Policy Rate Updates: BSP outlook — cloudy with a chance of rate cut

DOWNLOAD

DOWNLOAD

January Economic Update: Growth slows, prices rise

DOWNLOAD

DOWNLOAD

Inflation Update: Up, up, and away?

DOWNLOAD

DOWNLOAD

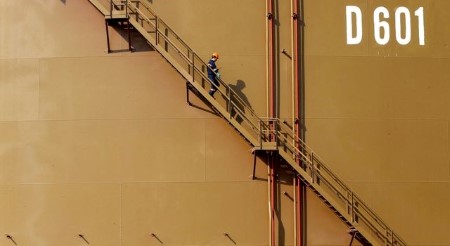

Oil steady as markets weigh OPEC+ surprise cuts amid demand woes

HOUSTON, April 4 (Reuters) – Oil prices were little changed in choppy trading on Tuesday as investors weighed OPEC+ planned production cuts against weak US and Chinese economic data that could suggest cooling oil demand.

Brent crude futures settled 1 cent higher at USD 84.94 a barrel, while US West Texas Intermediate (WTI) crude futures closed up 29 cents, or 0.4%, at USD 80.71 a barrel.

“We will need to see demand hold and grow to push crude into the upper USD 80’s,” said Dennis Kissler, senior vice president of trading at BOK Financial.

Brent crude and WTI had jumped by more than 6% on Monday after the Organization of the Petroleum Exporting Countries and allies including Russia, collectively known as OPEC+, rocked markets with an announcement of voluntary production cuts of 1.66 million barrels per day (bpd) from May until the end of 2023.

US job openings in February fell to the lowest level in nearly two years and a

slump in US manufacturing activity in March raised concerns about oil demand. Weak manufacturing activity in China last month also added to the woes.

Stock markets declined on the weaker economic data, while gold crossed the key USD 2,000 level as investors rushed to buy the safe haven asset.

The economic signals ran alongside fears of an inflationary hit to the world economy, as rising oil prices fuel higher interest rates.

OPEC+’s latest output targets bring the total volume of cuts by OPEC+ to 3.66 million bpd, including a 2 million-barrel cut last October, equal to about 3.7% of global demand.

The production curbs led many analysts to raise their Brent oil price forecasts to around USD 100 per barrel by year-end. Goldman Sachs lifted its forecast for Brent to USD 95 a barrel by the end of 2023, and to USD 100 for 2024.

Meanwhile, US crude oil stockpiles drew by more than 4 million barrels last week, according to market sources citing American Petroleum Institute figures on Tuesday. A preliminary Reuters poll had estimated a 2.3 million barrel drop in inventories.

The US Energy Information Administration will release its data at 10:30 a.m. (1430 GMT) on Wednesday.

Market watchers have been trying to gauge how much longer the US Federal Reserve Bank may need to keep raising rates to cool inflation, and whether the US economy may be headed for a recession.

Investors now see an about 40% chance the Fed will hike rates by a quarter basis point in May, with a roughly 60% chance of a pause.

(Reporting by Arathy Somasekhar in Houston; Additional reporting by Ahmad Ghaddar in London, Yuka Obayashi in Tokyo and Andrew Hayley in Beijing; Editing by Jonathan Oatis, Matthew Lewis, Deepa Babington and Richard Chang)

This article originally appeared on reuters.com

By Reuters

By Reuters