September 2022 Updates: Inflation, peso depreciation, rate hikes

The inflation print slightly eased in August 2022, but global market movements and the strengthening dollar will continue to put upward pressure on prices. Further peso depreciation and BSP rate hikes are still anticipated as the Fed continues to aggressively hike rates.

The inflation print in August 2022 slightly eased to 6.3% due to the slower rise in transport costs and food and non-alcoholic beverages. Nevertheless, inflation rates in the succeeding months are seen to remain elevated as second-round effects, peso depreciation, and the upward pressure on global energy commodities remain.

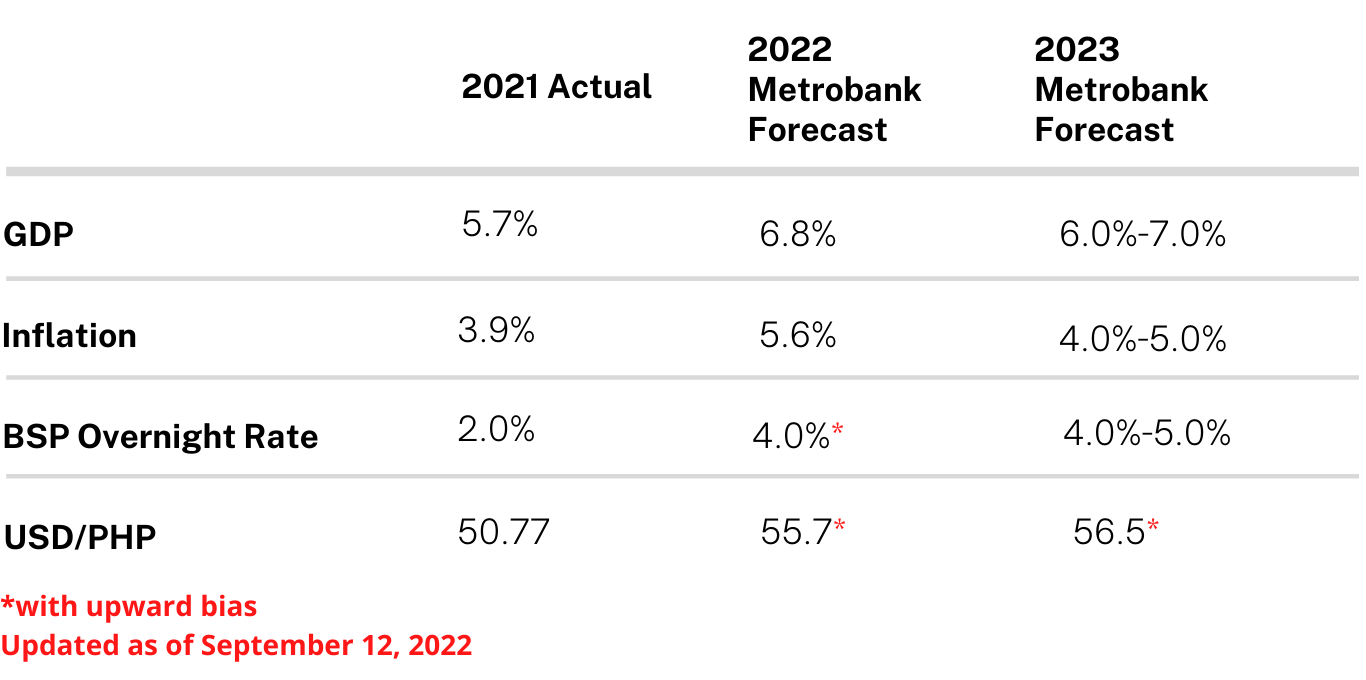

With the USD/PHP exchange rate hitting 57 levels, further depreciation of the peso is anticipated as the US Fed signaled a continued hawkish policy stance, which will potentially push the Bangko Sentral ng Pilipinas (BSP) to raise interest rates to lend support to the peso. Considering these new developments, we note an upside bias for the overnight rates in 2022 and USD/PHP exchange rate for 2022 and 2023 in the forecast table below as we continue to monitor further movements:

For more information on the performance and outlook for several macroeconomic indicators, as well as local and global macroeconomic news, please download the full report here.

DOWNLOAD

DOWNLOAD

By Metrobank Research

By Metrobank Research