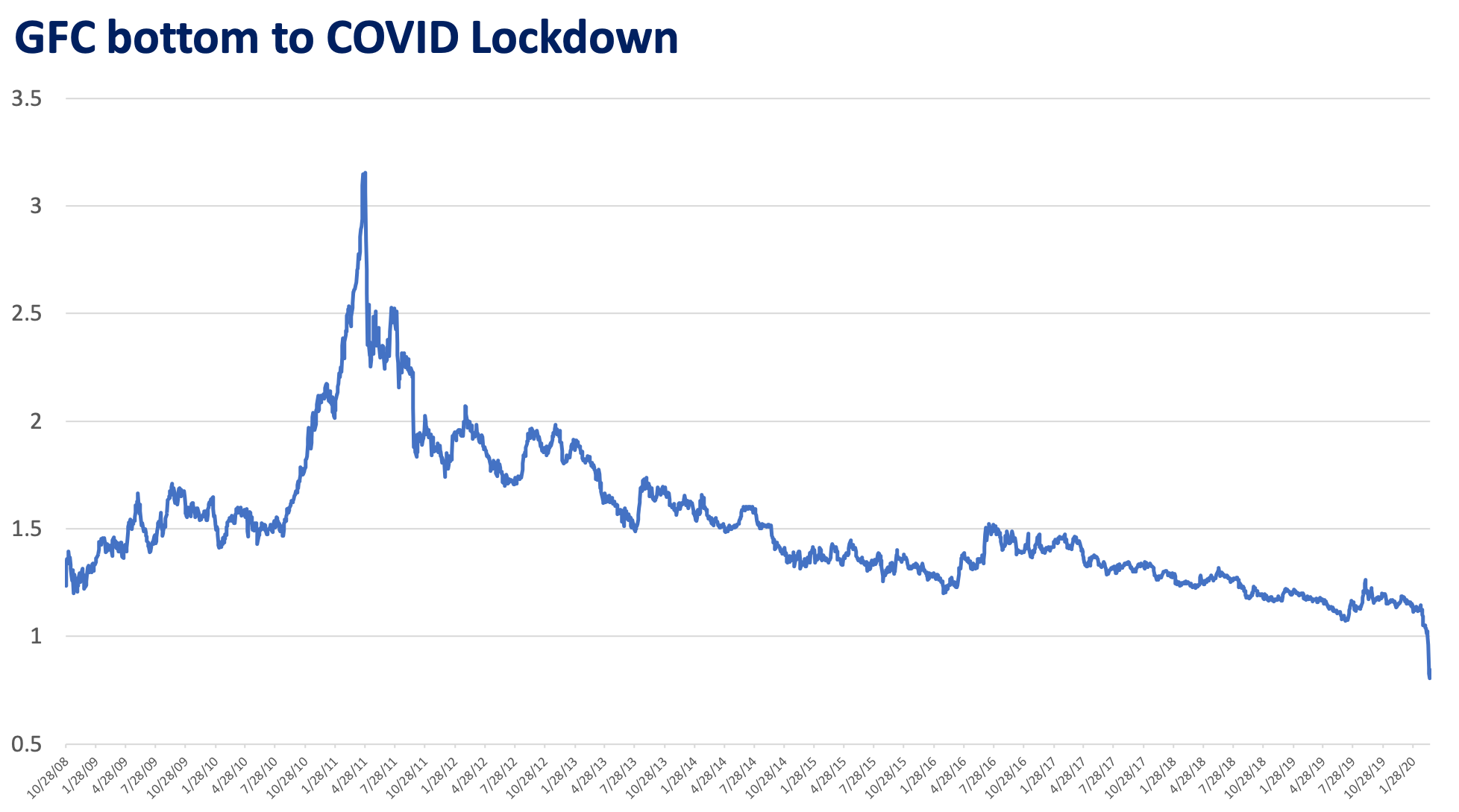

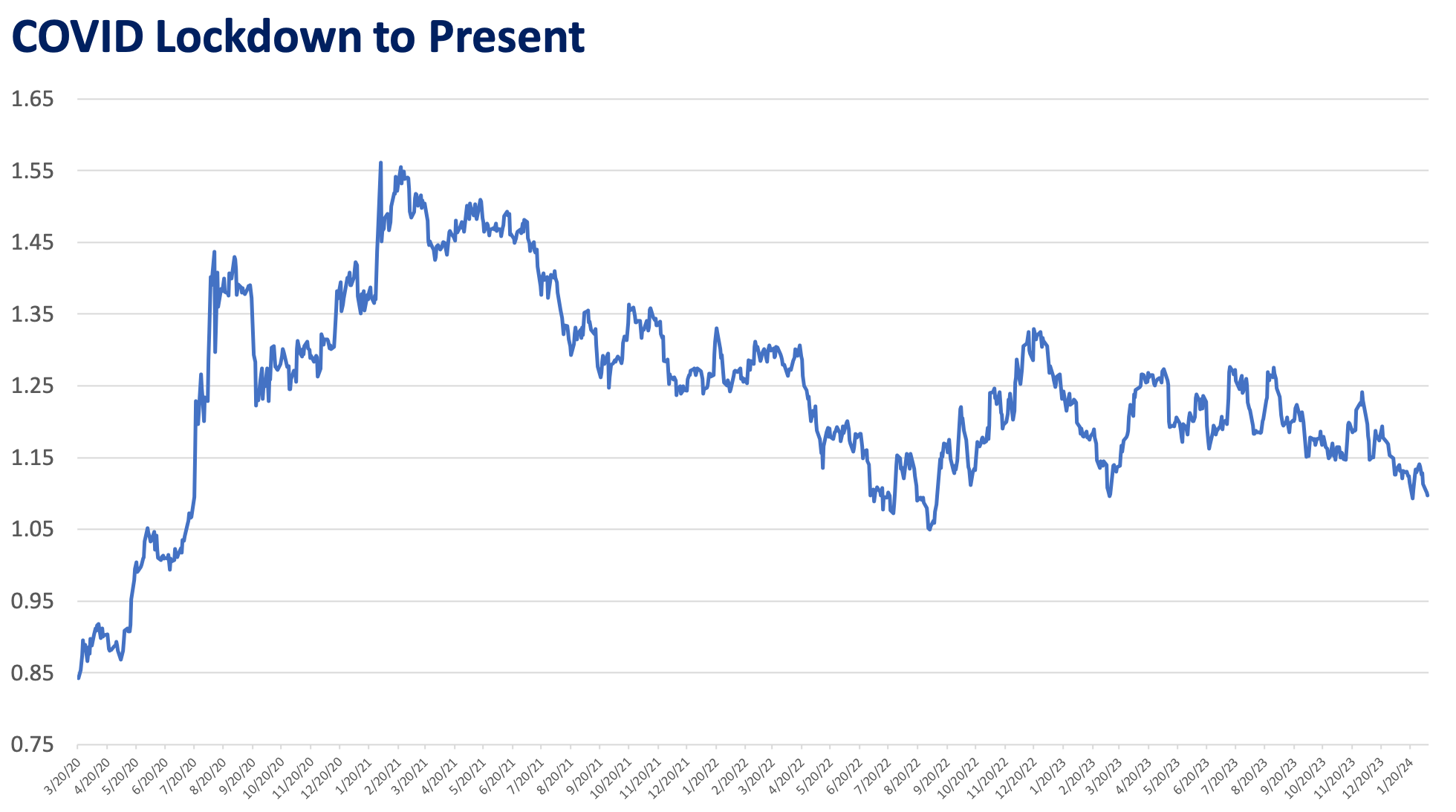

Below are the relative prices of silver to gold in two different periods.

The price ratio of silver to gold after the Global Financial Crisis (GFC) until the onslaught of COVID.

Silver has outperformed gold in times of expansion.

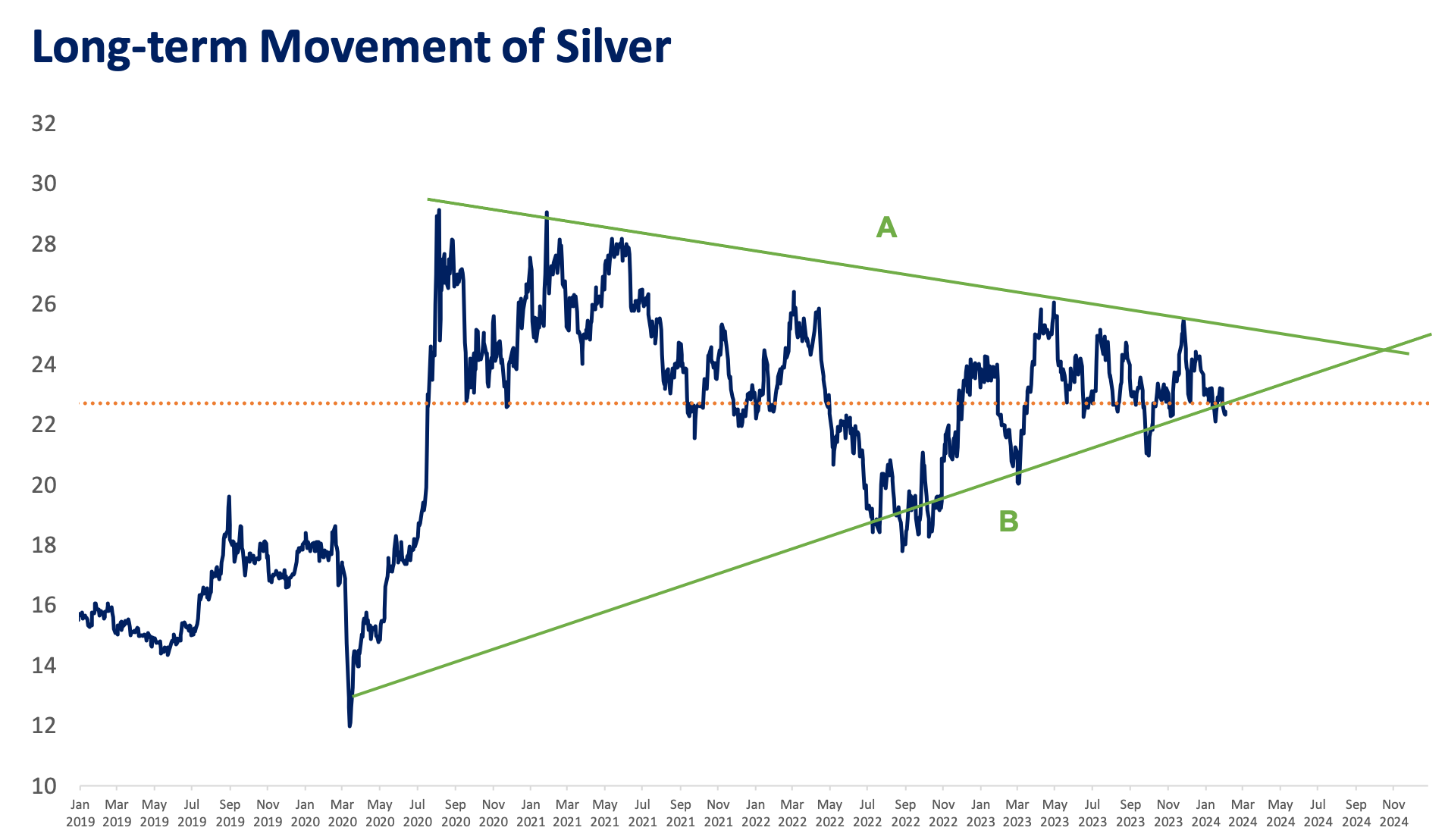

Since silver’s strong mark-up during the “V-shaped” recovery from the COVID-19 lockdown, silver prices have been stuck in the USD 17 to USD 30 range as growth prospects diminished as the economic cycle progressed. The range-bound price action has formed a “Symmetrical Triangle,” which is neither bullish nor bearish.

Currently, there are polar opposite views in global markets. The “most anticipated US recession in history” did not occur in 2023. To many, it was merely delayed, while the lag effects of the aggressive rate hikes continue to work its way into the economy. However, there has been growing optimism that a soft landing can be achieved by the US Federal Reserve after managing to bring down inflation from a high of 9.1% year-on-year (YoY) in May 2022 to 3.1% YoY, all while avoiding a substantial increase in unemployment.

- Soft-landing scenario – A clear break above Line A would be a bullish signal and may be prompted by the US Fed achieving a soft landing and cutting rates to restart the economic cycle.

- Hard-landing or recession – A clear break below Line B would be a bearish signal and may be triggered by a recession or slowdown under the pressure of four-decade-high interest rates.

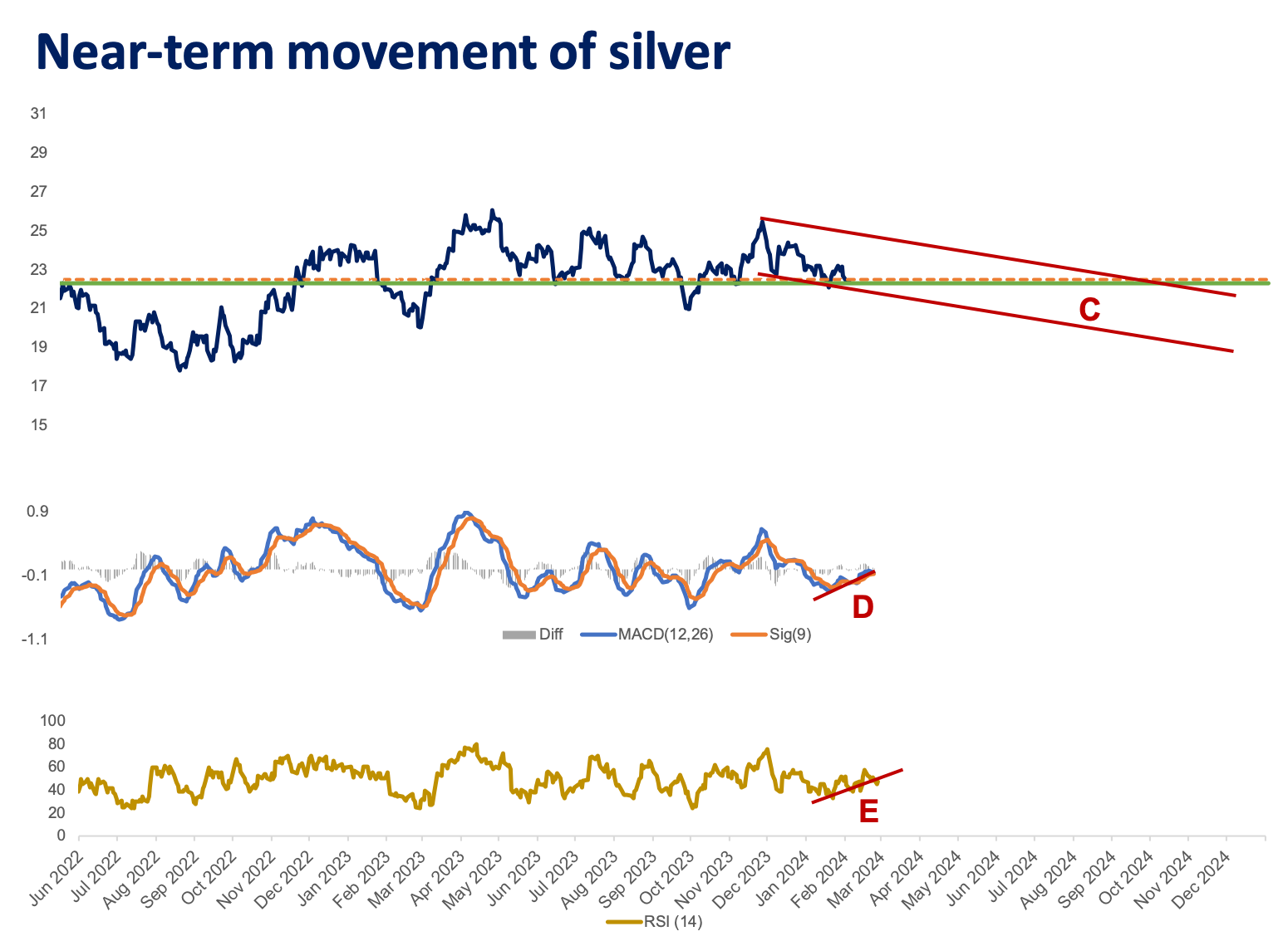

- Bullish in the near-term? – The price (USD 22.51) is near the support level C, following a downward channel. A bounce-off at this level would allow the price to break out of the down sloping channel and re-test the USD 25 level.

- Momentum can support upward price action.

A. Momentum point D currently consolidates near support levels, suggesting room for a potential up move.

B. Momentum point E indicates short-term stability as the price nears the neutral zone 50 in the technical indicator RSI. A potential up move in price would be guided by this indicator as it moves above 50.

Takeaways

The end of the US Fed’s hiking cycle would be positive for silver from its precious metal point-of-view. However, the lag effect of the rate hikes has yet to be fully priced-in by the global economy, and a slowdown in growth in 2024 may pose significant risks to silver.

For now, the risk-reward ratio from the market, geopolitical tensions, and debt concerns point to gold over silver. But silver will have its time. It is, after all, a commodity that dominates when the economy exits a recession or slowdown.

KYLE TAN, MSFE, CSS is a Fund Manager at Metrobank’s Trust Banking Group, managing the bank’s offshore Unit Investment Trust Funds (UITF). He holds a master’s degree in Financial Engineering from the De La Salle University and is a Level 2 passer of the Chartered Market Technician (CMT) certification course and a PSE Certified Securities Specialist (CSS). He spends his free time working out, training at the gun range, or hunting for rare Star Wars collectibles.

DOWNLOAD

DOWNLOAD

By Kyle Tan

By Kyle Tan