Ask Your Advisor: Is it too late to buy the RTB 5-19?

Updated as of September 29, 2025: It has been a month since RTB 5-19 was issued. And yet, it still offers a few benefits that cannot be ignored

(Editor’s Note: This article has been updated to reflect the latest information and charts about RTB 5 –19.)

You may think you should not even bother with the Retail Treasury Bond (RTB) 5-19. A month has passed since it was issued. The central bank has also recently started cutting rates.

Is the bond still attractive? We’ll let you in on our trade plan.

Let’s compare this with the current five-year benchmark is Fixed Rate Treasury Note (FXTN) 7-70. While RTB 5-19 will mature on August 20, 2030, and pays a gross coupon rate of 6.000% per annum, the FXTN 7-70 will mature a little earlier on July 27, 2030, and has a higher gross coupon rate of 6.375% per annum.

Based on coupon rate, FXTN 7-70 may seem more attractive. But here are three reasons why we think the RTB 5-19 still comes out on top.

1. Liquidity

Since FXTN 7-70 is the current five-year benchmark of the Bureau of the Treasury (BTr), it is typically chosen to be reissued in the occasional five-year auction. As of this writing, there is PHP 356 billion of the bond circulating in the market. But in contrast, the primary issuance of RTB 5-19 was able to raise a staggering PHP 507 billion.

Having more volume makes RTB 5-19 much more liquid than its FXTN counterparts. This means that it is generally much easier to source in the market. And with plenty of market participants trading this bond, new investors could potentially come across more attractive pricing, too.

2. Time value of money

Net of 20% withholding taxes, the RTB 5-19’s coupon rate is 4.8% per annum compared to the FXTN 7-70’s coupon rate of 5.1% per annum. But higher doesn’t always mean better.

Remember that RTBs pay coupons on a quarterly basis while FXTNs pay semiannually. This is important from a time value of money perspective. By receiving coupon payments much more frequently, investors are then able to reinvest these payments in other financial instruments much earlier. After all, the sooner a person is able to invest, the greater the potential returns.

3. Affordability

With the Bangko Sentral ng Pilipinas (BSP) in the middle of an interest rate cutting cycle, older bonds issued at higher coupon rates are expected to be more expensive to purchase. Want to buy FXTN 7-70 with a face value of PHP 100,000? You’d have to shell out PHP 102,975.82 at today’s indicative offer price.

On the other hand, purchasing RTB 5-19 for the same face value will only require PHP 101,368.71. That’s just a little bit more than what was paid by those who bought the bond during its primary issuance, so you won’t be sacrificing so much. When comparing their net effective yields p.a., the RTB 5-19 provides a higher yield of 4.4926% per annum compared to the FXTN 7-70’s 4.4614% per annum, should both bonds be held to maturity.

Metrobank Research expects the BSP to cut its policy interest rate by another 25 basis points (bps) before the end of the year and by an aggregate 50 basis points in 2026. Consider buying the RTB 5-19 from the secondary market now before it too becomes more expensive.

Source: Metrobank Treasury Group – Local Currency Trading Desk

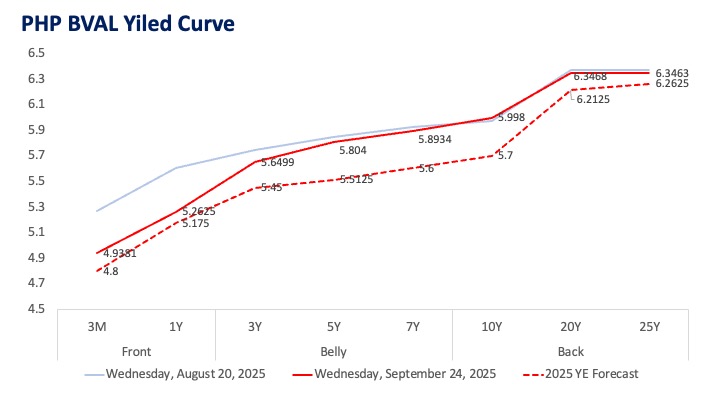

Yield Curve Forecast: Favorable for RTBs

The updated PHP BVAL yield curve as of September 24, 2025, shows an average 13.18 bps downward shift across tenors, with the five-year yield now around 5. 8040%, down from 5.8487% since the RTB 5-19 issuance date. We expect the 5-year PHP BVAL yield to fall 29.15 bps this 2025. The forecasted year-end curve suggests a steepening trend, consistent with Metrobank Research’s expectation of a 25-bp rate cut before year-end and 50 bps more in 2026.

In this environment, RTBs with quarterly coupons like RTB 5-19 become even more attractive. Investors benefit from quarterly cash flows and reinvestment opportunities, especially as rates begin to fall.

Source: Bloomberg

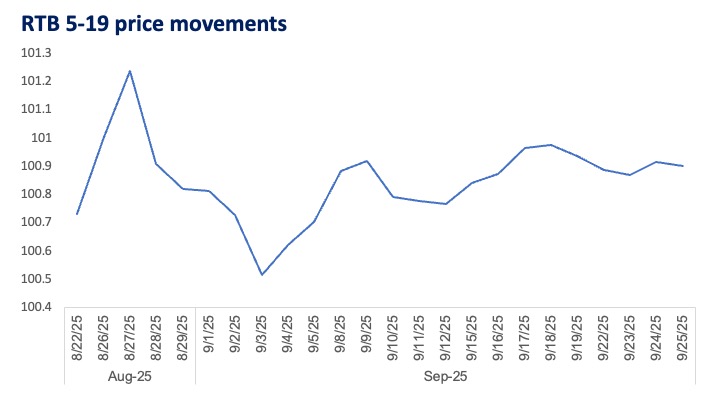

From August 22 to September 25, 2025, RTB 5-19’s price ranged from a high of 101.237 to a low of 100.516, with the latest price at 100.899. This slight dip from its peak suggests a more affordable entry point for investors today, especially compared to FXTN 7-70, which remains priced above par (102.087).

Takeaways

There are plenty of peso government securities available in the market. However, in the five-year space specifically, we still recommend the new RTB 5-19. With more volume in circulation, quarterly coupon payments, and relatively lower offer prices compared to bonds with higher coupon rates, the RTB 5-19 clearly outshines its FXTN counterpart.

For more information on the RTB 5-19 and other peso government securities, kindly reach out to your investment specialist or log on to Metrobank Wealth Manager. We offer lower fees of 0.050% for every successful buy or sell transaction placed on Wealth Manager until December 31, 2025.

Not yet on Wealth Manager? You may ask for assistance from your relationship manager or investment specialist. If you are not yet a Metrobank client, you may go to any Metrobank branch.

(Disclaimer: This is general investment information only and does not constitute an offer or guarantee, with all investment decisions made at your own risk. The bank takes no responsibility for any potential losses.)

EARL ANDREW “EA” AGUIRRE is the Head of the Investment Counselor Department under the Financial Markets Sector of Metrobank. He has more than a decade of experience in foreign exchange, fixed income securities, and derivatives sales. He has a Master’s in Business Administration from the Ateneo Graduate School of Business. His interests include regularly traveling to Japan and learning its language and culture.

DOWNLOAD

DOWNLOAD

By Earl Andrew A. Aguirre

By Earl Andrew A. Aguirre