Technical Analysis: Divergent global growth in Q1 2025

Treasury yields and US dollar rise, pressuring markets amid decelerating growth; US economy outperforms; S&P 500 expected near 6,150-6,200 in Q1 2025.

The US has dodged a recession in 2023 and 2024, with the “no landing” scenario (where the economy keeps growing steadily) likely to be priced-in for at least Q1 2025.

Inflation has become anchored at the 2.5% range, with the Producer Price Index (PPI), which measures prices that manufacturers pay and often predicts consumer inflation, rising from 2.4% in October 2024 to 3.0% in November 2024 year-over-year. This has triggered US Treasury yields and the US dollar to rise despite the Federal Reserve’s easing cycle to make borrowing easier.

The yield on the 10-year US Treasury bond (10Yr) has formed a “bullflag”, a long-term bullish continuation pattern. Since the US presidential election, investors optimistic about higher yields (bears) and those expecting lower yields (bulls) have been fighting over the 4.40% level. Initially being rejected at this level, a re-test of the 4.15% level set the stage for a decisive move higher. The initial break-out target of 4.70% has been hit and is now into hard resistance. Now that yields have turned overbought, yields may drop towards the 4.5% level before retesting the 5.0% target.

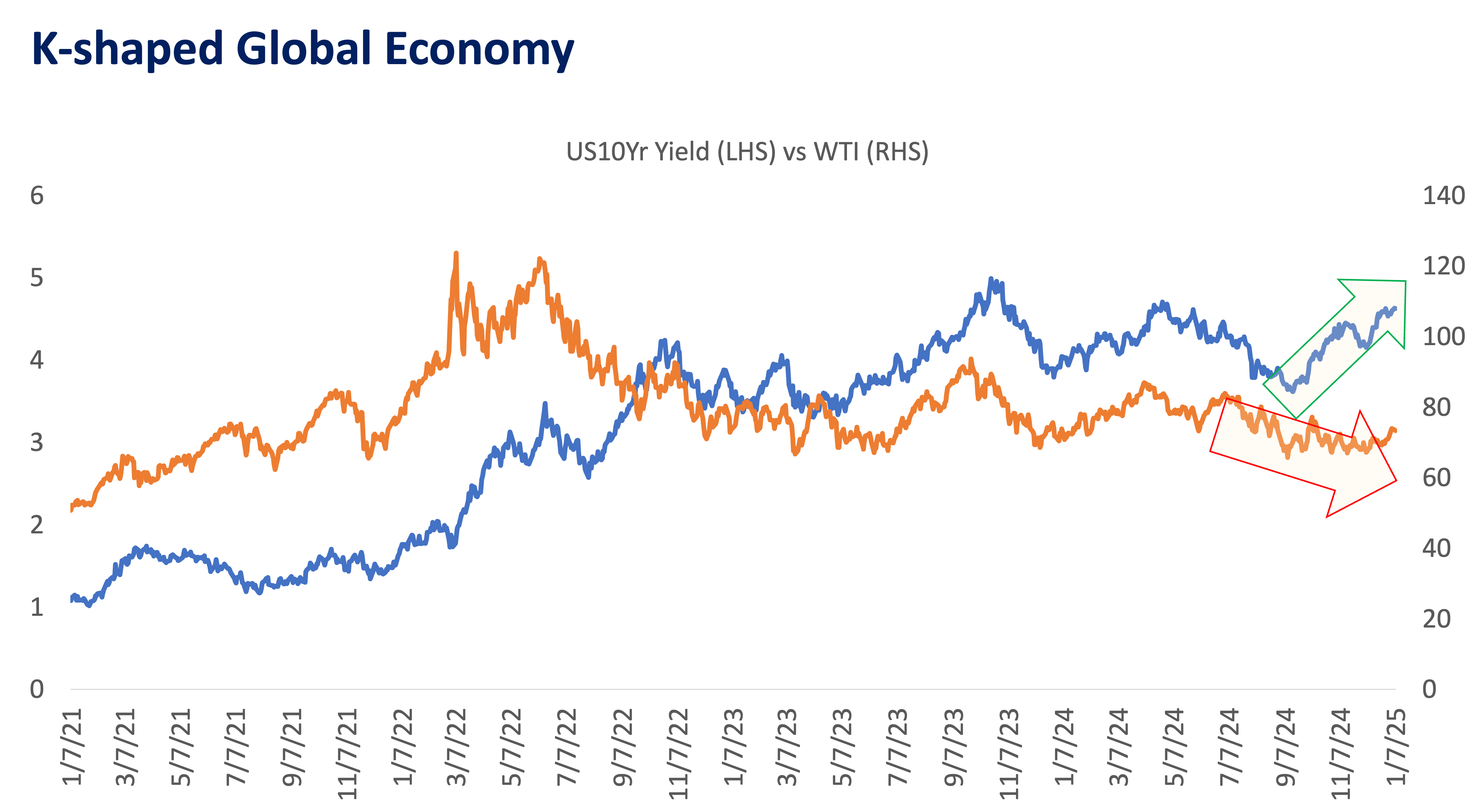

Growth divergences have been identified and are likely to persist in the short to medium term. The resilient US economy has pushed Treasury yields and the dollar higher, while slowing growth in China and Europe has pushed the global oil benchmark, West Texas Intermediate (WTI) crude oil prices, to key support levels. Oil has been a leading indicator of both growth and inflation.

The strengthening dollar and proposed import tariffs by President-elect Donald Trump may lead to deflation (falling prices, which can slow economic growth) or stagflation (a mix of high inflation with slow economic growth) in economies outside the US. US exceptionalism can aggravate de-globalization and further disrupt the economies of scale of trading parties.

Global funds converging into the S&P500

With the conclusion of the US elections resulting in a “Pro-US ” Republican sweep, “America

First” has also become the global markets’ mantra. However, rising yields and a stronger dollar is creating a “K-shaped” economy in the US: AI and technology mega-caps are thriving and pushing the market higher, while real estate, small-caps, and mid-caps struggle.

The US Congress and outgoing President Joe Biden approved a stop-gap funding bill to prevent a government shutdown. The legislation legally allows the federal government to use the USD 700+ billion Treasury General Account (TGA). Using the TGA increases both money supply and liquidity, which is positive for risk assets in the near term. However, this is also an inflationary driver in the medium to long term.

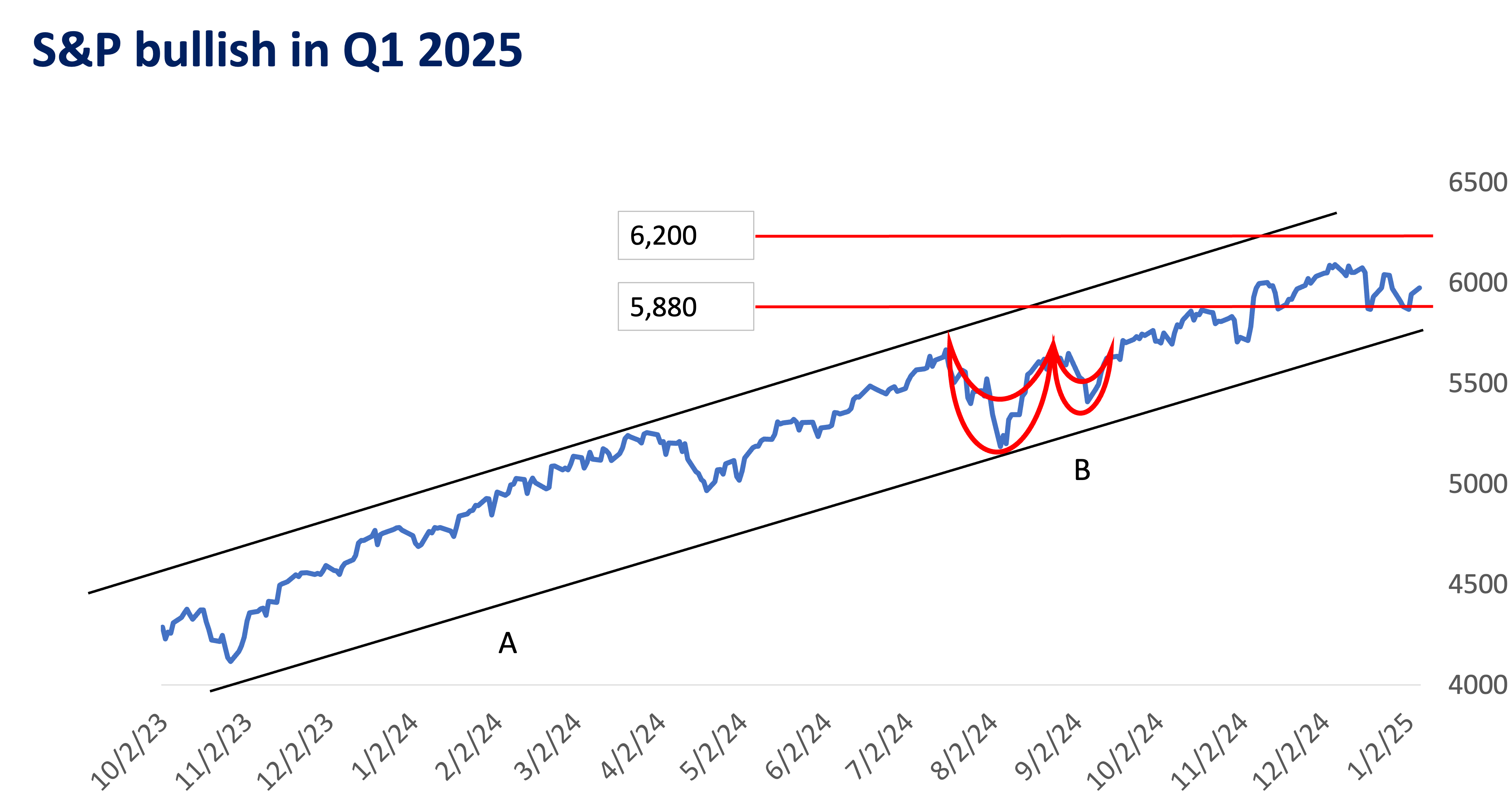

The S&P500, which is currently at 5,900, remains in a long-term uptrend (A). A cup-and-handle pattern, which typically signals further price increases, has formed in October 2024, suggesting the index could reach 6,150 to 6,200. Upper bound targets can be sighted at 6,400 while near-term support stands at 5,880.

Following the back-to-back 20% gains in 2023 and 2024, 2025 is expected to be volatile given the developing inflationary concerns. As long as the US economy remains resilient, data suggest that a correction or a market pullback will be triggered by sticky inflation.

Takeaways

- Rising US Treasury yields and a stronger dollar make borrowing more expensive globally, which could slow down economic growth.

- “K-shaped” growth is splitting in two directions. Globally, the US economy is strengthening while other regions sputter. Within the US, large tech companies are thriving while real estate and smaller companies struggle.

- The 10-year US Treasury yield is expected to reach 4.75% in the near term.

- The S&P 500 has a near term target of 6,150 to 6,200.

- The US government’s spending from its Treasury General Account (TGA) could boost risk assets in the near term but may fuel inflation later.

(Disclaimer: This is general investment information only and does not constitute an offer or guarantee, with all investment decisions made at your own risk. The bank takes no responsibility for any potential losses.)

KYLE TAN, MSFE, CFTe, CSS is a Portfolio Manager at Metrobank’s Trust Banking Group, managing the bank’s global Unit Investment Trust Funds (UITF). He holds a Master’s degree in Financial Engineering from the De La Salle University, a Certified Financial Technician (CFTe), a Level 3 candidate of the Chartered Market Technician (CMT) certification course and a PSE Certified Securities Specialist (CSS). He spends his free time working out, training at the gun range, or hunting for rare Star Wars collectibles.

DOWNLOAD

DOWNLOAD

By Kyle Tan

By Kyle Tan