Stay calm, SVB isn’t another Lehman Brothers

Many investors are losing sleep over the unfortunate collapse of a tech-start-up-focused bank in the US. It’s a good time to assess whether such fears are justified.

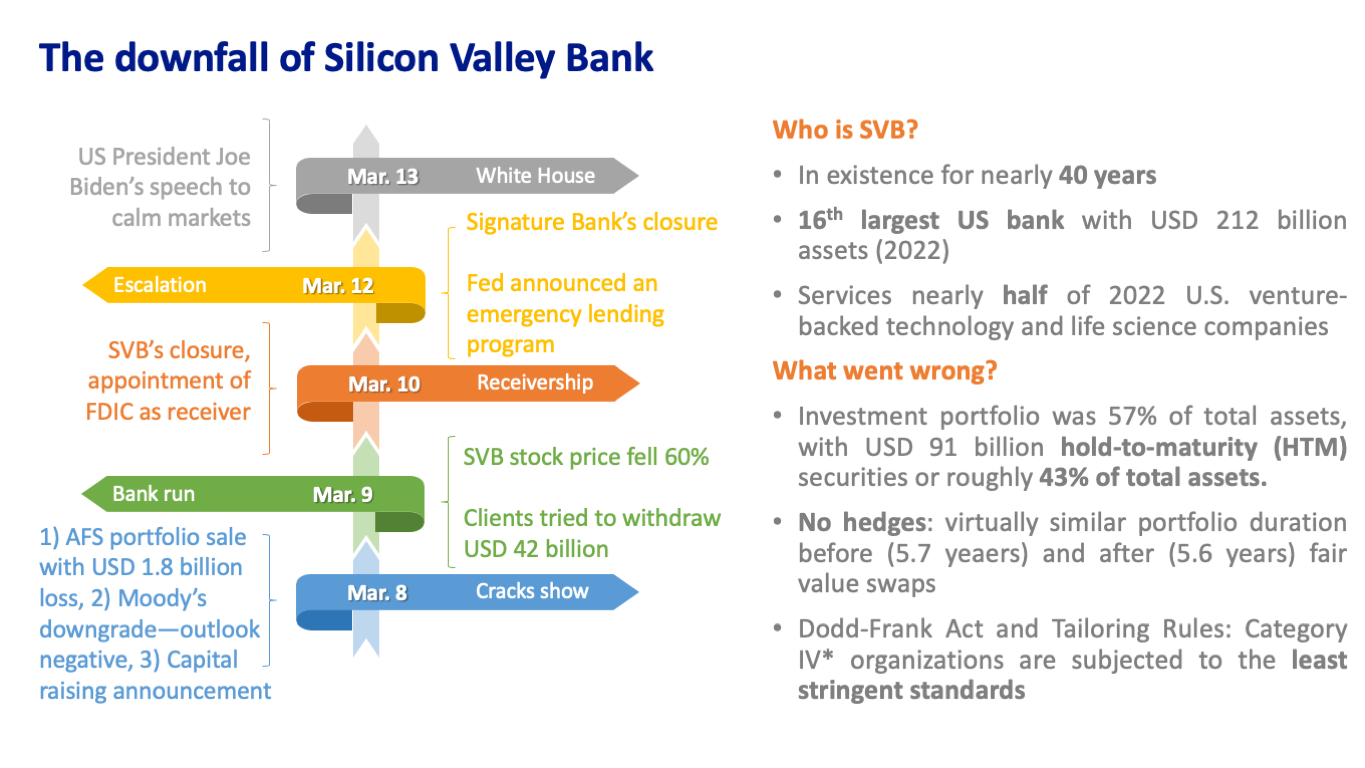

On March 10, Silicon Valley Bank (SVB), the US’ 16th largest bank, collapsed swiftly and sensationally after an unsuccessful attempt to raise fresh capital, which then drove a bank run by its depositors, made up primarily of tech start-ups and venture capitalists. SVB was the largest US bank to fail since the Global Financial Crisis (GFC).

SVB’s USD 212 billion worth of assets was loaded disproportionately with long-term government bonds and asset-backed securities rather than loans, which meant that SVB took a very large (and, it turns out, unhedged) bet that interest rates will stay low. The bet went badly when the value of their bond holdings crashed after the Fed raised policy rates, the fastest in four decades, to fight inflation.

Concerns of a wider-spread contagion gripped global markets, with the fall of SVB sparking comparisons to the collapse of Lehman Brothers in 2008, the precursor to the biggest financial crisis since the Great Depression.

We, however, argue that SVB’s failure is an idiosyncratic stress event, driven by aggressive interest rate risk-taking and the mismanagement of this risk by a large but still niche bank. It’s not a global-level systemic crisis event that would undermine financial systems across the world the way Lehman Brothers did.

Here’s why:

1. The underlying cause of the GFC was the exposure of very large global banks to mortgage-backed securities tied to subprime, very low-quality housing loans, which collapsed in value. These major banks then had extensive exposure to one another. The closure of one of the main players, Lehman Brothers, rippled across other major financial institutions. This is not the case with SVB, which placed the bulk of its sizeable deposits into risk-free and very liquid government bonds. So even if all the bonds of SVB were sold all at once, there wouldn’t be a fallout in value, unlike the sub-prime mortgage-backed securities in 2008.

2. Despite its large asset base, SVB is still a niche bank, not the global financial behemoth that Lehman was. Based on a report of JP Morgan Asset Management, SVB only had 16 domestic branches. It more than quadrupled its deposits in the past five years as the bank of choice for startup tech companies and the rich venture capital firms in Silicon Valley that funded them. Around 93% of SVB’s deposits were from corporations, not individuals, and 84% of these deposits were well in excess of the USD 250,000 limit insured by the US Federal Deposit Insurance Corporation (FDIC). This high concentration of depositors in the same sector, i.e., wealthy tech companies, meant SVB was uniquely vulnerable to an old-fashioned bank run.

3. The global financial system is much stronger than it was in 2008, thanks largely to stricter capitalization requirements and regulatory monitoring since the GFC. More important, the US government, FDIC, and Federal Reserve also acted swiftly and decisively to ring-fence any contagion effects from the failure of SVB, as well as another beleaguered bank, Signature Bank, and restore confidence by keeping the depositors of both banks whole and offering subsidized one-year loans to vulnerable banks to prevent them from selling securities under duress. This is unlike 2008, when everything was unprecedented, and governments and regulators had no playbook to follow.

Nevertheless, we believe that there’s no reason to be complacent. We advise against outsized bets in risk assets given the current weakness. While this isn’t 2008, we are mindful that it took several weeks after Lehman Brothers folded before financial markets fully digested the long-term ramifications.

Given the still fragile market psyche against the backdrop of a slowing global economy, we expect more market volatility in the near term and, hence, prefer to remain prudent and defensive.

RUBEN ZAMORA is First Vice-President and Head of Institutional Investors Coverage Division, Financial Markets Sector, at Metrobank, which manages the bank’s relationships with Non-Bank Financial Institutions, including government financial institutions, insurance companies, and asset managers. He is also the bank’s Financial Markets Strategist, focusing on fixed Income and rates advisory for our high-net-worth individuals and institutional clients. He holds a Master’s in Business Administration from the University of Chicago Graduate School of Business. He is also an avid traveler and golfer.

DOWNLOAD

DOWNLOAD

By Ruben Zamora

By Ruben Zamora